The Illinois Form 1120 ST is a required filing for businesses operating in the state of Illinois, and it can be a complex and time-consuming process. However, with the right guidance, you can ensure that your business is in compliance with state regulations and avoid any potential penalties. Here are five ways to fill out the Illinois Form 1120 ST correctly and efficiently.

Understanding the Illinois Form 1120 ST

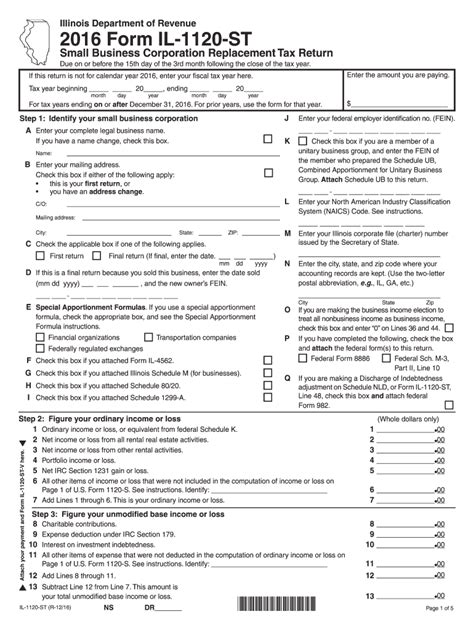

The Illinois Form 1120 ST is a sales tax return that must be filed by businesses operating in the state of Illinois. The form is used to report and pay sales tax on tangible personal property, including goods and services. Businesses that are required to file the Form 1120 ST include retailers, wholesalers, and service providers.

Way 1: Manual Filing

Manual filing involves filling out the Illinois Form 1120 ST by hand and submitting it to the Illinois Department of Revenue. This method can be time-consuming and prone to errors, but it is a viable option for small businesses or those with simple tax obligations.

To file manually, you will need to:

- Obtain a copy of the Illinois Form 1120 ST from the Illinois Department of Revenue website or by contacting their office.

- Fill out the form completely and accurately, making sure to include all required information, such as your business's name, address, and federal employer identification number.

- Calculate your sales tax liability and make payment by check or money order.

- Submit the completed form and payment to the Illinois Department of Revenue.

Way 2: Electronic Filing

Electronic filing is a faster and more efficient way to file the Illinois Form 1120 ST. This method involves using a computer and internet connection to submit your tax return and payment online.

To file electronically, you will need to:

- Register for an account on the Illinois Department of Revenue's website.

- Fill out the Form 1120 ST online, using the department's electronic filing system.

- Calculate your sales tax liability and make payment using a credit or debit card, or electronic check.

- Submit the completed form and payment online.

Benefits of Electronic Filing

Electronic filing offers several benefits, including:

- Faster processing and payment

- Reduced risk of errors and penalties

- Increased convenience and flexibility

- Ability to save and retrieve your tax return for future reference

Way 3: Outsourcing to a Tax Professional

If you are not comfortable filing the Illinois Form 1120 ST yourself, you can outsource the task to a tax professional. This can be especially beneficial for businesses with complex tax obligations or those who need assistance with audit representation.

To outsource to a tax professional, you will need to:

- Research and select a qualified tax professional with experience in Illinois sales tax.

- Provide the tax professional with all necessary documentation and information.

- Review and approve the completed Form 1120 ST before submission.

Benefits of Outsourcing to a Tax Professional

Outsourcing to a tax professional offers several benefits, including:

- Expertise and knowledge of Illinois sales tax laws and regulations

- Increased accuracy and reduced risk of errors and penalties

- Ability to handle complex tax obligations and audit representation

- More time to focus on running your business

Way 4: Using Tax Preparation Software

Tax preparation software is another option for filing the Illinois Form 1120 ST. This method involves using a computer program to prepare and submit your tax return.

To use tax preparation software, you will need to:

- Purchase and install the software on your computer.

- Fill out the Form 1120 ST using the software's guided interview process.

- Calculate your sales tax liability and make payment using the software's built-in payment options.

- Submit the completed form and payment online.

Way 5: Using a Third-Party Filing Service

A third-party filing service is a company that specializes in preparing and submitting tax returns on behalf of businesses. This method can be beneficial for businesses with complex tax obligations or those who need assistance with audit representation.

To use a third-party filing service, you will need to:

- Research and select a qualified third-party filing service with experience in Illinois sales tax.

- Provide the service with all necessary documentation and information.

- Review and approve the completed Form 1120 ST before submission.

Benefits of Using a Third-Party Filing Service

Using a third-party filing service offers several benefits, including:

- Expertise and knowledge of Illinois sales tax laws and regulations

- Increased accuracy and reduced risk of errors and penalties

- Ability to handle complex tax obligations and audit representation

- More time to focus on running your business

Get the Help You Need

Filing the Illinois Form 1120 ST can be a complex and time-consuming process, but with the right guidance, you can ensure that your business is in compliance with state regulations. Whether you choose to file manually, electronically, or outsource to a tax professional, the key is to find a method that works best for your business.

Next Steps

If you are ready to start the filing process, here are some next steps to take:

- Visit the Illinois Department of Revenue website to obtain a copy of the Form 1120 ST and to learn more about the filing process.

- Research and select a qualified tax professional or third-party filing service to assist with the filing process.

- Gather all necessary documentation and information to complete the Form 1120 ST.

By following these steps and choosing the right filing method for your business, you can ensure that you are in compliance with Illinois sales tax laws and regulations.

FAQs

What is the Illinois Form 1120 ST?

+The Illinois Form 1120 ST is a sales tax return that must be filed by businesses operating in the state of Illinois.

Who is required to file the Illinois Form 1120 ST?

+Businesses that are required to file the Form 1120 ST include retailers, wholesalers, and service providers.

What are the benefits of electronic filing?

+Electronic filing offers several benefits, including faster processing and payment, reduced risk of errors and penalties, and increased convenience and flexibility.