The DCP Income Verification Form is a crucial document required for various purposes, including loan applications, credit assessments, and other financial evaluations. In this article, we will delve into the details of the DCP Income Verification Form, explaining its importance, benefits, and providing a step-by-step guide on how to complete it accurately.

Understanding the DCP Income Verification Form

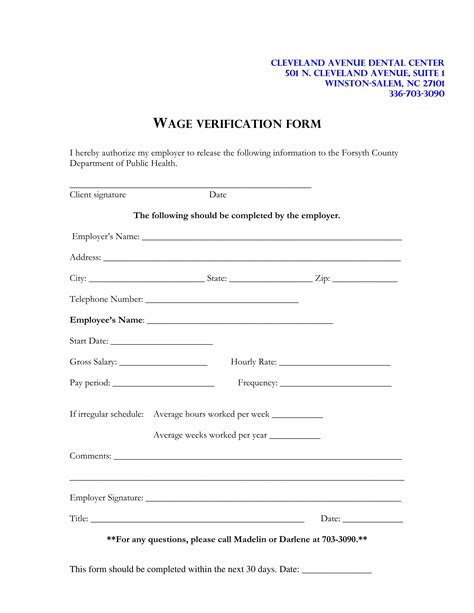

The DCP Income Verification Form is a standardized document used to verify an individual's income and employment status. The form is typically required by lenders, creditors, and other financial institutions to assess an individual's creditworthiness and ability to repay loans or debts. The form provides a comprehensive overview of an individual's income, including salary, wages, tips, and other forms of income.

Why is the DCP Income Verification Form Important?

The DCP Income Verification Form is essential for several reasons:

- Creditworthiness: The form helps lenders assess an individual's creditworthiness by verifying their income and employment status.

- Loan Applications: The form is required for loan applications, including mortgages, personal loans, and credit cards.

- Credit Assessments: The form is used to evaluate an individual's creditworthiness for credit assessments and reports.

Step-by-Step Guide to Completing the DCP Income Verification Form

Completing the DCP Income Verification Form accurately is crucial to ensure that your loan application or credit assessment is processed smoothly. Here's a step-by-step guide to help you complete the form:

Step 1: Gather Required Documents

Before starting the form, gather the required documents, including:

- Pay stubs: Recent pay stubs showing your income and employment status.

- W-2 forms: W-2 forms from your employer, showing your annual income.

- Tax returns: Recent tax returns, including Form 1040 and Schedule C (if self-employed).

Step 2: Fill in Personal and Employment Information

Fill in your personal and employment information, including:

- Name: Your full name, as it appears on your government-issued ID.

- Address: Your current address, including street address, city, state, and zip code.

- Employer: Your current employer's name, address, and phone number.

- Job title: Your job title and position.

Step 3: Report Income and Benefits

Report your income and benefits, including:

- Salary: Your annual salary or wages.

- Tips: Any tips or gratuities you receive.

- Benefits: Any benefits you receive, including health insurance, retirement plans, or other perks.

Step 4: Provide Employment History

Provide your employment history, including:

- Previous employers: A list of your previous employers, including their names, addresses, and phone numbers.

- Job dates: The dates you worked for each employer.

Step 5: Sign and Date the Form

Sign and date the form, ensuring that you have accurately completed all sections.

Tips for Completing the DCP Income Verification Form

Here are some tips to help you complete the DCP Income Verification Form accurately:

- Use black ink: Use black ink to complete the form, as it is easier to read and scan.

- Be accurate: Ensure that you accurately complete all sections, including your personal and employment information.

- Use exact figures: Use exact figures when reporting your income and benefits.

- Keep a copy: Keep a copy of the completed form for your records.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing the DCP Income Verification Form:

- Inaccurate information: Inaccurate information, including incorrect dates or figures.

- Incomplete sections: Incomplete sections, including missing signatures or dates.

- Illegible handwriting: Illegible handwriting, making it difficult to read and scan the form.

Conclusion

The DCP Income Verification Form is a crucial document required for various financial purposes. By following the step-by-step guide and tips provided in this article, you can complete the form accurately and avoid common mistakes. Remember to gather all required documents, fill in personal and employment information, report income and benefits, provide employment history, and sign and date the form.

We hope this article has helped you understand the importance of the DCP Income Verification Form and how to complete it accurately. If you have any further questions or concerns, please leave a comment below.

What is the purpose of the DCP Income Verification Form?

+The DCP Income Verification Form is used to verify an individual's income and employment status for loan applications, credit assessments, and other financial evaluations.

What documents are required to complete the DCP Income Verification Form?

+The required documents include pay stubs, W-2 forms, and tax returns.

How do I avoid common mistakes when completing the DCP Income Verification Form?

+Avoid common mistakes by using black ink, being accurate, using exact figures, and keeping a copy of the completed form.