Taxpayers who engage in certain types of trading activities may be required to report gains and losses from these activities on Form 6781, Gains and Losses From Section 1256 Contracts and Straddles. This form is used to report gains and losses from section 1256 contracts, which include regulated futures contracts, foreign currency contracts, and non-equity options. In this article, we will provide a comprehensive guide to Form 6781 instructions, including who is required to file, how to calculate gains and losses, and how to report these amounts on the form.

Who Must File Form 6781?

Form 6781 must be filed by taxpayers who have gains or losses from section 1256 contracts. These contracts include:

- Regulated futures contracts

- Foreign currency contracts

- Non-equity options

Taxpayers who engage in these types of trading activities must file Form 6781, regardless of whether they have gains or losses.

Calculating Gains and Losses

Gains and losses from section 1256 contracts are calculated using the mark-to-market method. This means that gains and losses are recognized at the end of the tax year, regardless of whether the contract is closed or still open.

To calculate gains and losses, taxpayers must determine the fair market value of each contract at the end of the tax year. This value is then compared to the cost basis of the contract to determine the gain or loss.

Example of Calculating Gains and Losses

Taxpayer A purchases a regulated futures contract for $10,000. At the end of the tax year, the fair market value of the contract is $12,000. Taxpayer A recognizes a gain of $2,000 ($12,000 - $10,000).

Reporting Gains and Losses on Form 6781

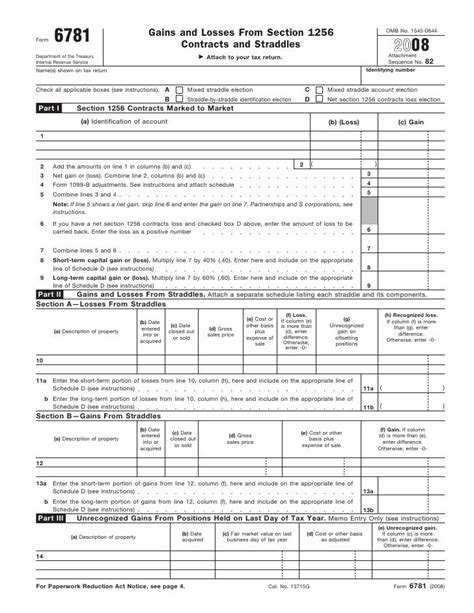

Gains and losses from section 1256 contracts are reported on Form 6781. The form consists of three parts:

- Part I: Section 1256 Contracts Marked to Market

- Part II: Straddles

- Part III: Summary of Gains and Losses

Taxpayers must report the following information on Form 6781:

- The type of contract (regulated futures contract, foreign currency contract, or non-equity option)

- The date the contract was acquired

- The date the contract was sold or closed

- The cost basis of the contract

- The fair market value of the contract at the end of the tax year

- The gain or loss from the contract

Straddles

A straddle is a set of two or more section 1256 contracts that are acquired and held as a single unit. Straddles are reported on Part II of Form 6781.

To report a straddle on Form 6781, taxpayers must identify the contracts that make up the straddle and calculate the gain or loss from the straddle. The gain or loss from the straddle is then reported on Part III of the form.

Summary of Gains and Losses

Part III of Form 6781 requires taxpayers to summarize their gains and losses from section 1256 contracts and straddles. This includes:

- The total gain or loss from section 1256 contracts

- The total gain or loss from straddles

- The net gain or loss from section 1256 contracts and straddles

The net gain or loss from section 1256 contracts and straddles is then carried over to Schedule D (Form 1040) and reported as a capital gain or loss.

Conclusion

Form 6781 is an important tax form for taxpayers who engage in trading activities involving section 1256 contracts. By following the instructions and guidelines outlined in this article, taxpayers can ensure that they accurately report their gains and losses from these contracts and comply with tax regulations.

We encourage you to share your experiences with Form 6781 in the comments below. If you have any questions or need further clarification on any of the topics discussed in this article, please don't hesitate to ask.

Who must file Form 6781?

+Form 6781 must be filed by taxpayers who have gains or losses from section 1256 contracts, including regulated futures contracts, foreign currency contracts, and non-equity options.

How are gains and losses from section 1256 contracts calculated?

+Gains and losses from section 1256 contracts are calculated using the mark-to-market method, which recognizes gains and losses at the end of the tax year, regardless of whether the contract is closed or still open.

What information must be reported on Form 6781?

+Form 6781 requires taxpayers to report the type of contract, the date the contract was acquired, the date the contract was sold or closed, the cost basis of the contract, the fair market value of the contract at the end of the tax year, and the gain or loss from the contract.