Completing tax forms can be a daunting task, especially when dealing with the various schedules and attachments required by the IRS. One of these forms is the IRS Form 1040 Schedule 3, also known as the "Additional Income and Adjustments to Income" schedule. This form is used to report additional income and adjustments to income that are not reported on the main Form 1040. In this article, we will explore the five ways to complete IRS Form 1040 Schedule 3.

Understanding the Purpose of Form 1040 Schedule 3

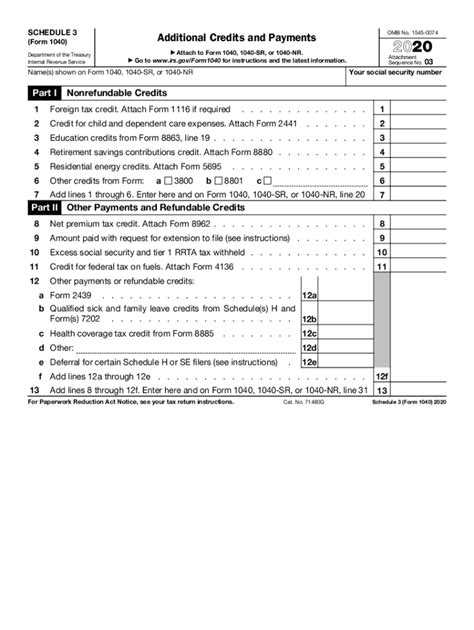

Before we dive into the five ways to complete Form 1040 Schedule 3, it's essential to understand the purpose of this form. Form 1040 Schedule 3 is used to report various types of income and adjustments to income that are not reported on the main Form 1040. This includes income from sources such as alimony, prizes, and awards, as well as adjustments to income such as alimony payments and student loan interest deductions.

5 Ways to Complete IRS Form 1040 Schedule 3

1. Reporting Alimony Received

If you received alimony payments from your former spouse, you will need to report this income on Form 1040 Schedule 3. To do this, you will need to complete Line 1 of the form, which asks for the amount of alimony received. You will also need to provide the name and Social Security number or Individual Taxpayer Identification Number (ITIN) of the person who made the alimony payments.

2. Reporting Prizes and Awards

If you received prizes or awards during the tax year, you will need to report this income on Form 1040 Schedule 3. This includes income from sources such as contests, sweepstakes, and awards. To report this income, you will need to complete Line 2 of the form, which asks for the amount of prizes and awards received.

3. Reporting Adjustments to Income

Form 1040 Schedule 3 is also used to report adjustments to income, such as alimony payments and student loan interest deductions. To report these adjustments, you will need to complete Lines 3-10 of the form. These lines ask for the amount of various adjustments to income, such as alimony payments, student loan interest deductions, and moving expenses.

4. Reporting Income from Other Sources

Form 1040 Schedule 3 is also used to report income from other sources, such as jury duty pay and winnings from gambling. To report this income, you will need to complete Line 11 of the form, which asks for the amount of income from other sources.

5. Reporting Total Additional Income

Finally, you will need to report the total additional income from all sources on Line 12 of Form 1040 Schedule 3. This total will be carried over to Line 6 of the main Form 1040.

Tips for Completing Form 1040 Schedule 3

- Make sure to read the instructions carefully before completing the form.

- Use the correct lines and columns to report each type of income and adjustment to income.

- Make sure to sign and date the form.

- Keep a copy of the form for your records.

Conclusion

Completing Form 1040 Schedule 3 can seem overwhelming, but by following these five steps, you can ensure that you report all of your additional income and adjustments to income correctly. Remember to read the instructions carefully, use the correct lines and columns, and keep a copy of the form for your records. By taking the time to complete Form 1040 Schedule 3 accurately, you can avoid errors and ensure that you receive the correct refund or pay the correct amount of taxes.

Frequently Asked Questions

What is Form 1040 Schedule 3 used for?

+Form 1040 Schedule 3 is used to report additional income and adjustments to income that are not reported on the main Form 1040.

Do I need to complete Form 1040 Schedule 3 if I only have a small amount of additional income?

+Yes, you will still need to complete Form 1040 Schedule 3, even if you only have a small amount of additional income.

Can I e-file Form 1040 Schedule 3?

+Yes, you can e-file Form 1040 Schedule 3, but you will need to attach it to your main Form 1040.