Donating a vehicle to charity can be a great way to support a good cause while also receiving a tax deduction. However, the process can be complex, and it's essential to follow the correct procedures to ensure that you receive the maximum deduction possible. One crucial step in this process is completing the IRS 1098-C form, also known as the Contributions of Motor Vehicles, Boats, and Airplanes form. In this article, we will break down the process into 5 easy steps to help you complete the IRS 1098-C form.

Understanding the IRS 1098-C Form

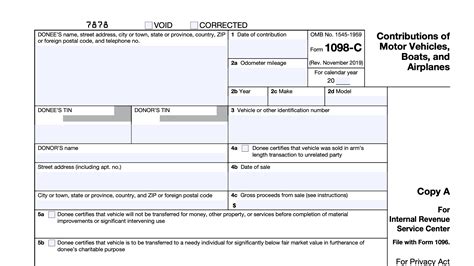

The IRS 1098-C form is used to report the contribution of a motor vehicle, boat, or airplane to a charitable organization. The form is designed to provide documentation of the contribution, which is required for the donor to claim a tax deduction. The form must be completed by the charitable organization and provided to the donor, who will then use it to claim the deduction on their tax return.

Step 1: Gather Required Information

Before starting the form, you will need to gather some required information. This includes:

- The donor's name and address

- The charitable organization's name, address, and Employer Identification Number (EIN)

- A description of the vehicle, including the make, model, and year

- The vehicle's identification number (VIN)

- The date of the contribution

- The fair market value of the vehicle

Completing the IRS 1098-C Form

Now that you have gathered the required information, you can start completing the form.

Step 2: Complete Box 1-3

Boxes 1-3 require you to enter the donor's information, including their name, address, and Social Security number or Employer Identification Number.

Step 3: Complete Box 4-6

Boxes 4-6 require you to enter the charitable organization's information, including their name, address, and Employer Identification Number.

Step 4: Complete Box 7-9

Boxes 7-9 require you to enter the vehicle's information, including the make, model, year, and VIN.

Step 5: Complete Box 10-12

Boxes 10-12 require you to enter the date of the contribution, the fair market value of the vehicle, and a statement indicating whether the charitable organization sold the vehicle or retained it for its own use.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind when completing the IRS 1098-C form:

- Make sure to complete the form accurately and legibly

- Use a pen or pencil to complete the form, and avoid using a marker or other writing instrument that may be difficult to read

- Keep a copy of the completed form for your records

- Provide the completed form to the donor within 30 days of the contribution

- The charitable organization is required to file a copy of the form with the IRS by February 28th of each year

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing the IRS 1098-C form:

- Failing to complete the form accurately and legibly

- Not providing the required information

- Not signing the form

- Not providing the completed form to the donor within the required timeframe

Conclusion

Completing the IRS 1098-C form can seem like a daunting task, but by following these 5 easy steps, you can ensure that you complete the form accurately and efficiently. Remember to gather all the required information, complete the form accurately and legibly, and provide the completed form to the donor within the required timeframe. By avoiding common mistakes and following these tips and reminders, you can ensure that the donor receives the maximum tax deduction possible.

We hope this article has been helpful in guiding you through the process of completing the IRS 1098-C form. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is the IRS 1098-C form?

+The IRS 1098-C form is used to report the contribution of a motor vehicle, boat, or airplane to a charitable organization.

Who completes the IRS 1098-C form?

+The charitable organization completes the IRS 1098-C form and provides it to the donor.

What information is required to complete the IRS 1098-C form?

+The required information includes the donor's name and address, the charitable organization's name, address, and Employer Identification Number, a description of the vehicle, the vehicle's identification number, the date of the contribution, and the fair market value of the vehicle.