Understanding the Importance of IRS Form 15111

Why Accuracy Matters

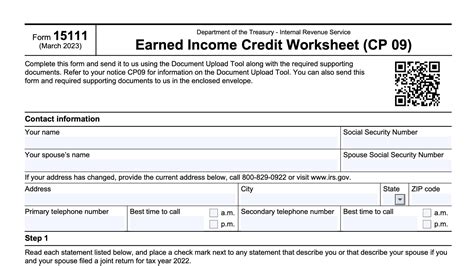

Completing IRS Form 15111 correctly is essential to ensure that your claim for refund or abatement is processed efficiently. Inaccurate or incomplete information can lead to delays, rejection, or even audits. By following the correct procedures and providing all required information, you can minimize the risk of errors and ensure a smooth process.Step 1: Gather Required Information

- Your name, address, and taxpayer identification number (TIN)

- The type of tax, interest, or penalty you are claiming a refund or abatement for

- The tax year or period involved

- The amount of refund or abatement claimed

- Supporting documentation, such as receipts, invoices, or proof of payment

Step 2: Complete Part I - Claimant Information

Part I of IRS Form 15111 requires you to provide your personal and tax-related information. This includes:- Your name and address

- Your TIN (Social Security number or Employer Identification Number)

- Your contact information (phone number and email address)

Step 3: Complete Part II - Claim Information

- The type of tax, interest, or penalty you are claiming a refund or abatement for

- The tax year or period involved

- The amount of refund or abatement claimed

- A brief explanation of why you are claiming a refund or abatement

Step 4: Attach Supporting Documentation

You must attach all supporting documentation to IRS Form 15111, including receipts, invoices, proof of payment, and any other relevant documents. Make sure to keep a copy of all documentation for your records.Step 5: Review and Sign the Form

Additional Tips and Reminders

* Use black ink to sign the form * Make sure to keep a copy of the completed form and supporting documentation for your records * Submit the form to the IRS address listed in the instructions or online * Follow up with the IRS if you have not received a response within 6-8 weeksBy following these steps and tips, you can ensure that your IRS Form 15111 is completed correctly and accurately, minimizing the risk of errors and delays.

What is IRS Form 15111 used for?

+IRS Form 15111 is used to request a refund or abatement of certain taxes, interest, or penalties.

What information do I need to gather before completing IRS Form 15111?

+You need to gather your personal and tax-related information, including your name, address, TIN, and supporting documentation.

How do I submit IRS Form 15111?

+You can submit the form to the IRS address listed in the instructions or online.