The Illinois 1041 tax form is a crucial document for estates, trusts, and beneficiaries in the state of Illinois. As an executor or trustee, it's essential to understand the ins and outs of this form to ensure you're meeting your tax obligations and taking advantage of available deductions. In this article, we'll delve into the world of the Illinois 1041 tax form, exploring its purpose, benefits, and steps to complete it accurately.

What is the Illinois 1041 Tax Form?

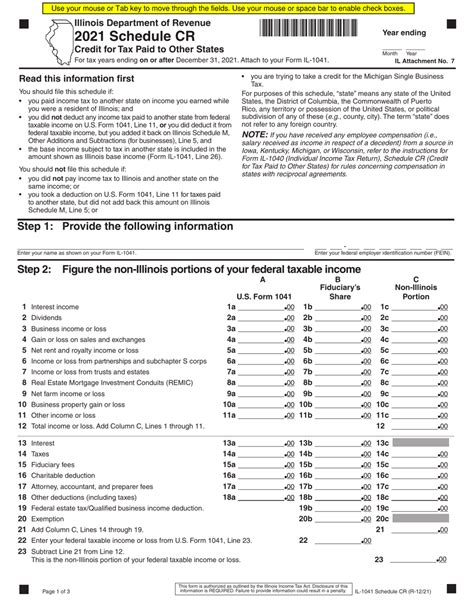

The Illinois 1041 tax form, also known as the Illinois Fiduciary Income and Replacement Tax Return, is a tax document used to report the income, deductions, and tax liability of an estate or trust. This form is similar to the federal Form 1041, but it's specific to the state of Illinois. The Illinois 1041 tax form is used to calculate the tax owed by the estate or trust, as well as the tax owed by the beneficiaries.

Who Needs to File the Illinois 1041 Tax Form?

The Illinois 1041 tax form is required for estates and trusts that have income taxable in Illinois. This includes:

- Estates of deceased individuals

- Trusts, including revocable and irrevocable trusts

- Beneficiaries of estates and trusts

As an executor or trustee, it's essential to determine whether the estate or trust is required to file the Illinois 1041 tax form. If the estate or trust has income taxable in Illinois, you'll need to file this form to report the income and pay any tax owed.

Benefits of Filing the Illinois 1041 Tax Form

Filing the Illinois 1041 tax form provides several benefits, including:

- Reduces the risk of penalties and fines for non-compliance

- Ensures accurate reporting of income and deductions

- Allows for the calculation of tax owed and payment of tax due

- Provides a record of tax payments for future reference

Steps to Complete the Illinois 1041 Tax Form

Completing the Illinois 1041 tax form requires accurate and detailed information. Here are the steps to follow:

- Gather necessary documents, including:

- Federal Form 1041

- Illinois Schedule 1041

- Supporting schedules and statements

- Determine the estate's or trust's tax year, which may be a calendar year or a fiscal year

- Calculate the estate's or trust's taxable income, including:

- Interest and dividends

- Capital gains and losses

- Rental income and expenses

- Business income and expenses

- Calculate the estate's or trust's deductions, including:

- Funeral expenses

- Administration expenses

- Charitable contributions

- Complete the Illinois 1041 tax form, including:

- Identifying information, such as the estate's or trust's name and address

- Tax year and tax period

- Income and deductions

- Tax liability and payment information

- Attach supporting schedules and statements, as required

- Sign and date the form, as the executor or trustee

Common Mistakes to Avoid When Filing the Illinois 1041 Tax Form

When filing the Illinois 1041 tax form, it's essential to avoid common mistakes, including:

- Inaccurate or incomplete information

- Failure to attach supporting schedules and statements

- Miscalculation of taxable income and deductions

- Failure to sign and date the form

- Missing deadlines for filing and payment

Penalties for Non-Compliance

Failure to file the Illinois 1041 tax form or pay tax owed can result in penalties and fines. These penalties may include:

- Late filing penalty: 5% of the tax owed per month, up to 25%

- Late payment penalty: 5% of the tax owed per month, up to 25%

- Interest on unpaid tax: 12% per annum

Conclusion

The Illinois 1041 tax form is a critical document for estates and trusts in the state of Illinois. By understanding the purpose, benefits, and steps to complete this form, you can ensure accurate reporting of income and deductions, reduce the risk of penalties and fines, and take advantage of available deductions. Remember to avoid common mistakes and seek professional advice if needed.

Who is required to file the Illinois 1041 tax form?

+Estates and trusts with income taxable in Illinois are required to file the Illinois 1041 tax form.

What is the deadline for filing the Illinois 1041 tax form?

+The deadline for filing the Illinois 1041 tax form is typically April 15th, but may vary depending on the estate's or trust's tax year.

What are the penalties for non-compliance with the Illinois 1041 tax form?

+Penalties for non-compliance may include late filing and payment penalties, as well as interest on unpaid tax.

We hope this article has provided you with a comprehensive understanding of the Illinois 1041 tax form. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or comment below.