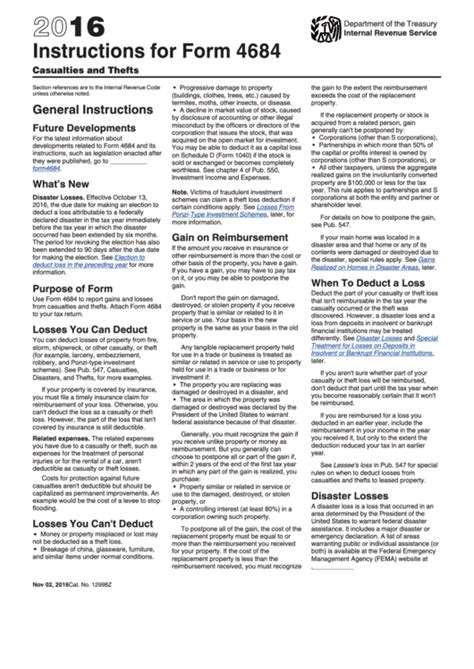

Tax season can be a daunting time for individuals and businesses alike. One of the most critical forms for those who have suffered losses due to theft, vandalism, or other disasters is Form 4684, also known as the Casualties and Thefts form. This form is used to report losses and claim deductions on your tax return. In this article, we will guide you through the essential steps to complete Form 4684 accurately and efficiently.

Understanding Form 4684

Form 4684 is used to report losses due to casualties, thefts, or other disasters that occurred during the tax year. Casualties can include natural disasters like hurricanes, floods, or wildfires, while thefts can include burglaries, vandalism, or embezzlement. The form is used to calculate the loss and claim a deduction on your tax return.

Step 1: Gather Required Documents and Information

Before starting to complete Form 4684, it is essential to gather all the necessary documents and information. This includes:

- A detailed description of the casualty or theft

- Date and location of the casualty or theft

- Type and value of the property damaged or stolen

- Insurance reimbursement (if any)

- Police report or other documentation (if applicable)

Step 2: Determine the Type of Loss

Form 4684 has two main sections: Section A for personal-use property and Section B for business-use property. You need to determine the type of loss you are reporting and fill out the corresponding section.

Step 3: Calculate the Loss

To calculate the loss, you need to determine the fair market value (FMV) of the property before and after the casualty or theft. You can use the following steps to calculate the loss:

- Determine the FMV of the property before the casualty or theft

- Determine the FMV of the property after the casualty or theft

- Subtract the FMV after the casualty or theft from the FMV before the casualty or theft

- This will give you the amount of the loss

Step 4: Complete Section A (Personal-Use Property)

If you are reporting a loss for personal-use property, you need to complete Section A of Form 4684. This section includes:

- Description of the property

- Date and location of the casualty or theft

- FMV before and after the casualty or theft

- Insurance reimbursement (if any)

- Calculated loss

Step 5: Complete Section B (Business-Use Property)

If you are reporting a loss for business-use property, you need to complete Section B of Form 4684. This section includes:

- Description of the property

- Date and location of the casualty or theft

- FMV before and after the casualty or theft

- Insurance reimbursement (if any)

- Calculated loss

- Business use percentage (if applicable)

Step 6: Attach Supporting Documentation

Finally, you need to attach supporting documentation to Form 4684. This includes:

- Police report or other documentation (if applicable)

- Insurance claims or reimbursement documentation (if applicable)

- Appraisal or valuation documentation (if applicable)

By following these essential steps, you can accurately and efficiently complete Form 4684 and claim a deduction for your losses. Remember to attach all supporting documentation to ensure a smooth processing of your tax return.

Additional Tips and Reminders

- Make sure to keep detailed records of your losses, including dates, times, and descriptions of the events.

- Take photos or videos of the damaged property, if possible.

- Keep receipts and documentation for any insurance claims or reimbursements.

- Consult with a tax professional if you are unsure about any part of the process.

Frequently Asked Questions

What is Form 4684 used for?

+Form 4684 is used to report losses due to casualties, thefts, or other disasters that occurred during the tax year.

What type of losses can be reported on Form 4684?

+Form 4684 can be used to report losses due to natural disasters, thefts, vandalism, and other disasters.

What documentation is required to support a loss on Form 4684?

+Supporting documentation may include police reports, insurance claims, appraisal or valuation documentation, and receipts for any expenses related to the loss.

We hope this article has helped you understand the essential steps to complete Form 4684. If you have any further questions or concerns, please don't hesitate to comment below. Remember to share this article with anyone who may be affected by casualties or thefts during the tax year.