Managing payroll can be a daunting task for any business owner, especially when it comes to ensuring timely and accurate payments to employees. Intuit QuickBooks Payroll offers a convenient solution with its direct deposit feature, which allows you to pay your employees electronically. In this article, we will walk you through the 5 easy steps for setting up and using Intuit QuickBooks Payroll direct deposit.

Understanding the Benefits of Direct Deposit

Before we dive into the steps, let's quickly explore the benefits of using direct deposit with Intuit QuickBooks Payroll. Direct deposit offers several advantages, including:

- Convenience: Employees can receive their paychecks electronically, eliminating the need for paper checks.

- Timeliness: Payments are deposited directly into employees' bank accounts, reducing the risk of lost or delayed checks.

- Accuracy: Direct deposit reduces the risk of errors, as payments are made electronically and can be easily tracked.

- Cost-effectiveness: Direct deposit can help reduce payroll processing costs, as there is no need for printing and mailing paper checks.

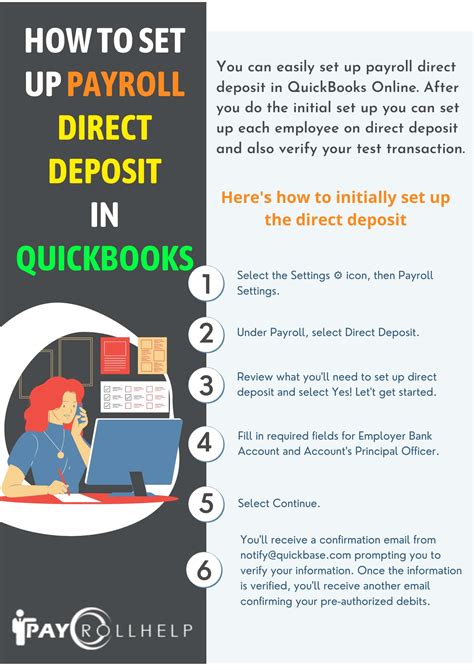

Step 1: Setting Up Direct Deposit in QuickBooks

To get started with direct deposit in QuickBooks, follow these steps:

- Log in to your QuickBooks account and navigate to the "Payroll" menu.

- Click on "Payroll Settings" and select "Direct Deposit" from the dropdown menu.

- Enter your company's direct deposit information, including your bank account number and routing number.

- Click "Save" to save your changes.

Step 2: Adding Employee Bank Account Information

To use direct deposit, you will need to collect and store your employees' bank account information. Here's how:

- Ask your employees to provide their bank account information, including their account number and routing number.

- Log in to QuickBooks and navigate to the "Employee" menu.

- Click on "Employee Details" and select the employee for whom you want to add bank account information.

- Click on "Bank Account" and enter the employee's bank account information.

- Click "Save" to save the changes.

Step 3: Creating a Payroll Schedule

To use direct deposit, you will need to create a payroll schedule. Here's how:

- Log in to QuickBooks and navigate to the "Payroll" menu.

- Click on "Payroll Schedules" and select "Create Payroll Schedule" from the dropdown menu.

- Enter the payroll schedule details, including the pay frequency and pay date.

- Click "Save" to save the changes.

Step 4: Processing Payroll with Direct Deposit

Once you have set up direct deposit and created a payroll schedule, you can process payroll using the following steps:

- Log in to QuickBooks and navigate to the "Payroll" menu.

- Click on "Process Payroll" and select the payroll schedule you created earlier.

- Review the payroll details, including the employee names, pay amounts, and bank account information.

- Click "Submit" to submit the payroll for processing.

Step 5: Verifying Direct Deposit Transactions

After processing payroll, you will need to verify the direct deposit transactions. Here's how:

- Log in to QuickBooks and navigate to the "Payroll" menu.

- Click on "Payroll Reports" and select "Direct Deposit Report" from the dropdown menu.

- Review the report to ensure that the direct deposit transactions were processed correctly.

- Click "Print" or "Save" to print or save the report for your records.

Conclusion

Intuit QuickBooks Payroll direct deposit is a convenient and efficient way to pay your employees electronically. By following the 5 easy steps outlined in this article, you can set up and use direct deposit in QuickBooks to streamline your payroll processing and reduce errors. Remember to verify direct deposit transactions regularly to ensure that payments are being processed correctly.

Get Started with QuickBooks Payroll Today!

If you're not already using QuickBooks Payroll, consider getting started today. With its easy-to-use interface and robust features, QuickBooks Payroll can help you streamline your payroll processing and reduce errors. Contact Intuit or a certified QuickBooks reseller to learn more about QuickBooks Payroll and how it can benefit your business.

FAQs

What is direct deposit in QuickBooks?

+Direct deposit in QuickBooks is a feature that allows you to pay your employees electronically by depositing their paychecks directly into their bank accounts.

How do I set up direct deposit in QuickBooks?

+To set up direct deposit in QuickBooks, follow the steps outlined in this article, including setting up direct deposit in QuickBooks, adding employee bank account information, creating a payroll schedule, processing payroll, and verifying direct deposit transactions.

What are the benefits of using direct deposit in QuickBooks?

+The benefits of using direct deposit in QuickBooks include convenience, timeliness, accuracy, and cost-effectiveness. Direct deposit eliminates the need for paper checks, reduces the risk of errors, and can help reduce payroll processing costs.