Filling out an Iowa Small Estate Affidavit form can be a daunting task, especially for those who are not familiar with the process. However, with the right guidance, it can be done efficiently and effectively. In this article, we will discuss the importance of the Iowa Small Estate Affidavit form, its purpose, and provide a step-by-step guide on how to fill it out correctly.

What is an Iowa Small Estate Affidavit Form?

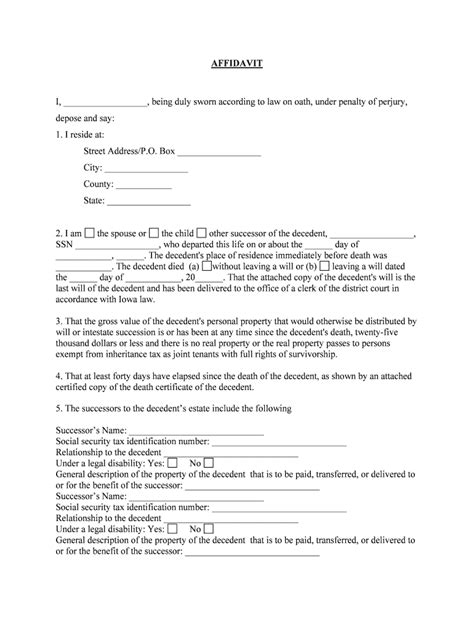

An Iowa Small Estate Affidavit form is a legal document used to transfer assets from a deceased person's estate to their heirs or beneficiaries. The form is typically used when the deceased person's estate is small, meaning it does not exceed a certain value, usually $50,000 in Iowa. The form allows the heirs or beneficiaries to claim the assets without going through the probate process.

Why is it Important to Fill Out the Iowa Small Estate Affidavit Form Correctly?

Filling out the Iowa Small Estate Affidavit form correctly is crucial to ensure that the transfer of assets is done smoothly and efficiently. If the form is not filled out correctly, it can lead to delays, disputes, and even litigation. Moreover, if the form is not completed accurately, it may not be accepted by the relevant authorities, which can cause additional stress and costs for the heirs or beneficiaries.

What are the Requirements for Filling Out the Iowa Small Estate Affidavit Form?

To fill out the Iowa Small Estate Affidavit form, you will need to meet certain requirements. These include:

- The deceased person must have been a resident of Iowa at the time of their death.

- The estate must be small, meaning it does not exceed $50,000 in value.

- The heirs or beneficiaries must be entitled to receive the assets under Iowa law.

- The form must be signed by the heirs or beneficiaries and notarized.

5 Ways to Fill Out the Iowa Small Estate Affidavit Form

Here are the 5 ways to fill out the Iowa Small Estate Affidavit form:

1. Gather All the Necessary Documents and Information

Before filling out the form, you will need to gather all the necessary documents and information. These include:

- The deceased person's will, if they had one.

- A list of the deceased person's assets, including bank accounts, investments, and real estate.

- A list of the deceased person's debts, including credit card debt, loans, and mortgages.

- The deceased person's social security number and date of birth.

- The names and addresses of the heirs or beneficiaries.

2. Fill Out the Form Carefully and Accurately

Once you have gathered all the necessary documents and information, you can start filling out the form. Make sure to fill out the form carefully and accurately, as any mistakes can lead to delays or disputes. The form will ask for the following information:

- The deceased person's name, address, and date of death.

- A list of the deceased person's assets, including their value.

- A list of the deceased person's debts, including their value.

- The names and addresses of the heirs or beneficiaries.

- The relationship between the heirs or beneficiaries and the deceased person.

3. Sign and Notarize the Form

Once you have completed the form, you will need to sign and notarize it. The form must be signed by the heirs or beneficiaries, and the signature must be notarized. This is to ensure that the form is authentic and that the heirs or beneficiaries are who they claim to be.

4. Attach Supporting Documents

In addition to the completed form, you may need to attach supporting documents. These can include:

- A copy of the deceased person's will, if they had one.

- A copy of the deceased person's death certificate.

- A copy of the deceased person's social security number and date of birth.

- A list of the deceased person's assets and debts.

5. Submit the Form to the Relevant Authorities

Once you have completed the form and attached all the necessary supporting documents, you can submit it to the relevant authorities. This can include the county clerk's office, the probate court, or the Iowa Department of Revenue.

What to Do Next?

After submitting the form, you will need to wait for the relevant authorities to process it. This can take several weeks or even months, depending on the complexity of the estate and the workload of the authorities. Once the form has been processed, you will receive a letter or notification stating that the assets have been transferred to the heirs or beneficiaries.

FAQs

What is the purpose of the Iowa Small Estate Affidavit form?

+The purpose of the Iowa Small Estate Affidavit form is to transfer assets from a deceased person's estate to their heirs or beneficiaries without going through the probate process.

Who is eligible to fill out the Iowa Small Estate Affidavit form?

+The heirs or beneficiaries of the deceased person are eligible to fill out the Iowa Small Estate Affidavit form.

What documents do I need to attach to the Iowa Small Estate Affidavit form?

+You may need to attach supporting documents, such as a copy of the deceased person's will, death certificate, and social security number and date of birth.

We hope this article has provided you with a comprehensive guide on how to fill out the Iowa Small Estate Affidavit form. Remember to gather all the necessary documents and information, fill out the form carefully and accurately, sign and notarize it, attach supporting documents, and submit it to the relevant authorities. If you have any further questions or concerns, please do not hesitate to reach out to us.