The world of trucking and logistics is complex, with many moving parts and potential risks involved. For carriers, having the right insurance coverage is crucial to protect their business and financial well-being. One essential component of this coverage is the BMC-91 insurance liability form. In this article, we'll explore five ways the BMC-91 form safeguards carriers and helps them navigate the challenges of the transportation industry.

Understanding the BMC-91 Form

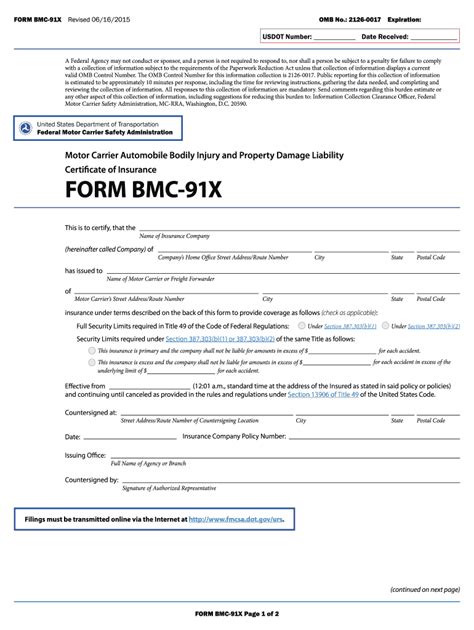

The BMC-91 form, also known as the Uniform Motor Carrier Bodily Injury and Property Damage Liability Insurance Endorsement, is a federal filing requirement for motor carriers. It certifies that a carrier has the necessary insurance coverage to operate in compliance with federal regulations. The form is usually filed with the Federal Motor Carrier Safety Administration (FMCSA) and is a critical component of a carrier's insurance portfolio.

Way #1: Proof of Financial Responsibility

Proof of Financial Responsibility

The BMC-91 form serves as proof of a carrier's financial responsibility to the FMCSA. By filing this form, carriers demonstrate that they have the necessary insurance coverage to compensate third parties in the event of an accident or other covered incident. This assurance helps to protect the public and promotes a safer transportation environment.

Way #2: Compliance with Federal Regulations

Compliance with Federal Regulations

The BMC-91 form is a mandatory filing requirement for motor carriers operating in interstate commerce. By filing this form, carriers comply with federal regulations and avoid potential penalties or fines. This compliance also helps to ensure that carriers are properly insured, which reduces the risk of uninsured or underinsured incidents.

Way #3: Protection Against Lawsuits and Claims

Protection Against Lawsuits and Claims

The BMC-91 form provides carriers with protection against lawsuits and claims arising from accidents or other covered incidents. By having the necessary insurance coverage in place, carriers can respond to claims and lawsuits more effectively, reducing the risk of financial loss or damage to their reputation.

Way #4: Enhanced Credibility and Reputation

Enhanced Credibility and Reputation

Filing the BMC-91 form demonstrates a carrier's commitment to safety and responsible business practices. This can enhance their credibility and reputation within the industry, making it easier to attract and retain customers, as well as top talent.

Way #5: Access to More Business Opportunities

Access to More Business Opportunities

By filing the BMC-91 form, carriers can access more business opportunities and expand their operations. Many shippers and brokers require carriers to have this form on file before awarding contracts or loads. By having this form in place, carriers can tap into new revenue streams and grow their business.

Getting Started with the BMC-91 Form

To file the BMC-91 form, carriers typically need to work with an insurance agent or broker who specializes in trucking insurance. The process typically involves:

- Obtaining the necessary insurance coverage

- Completing the BMC-91 form

- Filing the form with the FMCSA

Conclusion: Safeguard Your Business with the BMC-91 Form

The BMC-91 insurance liability form is a critical component of a carrier's insurance portfolio. By filing this form, carriers can protect their business and financial well-being, enhance their credibility and reputation, and access more business opportunities. If you're a carrier operating in the transportation industry, don't wait – get started with the BMC-91 form today and safeguard your business for the road ahead.

What's Next?

We hope this article has provided you with a comprehensive understanding of the BMC-91 form and its importance in the transportation industry. If you have any questions or would like to learn more about trucking insurance, please don't hesitate to comment below or share this article with your colleagues.

FAQ Section

What is the BMC-91 form?

+The BMC-91 form, also known as the Uniform Motor Carrier Bodily Injury and Property Damage Liability Insurance Endorsement, is a federal filing requirement for motor carriers.

Why is the BMC-91 form important?

+The BMC-91 form provides proof of financial responsibility, compliance with federal regulations, protection against lawsuits and claims, enhanced credibility and reputation, and access to more business opportunities.

How do I file the BMC-91 form?

+To file the BMC-91 form, carriers typically need to work with an insurance agent or broker who specializes in trucking insurance. The process typically involves obtaining the necessary insurance coverage, completing the BMC-91 form, and filing the form with the FMCSA.