The IRS Form 1310, also known as the "Statement of Person Claiming Refund Due a Deceased Taxpayer," is a crucial document for individuals who need to claim a refund on behalf of a deceased taxpayer. If you're one of them, you're probably wondering how to get your hands on a printable version of this form. Look no further! In this article, we'll explore five ways to obtain an IRS Form 1310 printable, making it easier for you to claim the refund you deserve.

What is IRS Form 1310?

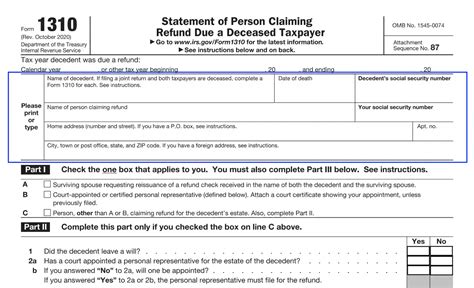

Before we dive into the ways to get an IRS Form 1310 printable, let's quickly understand what this form is all about. The IRS Form 1310 is used by individuals who need to claim a refund on behalf of a deceased taxpayer. This can include spouses, personal representatives, or other authorized parties. The form requires you to provide information about the deceased taxpayer, the refund amount, and your relationship to the deceased.

Why Do You Need an IRS Form 1310 Printable?

Having a printable version of the IRS Form 1310 can be incredibly convenient. You can fill it out at your own pace, make any necessary corrections, and ensure that you have all the required information before submitting it to the IRS. Moreover, having a physical copy of the form can help you keep track of your refund claim and avoid any potential errors or delays.

5 Ways to Get an IRS Form 1310 Printable

Now that we've covered the basics, let's move on to the five ways to get an IRS Form 1310 printable:

1. Download from the IRS Website

The most straightforward way to get an IRS Form 1310 printable is to download it directly from the IRS website. You can visit the IRS website () and search for "Form 1310." Once you've found the form, click on the "Download" button to save it to your computer. Make sure you have a PDF reader installed on your device to view and print the form.

2. Use the IRS Free File Program

The IRS Free File program is a great resource for taxpayers who need to access various IRS forms, including the Form 1310. To use this program, visit the IRS website and click on the "Free File" tab. From there, you can select the "Forms" option and search for "Form 1310." You'll be able to download and print the form for free.

3. Contact the IRS by Phone

If you prefer to get a physical copy of the IRS Form 1310, you can contact the IRS by phone. Call the IRS at 1-800-829-3676 (individuals) or 1-800-829-4933 (businesses) and ask for a copy of the Form 1310. They'll mail it to you, and you can expect to receive it within a few days.

4. Visit Your Local IRS Office

Another way to get an IRS Form 1310 printable is to visit your local IRS office. You can find the nearest office by using the IRS Office Locator tool on their website. Once you arrive at the office, ask for a copy of the Form 1310, and they'll provide it to you.

5. Use a Tax Software or Service

If you're using a tax software or service, such as TurboTax or H&R Block, you can access the IRS Form 1310 printable through their platform. These services often provide a range of IRS forms, including the Form 1310, which you can download and print.

Tips for Filling Out the IRS Form 1310

Now that you have access to an IRS Form 1310 printable, here are some tips to keep in mind when filling it out:

- Make sure you have all the required information, including the deceased taxpayer's Social Security number, date of birth, and date of death.

- Use black ink to fill out the form, and make sure your handwriting is legible.

- Be accurate and thorough when providing information about the refund amount and your relationship to the deceased taxpayer.

- Sign the form in the designated area, and make sure to include your name, address, and phone number.

What to Do After Filling Out the IRS Form 1310

After filling out the IRS Form 1310, you'll need to submit it to the IRS along with any required supporting documentation. Here are the next steps:

- Attach a copy of the deceased taxpayer's tax return (if applicable) and any other required documentation.

- Mail the form to the IRS address listed in the instructions.

- Keep a copy of the form and supporting documentation for your records.

Get Help with Your IRS Form 1310

If you're having trouble filling out the IRS Form 1310 or need assistance with the refund claim process, don't hesitate to reach out for help. You can:

- Contact the IRS directly by phone or mail.

- Visit your local IRS office for in-person assistance.

- Use a tax professional or service to guide you through the process.

Final Thoughts

Obtaining an IRS Form 1310 printable is just the first step in claiming a refund on behalf of a deceased taxpayer. By following the tips and guidelines outlined in this article, you'll be well on your way to completing the form accurately and efficiently. Remember to stay organized, seek help when needed, and keep track of your refund claim to ensure a smooth process.

Now it's your turn! Have you had to claim a refund on behalf of a deceased taxpayer? Share your experiences and tips in the comments below. Don't forget to like and share this article with others who may be going through a similar situation.

What is the purpose of IRS Form 1310?

+The IRS Form 1310 is used by individuals who need to claim a refund on behalf of a deceased taxpayer.

How can I get an IRS Form 1310 printable?

+You can download the form from the IRS website, use the IRS Free File program, contact the IRS by phone, visit your local IRS office, or use a tax software or service.

What information do I need to provide on the IRS Form 1310?

+You'll need to provide information about the deceased taxpayer, the refund amount, and your relationship to the deceased taxpayer.