As an In-Home Supportive Services (IHSS) provider, filling out the IHSS W4 form is a crucial step in ensuring you receive accurate pay and comply with tax regulations. The IHSS W4 form, also known as the Employee's Withholding Certificate, is used to determine the amount of federal income tax to withhold from your IHSS payments. In this article, we will guide you through the 5 steps to fill out the IHSS W4 form accurately and efficiently.

Step 1: Download and Review the IHSS W4 Form

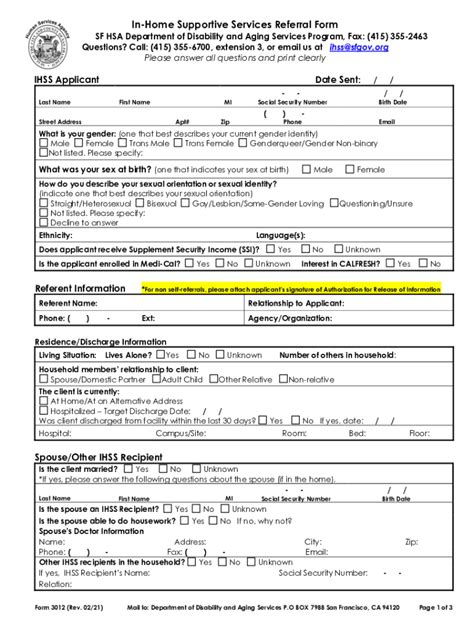

The first step is to download the IHSS W4 form from the California Department of Social Services (CDSS) website or obtain a copy from your IHSS provider. Review the form carefully to understand the sections and information required. The form consists of two main sections: Personal Allowances Worksheet and Withholding Certificate.

Understanding the IHSS W4 Form Sections

Before filling out the form, it's essential to understand the two main sections:

- Personal Allowances Worksheet: This section helps you determine the number of allowances you're eligible for, which affects the amount of tax withheld from your IHSS payments.

- Withholding Certificate: This section is where you certify your withholding status and provide information about your tax filing status, number of allowances, and any additional withholding amounts.

Personal Allowances Worksheet: Claiming Allowances

The Personal Allowances Worksheet helps you calculate the number of allowances you're eligible for based on your personal circumstances, such as marital status, number of dependents, and whether you're claiming the standard deduction. Follow these steps to complete the worksheet:

- Check the boxes that apply to your situation (e.g., single, married, number of dependents).

- Calculate the total number of allowances based on the worksheet.

- Enter the total number of allowances on Line 5 of the Withholding Certificate.

Step 2: Determine Your Filing Status

Your filing status affects the amount of tax withheld from your IHSS payments. Choose the correct filing status from the following options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Claim Dependents and Other Allowances

If you have dependents or are eligible for other allowances, you may claim them on the IHSS W4 form. This can reduce the amount of tax withheld from your IHSS payments. Follow these steps:

- List your dependents (e.g., children, spouse) and their relationship to you.

- Claim any other allowances you're eligible for (e.g., standard deduction, mortgage interest).

- Enter the total number of allowances on Line 5 of the Withholding Certificate.

Additional Withholding Options

If you want to have additional taxes withheld from your IHSS payments, you can specify the amount on Line 6 of the Withholding Certificate. This can be useful if you have other sources of income or want to avoid owing taxes at the end of the year.

Step 4: Sign and Date the Form

Once you've completed the IHSS W4 form, sign and date it. Make sure to sign in the presence of a notary public if required by your IHSS provider.

Step 5: Submit the Form to Your IHSS Provider

Submit the completed IHSS W4 form to your IHSS provider. They will use the information on the form to determine the correct amount of federal income tax to withhold from your IHSS payments.

By following these 5 steps, you can accurately fill out the IHSS W4 form and ensure you're receiving the correct amount of pay and complying with tax regulations. Remember to review and update your IHSS W4 form annually or whenever your tax situation changes.

Get Involved

We'd love to hear from you! If you have any questions or concerns about filling out the IHSS W4 form, please comment below. Share this article with fellow IHSS providers to help them navigate the process.

What is the IHSS W4 form used for?

+The IHSS W4 form is used to determine the amount of federal income tax to withhold from IHSS payments.

How often should I update my IHSS W4 form?

+You should review and update your IHSS W4 form annually or whenever your tax situation changes.

Can I claim dependents on the IHSS W4 form?

+Yes, you can claim dependents on the IHSS W4 form, which may reduce the amount of tax withheld from your IHSS payments.