Understanding the Illini Tax Form Rut 25: A Comprehensive Overview

As a resident of Illinois, understanding the tax forms and regulations is crucial for individuals and businesses alike. One such important form is the Illini Tax Form Rut 25, also known as the "Certificate of Registration" form. In this article, we will provide a step-by-step guide to help you navigate the process of filling out and submitting the Illini Tax Form Rut 25.

What is the Illini Tax Form Rut 25?

The Illini Tax Form Rut 25 is a registration form required by the Illinois Department of Revenue for businesses and individuals who engage in specific activities. The form is used to register for various taxes, including sales tax, use tax, and withholding tax. The certificate of registration is required for businesses that operate in Illinois, and it serves as proof of registration with the state.

Who Needs to File the Illini Tax Form Rut 25?

The Illini Tax Form Rut 25 is required for various businesses and individuals, including:

- Retailers and businesses that sell tangible personal property

- Businesses that provide services subject to service occupation tax

- Construction contractors and builders

- Businesses that lease or rent equipment or vehicles

- Individuals who engage in activities subject to withholding tax

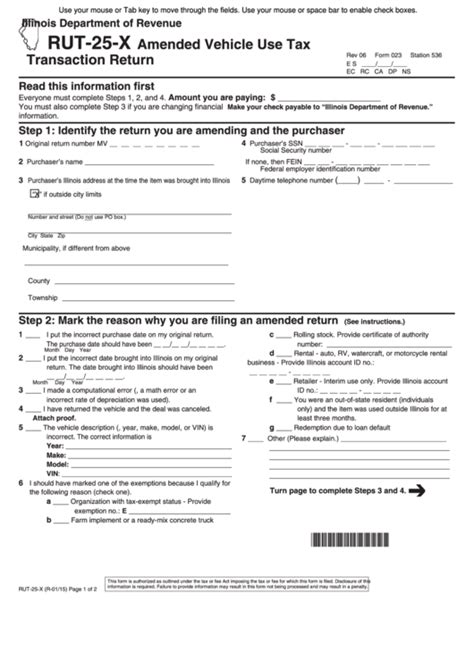

Step-by-Step Guide to Filling Out the Illini Tax Form Rut 25

Filling out the Illini Tax Form Rut 25 requires careful attention to detail. Here is a step-by-step guide to help you navigate the process:

- Download the Form: You can download the Illini Tax Form Rut 25 from the Illinois Department of Revenue website or obtain it from your local tax office.

- Business Information: Provide your business name, address, and contact information.

- Tax Type: Identify the type of tax you are registering for (sales tax, use tax, withholding tax, etc.).

- Federal Employer Identification Number (FEIN): Provide your FEIN, if applicable.

- Business Structure: Indicate your business structure (sole proprietorship, partnership, corporation, etc.).

- Owner/Officer Information: Provide the names, addresses, and social security numbers (or FEIN) of the business owners/officers.

- Signature: Sign and date the form.

Submitting the Illini Tax Form Rut 25

Once you have completed the form, you can submit it to the Illinois Department of Revenue by:

- Mailing it to the address listed on the form

- Faxing it to the number listed on the form

- Submitting it online through the Illinois Department of Revenue website

Penalties for Failure to Register

Failure to register for the required taxes can result in penalties and fines. The Illinois Department of Revenue may impose penalties for:

- Late registration

- Failure to file returns

- Failure to pay taxes

Additional Resources

For additional information and resources, you can:

- Visit the Illinois Department of Revenue website

- Contact your local tax office

- Consult with a tax professional

Conclusion

The Illini Tax Form Rut 25 is an essential registration form for businesses and individuals operating in Illinois. By following the step-by-step guide outlined in this article, you can ensure that you are in compliance with the state's tax regulations. Remember to submit the form on time to avoid penalties and fines. If you have any questions or concerns, don't hesitate to reach out to the Illinois Department of Revenue or a tax professional for guidance.

What is the purpose of the Illini Tax Form Rut 25?

+The Illini Tax Form Rut 25 is used to register for various taxes, including sales tax, use tax, and withholding tax.

Who needs to file the Illini Tax Form Rut 25?

+The Illini Tax Form Rut 25 is required for various businesses and individuals, including retailers, construction contractors, and individuals who engage in activities subject to withholding tax.

What are the penalties for failure to register?

+Failure to register for the required taxes can result in penalties and fines, including late registration, failure to file returns, and failure to pay taxes.