Understanding Iowa Form 6251 is crucial for individuals and businesses operating in the state of Iowa, as it pertains to the Alternative Minimum Tax (AMT) calculation. The AMT is a separate tax calculation that ensures individuals and corporations pay a minimum amount of tax, regardless of the deductions and exemptions they claim. In this article, we will break down the Iowa Form 6251 into 5 easy steps, providing a comprehensive guide on how to navigate this complex tax form.

Step 1: Understanding the Purpose of Iowa Form 6251

Iowa Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals and corporations. The AMT is designed to ensure that taxpayers pay a minimum amount of tax, regardless of the deductions and exemptions they claim. The form is used to calculate the AMT by applying a series of calculations and adjustments to the taxpayer's income.

Who Needs to File Iowa Form 6251?

Not all taxpayers need to file Iowa Form 6251. Generally, individuals and corporations with a high amount of deductions and exemptions may need to file this form. This includes taxpayers who claim large amounts of depreciation, depletion, or other deductions that reduce their taxable income.

Step 2: Gathering Required Information

Before starting the Iowa Form 6251, taxpayers need to gather the required information. This includes:

- Iowa income tax return (IA 1040 or IA 1120)

- Federal income tax return (Form 1040 or Form 1120)

- Supporting schedules and forms (e.g., Schedule A, Schedule C, Form 4562)

- Records of deductions and exemptions claimed

Taxpayers should ensure they have all the necessary documents and information before starting the form.

Understanding the Types of Income

Taxpayers need to understand the different types of income that are subject to the AMT. This includes:

- Ordinary income (e.g., wages, interest, dividends)

- Capital gains and losses

- Depreciation and depletion

- Other types of income (e.g., rents, royalties)

Step 3: Calculating the Alternative Minimum Tax

The next step is to calculate the Alternative Minimum Tax. This involves applying a series of calculations and adjustments to the taxpayer's income. The AMT is calculated using the following steps:

- Calculate the taxpayer's Alternative Minimum Taxable Income (AMTI)

- Apply the AMT exemptions and deductions

- Calculate the AMT using the AMT tax rates

AMT Exemptions and Deductions

Taxpayers may be eligible for AMT exemptions and deductions, which can reduce their AMT liability. These include:

- The standard exemption (e.g., $71,700 for single filers in 2022)

- Itemized deductions (e.g., mortgage interest, charitable contributions)

- Other deductions (e.g., depreciation, depletion)

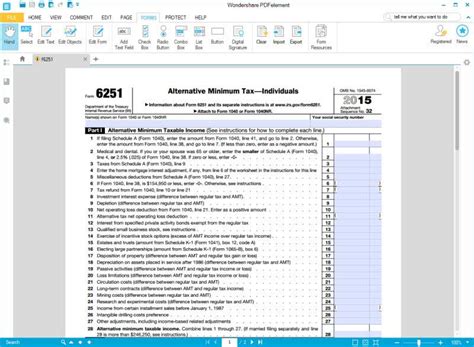

Step 4: Completing Iowa Form 6251

Once the AMT has been calculated, taxpayers can complete Iowa Form 6251. The form requires the following information:

- Taxpayer's name and address

- Taxpayer's identification number (e.g., Social Security number, Employer Identification Number)

- AMT calculation (including AMTI, exemptions, and deductions)

- AMT liability (or refund)

Common Errors to Avoid

Taxpayers should be aware of common errors to avoid when completing Iowa Form 6251. These include:

- Failing to report all income

- Claiming incorrect exemptions or deductions

- Miscalculating the AMT

Step 5: Filing and Paying the Alternative Minimum Tax

The final step is to file and pay the Alternative Minimum Tax. Taxpayers can file Iowa Form 6251 electronically or by mail. Payment can be made online, by phone, or by mail.

Important Deadlines

Taxpayers should be aware of the important deadlines for filing and paying the AMT. These include:

- April 15th for individual taxpayers (IA 1040)

- March 15th for corporate taxpayers (IA 1120)

Failure to file and pay the AMT on time can result in penalties and interest.

We hope this 5-step guide has helped you understand Iowa Form 6251 and the Alternative Minimum Tax calculation. If you have any questions or concerns, please leave a comment below or share this article with others.

Who needs to file Iowa Form 6251?

+Individuals and corporations with a high amount of deductions and exemptions may need to file Iowa Form 6251.

What is the Alternative Minimum Tax (AMT)?

+The AMT is a separate tax calculation that ensures individuals and corporations pay a minimum amount of tax, regardless of the deductions and exemptions they claim.

What is the deadline for filing and paying the AMT?

+The deadline for filing and paying the AMT is April 15th for individual taxpayers (IA 1040) and March 15th for corporate taxpayers (IA 1120).