Filing Schedule D on Form 1041 is a crucial task for estates and trusts that have capital gains or losses from the sale of investments. The process can be complex, but with a clear understanding of the requirements and a step-by-step approach, you can ensure accuracy and compliance with the IRS regulations.

Understanding Schedule D and Form 1041

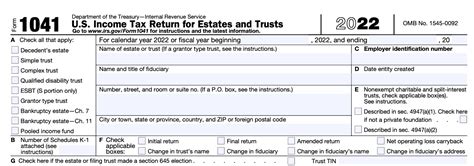

Schedule D is a supplemental form used to report capital gains and losses from the sale of investments, such as stocks, bonds, and real estate. Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is the primary form used to report the income, deductions, and credits of an estate or trust. The IRS requires estates and trusts to file Schedule D as part of Form 1041 if they have capital gains or losses from the sale of investments.

Who Needs to File Schedule D on Form 1041?

Estates and trusts that have capital gains or losses from the sale of investments need to file Schedule D on Form 1041. This includes:

- Estates: The executor or personal representative of the estate is responsible for filing Form 1041 and Schedule D.

- Trusts: The trustee is responsible for filing Form 1041 and Schedule D.

- Grantor trusts: The grantor is responsible for filing Form 1041 and Schedule D.

Types of Investments Reported on Schedule D

Schedule D reports capital gains and losses from the sale of various types of investments, including:

- Stocks

- Bonds

- Mutual funds

- Real estate

- Collectibles

- Cryptocurrencies

Step-by-Step Guide to Filing Schedule D on Form 1041

Filing Schedule D on Form 1041 requires careful attention to detail and accurate calculations. Here's a step-by-step guide to help you navigate the process:

- Gather necessary documents: Collect all relevant documents, including:

- Investment statements

- Sale receipts

- Cost basis records

- Dividend and interest statements

- Determine the type of investment: Identify the type of investment sold, such as stocks, bonds, or real estate.

- Calculate the gain or loss: Calculate the gain or loss from the sale of each investment using the following formula:

- Gain = Sale price - Cost basis

- Loss = Cost basis - Sale price

- Complete Part I of Schedule D: Report the gain or loss from the sale of each investment in Part I of Schedule D.

- Complete Part II of Schedule D: Report the total gain or loss from all investments in Part II of Schedule D.

- Calculate the net capital gain or loss: Calculate the net capital gain or loss by combining the gains and losses from all investments.

- Complete Form 1041: Report the net capital gain or loss on Form 1041.

Calculating the Net Capital Gain or Loss

The net capital gain or loss is calculated by combining the gains and losses from all investments. The following steps outline the calculation:

- Combine long-term gains and losses: Combine the long-term gains and losses from all investments.

- Combine short-term gains and losses: Combine the short-term gains and losses from all investments.

- Net long-term gain or loss: Calculate the net long-term gain or loss by subtracting the total long-term losses from the total long-term gains.

- Net short-term gain or loss: Calculate the net short-term gain or loss by subtracting the total short-term losses from the total short-term gains.

- Net capital gain or loss: Calculate the net capital gain or loss by combining the net long-term gain or loss and the net short-term gain or loss.

Common Mistakes to Avoid When Filing Schedule D

When filing Schedule D, it's essential to avoid common mistakes that can lead to errors and delays. Here are some mistakes to avoid:

- Incorrect cost basis: Ensure that the cost basis is accurate and up-to-date.

- Missing or incorrect documentation: Ensure that all necessary documents are included and accurate.

- Incorrect calculation of gain or loss: Ensure that the gain or loss is calculated correctly using the correct formula.

- Failure to report all investments: Ensure that all investments are reported on Schedule D.

Conclusion

Filing Schedule D on Form 1041 requires careful attention to detail and accurate calculations. By following the step-by-step guide and avoiding common mistakes, you can ensure accuracy and compliance with the IRS regulations. If you're unsure about any aspect of the process, consult a tax professional or seek guidance from the IRS.What is Schedule D, and why is it required?

+Schedule D is a supplemental form used to report capital gains and losses from the sale of investments. It is required for estates and trusts that have capital gains or losses from the sale of investments.

What types of investments are reported on Schedule D?

+Schedule D reports capital gains and losses from the sale of various types of investments, including stocks, bonds, mutual funds, real estate, collectibles, and cryptocurrencies.

How do I calculate the net capital gain or loss?

+The net capital gain or loss is calculated by combining the gains and losses from all investments. The calculation involves combining long-term gains and losses, combining short-term gains and losses, and then combining the net long-term gain or loss and the net short-term gain or loss.