The Form 1065 Schedule K-1 is a crucial document for partnerships to report the income, deductions, and credits of each partner. As a partner, it's essential to understand the instructions for completing this form to ensure accurate reporting and compliance with tax regulations. In this article, we'll provide a step-by-step guide to help you navigate the Form 1065 Schedule K-1 instructions.

What is Form 1065 Schedule K-1?

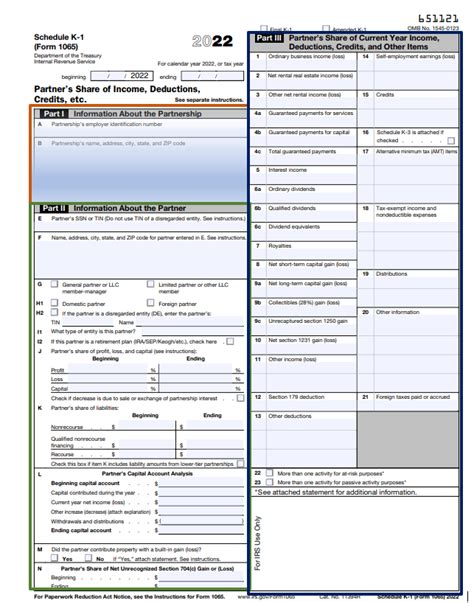

Form 1065 is the partnership return, which reports the partnership's income, deductions, and credits. Schedule K-1 is an attachment to Form 1065, which reports each partner's share of the partnership's income, deductions, and credits. The Schedule K-1 is used to report each partner's distributive share of the partnership's items, such as ordinary business income, capital gains, and tax credits.

Who Needs to File Form 1065 Schedule K-1?

Partnerships that are required to file Form 1065 must also provide a Schedule K-1 to each partner. This includes:

- General partnerships

- Limited partnerships

- Limited liability partnerships (LLPs)

- Limited liability companies (LLCs) that are treated as partnerships for tax purposes

When is the Form 1065 Schedule K-1 Due?

The Form 1065 Schedule K-1 is due on the same date as the partnership return, which is typically March 15th for calendar-year partnerships.

Step-by-Step Instructions for Form 1065 Schedule K-1

Here's a step-by-step guide to completing the Form 1065 Schedule K-1:

**Part I: Information About the Partner**

- Name and Address: Enter the partner's name and address.

- Taxpayer Identification Number: Enter the partner's Social Security number or Employer Identification Number (EIN).

- Percentage of Ownership: Enter the partner's percentage of ownership in the partnership.

**Part II: Partner's Share of Income, Deductions, and Credits**

- Ordinary Business Income (Loss): Enter the partner's share of ordinary business income or loss.

- Capital Gains (Loss): Enter the partner's share of capital gains or losses.

- Tax Credits: Enter the partner's share of tax credits, such as the low-income housing credit or the new markets tax credit.

**Part III: Partner's Share of Self-Employment Tax and Other Items**

- Self-Employment Tax: Enter the partner's share of self-employment tax.

- Other Items: Enter any other items that are not reported elsewhere on the Schedule K-1, such as guaranteed payments or distributions.

**Additional Information**

- Section 179 Deduction: If the partnership has made a Section 179 election, enter the partner's share of the deduction.

- Basis Limitations: If the partner's share of losses exceeds their basis, enter the amount of the limitation.

**Part IV: Additional Information for Certain Partners**

- Foreign Partners: If the partner is a foreign person, enter their country of residence and foreign tax identification number.

- Tax-Exempt Partners: If the partner is a tax-exempt organization, enter their employer identification number and a statement indicating that they are tax-exempt.

Conclusion

Completing the Form 1065 Schedule K-1 requires careful attention to detail and accuracy. By following these step-by-step instructions, you can ensure that you provide your partners with accurate information and comply with tax regulations. If you're unsure about any aspect of the Form 1065 Schedule K-1, consult with a tax professional or the IRS.

Additional Resources

- IRS Form 1065 Instructions

- IRS Schedule K-1 Instructions

- IRS Publication 541: Partnerships

FAQs

What is the deadline for filing Form 1065 Schedule K-1?

+The Form 1065 Schedule K-1 is due on the same date as the partnership return, which is typically March 15th for calendar-year partnerships.

Who needs to file Form 1065 Schedule K-1?

+Partnerships that are required to file Form 1065 must also provide a Schedule K-1 to each partner. This includes general partnerships, limited partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs) that are treated as partnerships for tax purposes.

What information is required on Form 1065 Schedule K-1?

+The Form 1065 Schedule K-1 requires information about the partner, including their name, address, and taxpayer identification number. It also requires information about the partner's share of income, deductions, and credits.