The Internal Revenue Service (IRS) requires various forms to process and manage tax-related information. One such form is the IRS Form 23, also known as the Certificate of Qualification for Employment of Nonimmigrant Aliens. This form is crucial for employers who hire nonimmigrant aliens, and it's essential to understand its purpose, requirements, and implications. In this article, we'll delve into five essential facts about IRS Form 23 that you need to know.

Fact 1: Purpose and Functionality of IRS Form 23

The primary purpose of IRS Form 23 is to certify that a nonimmigrant alien is eligible to work in the United States. The form serves as proof that the employer has verified the employee's identity and work authorization documents. It's a critical step in ensuring compliance with U.S. immigration laws and regulations. Employers must complete and retain Form 23 for each nonimmigrant alien employee, as it may be requested by the IRS or other government agencies during audits or inspections.

Key Components of Form 23

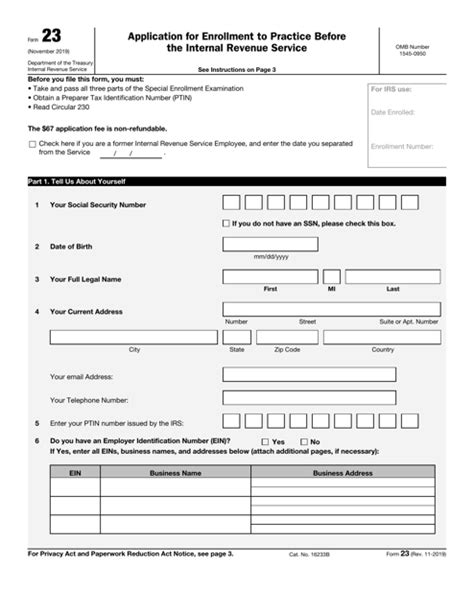

Form 23 consists of several sections that require specific information from both the employer and the employee. The key components include:

- Employee's biographical information (name, date of birth, and address)

- Immigration status ( visa type and expiration date)

- Employer's information (name, address, and EIN)

- Certification of the employee's work authorization documents (passport, visa, and I-94/I-94A arrival/departure record)

Fact 2: Eligible Nonimmigrant Aliens and Required Documents

Not all nonimmigrant aliens are eligible to work in the United States. To qualify, they must possess specific immigration status and documentation. The most common eligible categories include:

- H-1B visa holders (specialty occupations)

- L-1 visa holders (intracompany transferees)

- F-1 visa holders (students with Curricular Practical Training or Optional Practical Training)

- J-1 visa holders (exchange visitors with work authorization)

Employers must verify the employee's immigration status and work authorization documents, such as:

- Passport

- Visa

- I-94/I-94A arrival/departure record

- Form I-765 (Application for Employment Authorization)

Fact 3: Penalties for Non-Compliance and Failure to File

Employers who fail to complete and retain Form 23 or neglect to verify an employee's work authorization documents may face severe penalties, including:

- Fines ranging from $375 to $3,200 per unauthorized employee

- Back pay and benefits to the affected employees

- Potential debarment from participating in federal contracts

- Reputational damage and loss of business

It's essential for employers to maintain accurate records and ensure compliance with all applicable laws and regulations.

Record-Keeping Requirements

Employers must retain Form 23 and supporting documentation for at least three years from the date of hire or one year after the employee's termination, whichever is later. These records must be available for inspection by the IRS or other government agencies.

Fact 4: Impact on Tax Compliance and Reporting

IRS Form 23 is closely tied to tax compliance and reporting. Employers must report the income and taxes withheld for nonimmigrant alien employees on Form W-2 (Wage and Tax Statement). The IRS uses this information to determine the employee's tax liability and eligibility for certain tax credits.

Special Tax Considerations

Nonimmigrant alien employees may be subject to special tax considerations, such as:

- Withholding of taxes at a higher rate (30% or 14%)

- Exemption from Social Security and Medicare taxes

- Potential eligibility for the foreign earned income exclusion

Employers must understand these tax implications and ensure accurate reporting to avoid penalties and fines.

Fact 5: Changes and Updates to Form 23

The IRS regularly updates and revises forms to reflect changes in laws, regulations, and policies. Employers must use the most recent version of Form 23, which can be downloaded from the IRS website or obtained through other authorized sources.

Key Takeaways

To ensure compliance with IRS Form 23 requirements, employers must:

- Verify the employee's immigration status and work authorization documents

- Complete and retain Form 23 for each nonimmigrant alien employee

- Maintain accurate records and report income and taxes withheld

- Stay up-to-date with changes and updates to Form 23

By understanding these essential facts about IRS Form 23, employers can navigate the complexities of hiring nonimmigrant aliens and avoid costly penalties and fines.

If you have any questions or concerns about IRS Form 23 or tax compliance, please don't hesitate to ask. Share your thoughts and experiences in the comments section below.