The Internal Revenue Service (IRS) is responsible for collecting taxes and enforcing tax laws in the United States. One of the many forms that the IRS uses to collect taxes is Form 6251, also known as the Alternative Minimum Tax (AMT) form. In this article, we will delve into the world of Form 6251 and explore five essential facts that you need to know about it.

The Alternative Minimum Tax (AMT) was introduced in 1969 to ensure that wealthy individuals and corporations pay their fair share of taxes. The AMT is a separate tax system that is designed to prevent taxpayers from avoiding taxes by using tax deductions and credits. Form 6251 is used to calculate the AMT and determine if a taxpayer owes any AMT.

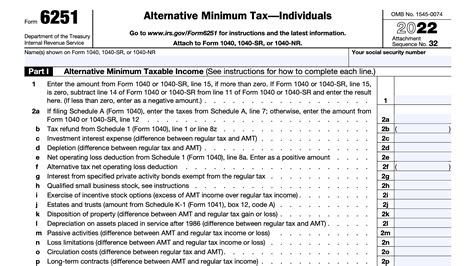

What is the Purpose of Form 6251?

The primary purpose of Form 6251 is to calculate the Alternative Minimum Tax (AMT) for individual taxpayers. The form is used to determine if a taxpayer's regular tax liability is less than their AMT liability. If the AMT liability is higher, the taxpayer must pay the difference as part of their tax bill.

Who Needs to File Form 6251?

Not all taxpayers need to file Form 6251. The form is typically required for taxpayers who have a high income or who claim certain tax deductions and credits. Some of the situations that may require a taxpayer to file Form 6251 include:

- Having a high income (above $500,000 for single filers or $1 million for joint filers)

- Claiming certain tax deductions and credits, such as the mortgage interest deduction or the foreign tax credit

- Having a large amount of long-term capital gains or dividends

- Being a beneficiary of a trust or estate

How to Calculate the Alternative Minimum Tax (AMT)

Calculating the AMT can be complex, but it involves the following steps:

- Calculate your regular tax liability using Form 1040.

- Calculate your AMT income by adding back certain deductions and credits to your regular income.

- Calculate your AMT exemptions and deductions.

- Calculate your tentative minimum tax.

- Compare your regular tax liability to your tentative minimum tax. If your tentative minimum tax is higher, you owe the difference as AMT.

What are the Penalties for Not Filing Form 6251?

If a taxpayer is required to file Form 6251 and fails to do so, they may be subject to penalties and interest. The penalties for not filing Form 6251 can include:

- A penalty of 47.6% of the unpaid AMT liability

- Interest on the unpaid AMT liability

- A penalty for failing to file Form 6251, which can be up to $100,000 for individuals and $200,000 for corporations

How to Avoid the Alternative Minimum Tax (AMT)

While it is not possible to completely avoid the AMT, there are some strategies that taxpayers can use to minimize their AMT liability. Some of these strategies include:

- Investing in tax-efficient investments, such as index funds or municipal bonds

- Deferring income or accelerating deductions to reduce AMT income

- Claiming the AMT exemption for qualified dividends and long-term capital gains

- Using AMT credits to reduce AMT liability

What are the Common Mistakes to Avoid When Filing Form 6251?

When filing Form 6251, taxpayers should avoid the following common mistakes:

- Failing to file Form 6251 when required

- Underreporting or overreporting AMT income

- Failing to claim AMT exemptions and deductions

- Failing to calculate the tentative minimum tax correctly

- Failing to pay the AMT liability on time

Conclusion

In conclusion, Form 6251 is an important tax form that is used to calculate the Alternative Minimum Tax (AMT) for individual taxpayers. Understanding the purpose of Form 6251, who needs to file it, and how to calculate the AMT can help taxpayers avoid penalties and interest. By using tax planning strategies and avoiding common mistakes, taxpayers can minimize their AMT liability and reduce their tax bill.

We encourage you to share your thoughts and experiences with Form 6251 in the comments section below. If you have any questions or need help with filing Form 6251, please don't hesitate to reach out to a tax professional.

What is the Alternative Minimum Tax (AMT)?

+The Alternative Minimum Tax (AMT) is a separate tax system that is designed to prevent taxpayers from avoiding taxes by using tax deductions and credits.

Who needs to file Form 6251?

+Form 6251 is typically required for taxpayers who have a high income or who claim certain tax deductions and credits.

How to calculate the Alternative Minimum Tax (AMT)?

+Calculating the AMT involves calculating your regular tax liability, AMT income, AMT exemptions and deductions, and tentative minimum tax.