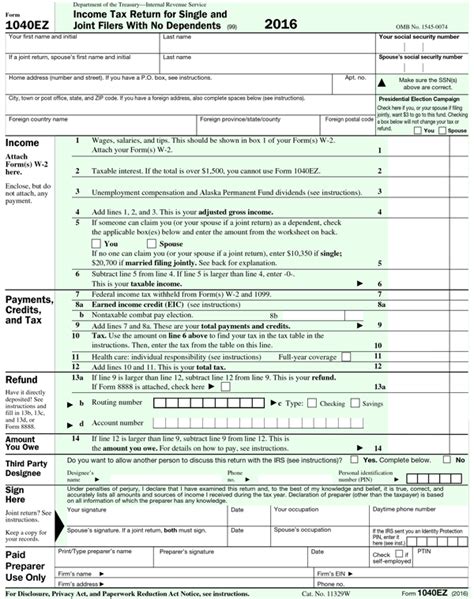

The tax season is upon us, and many individuals are eager to file their tax returns and receive their refunds as soon as possible. One of the most popular tax forms for individuals with simple tax situations is the 1040EZ. In this article, we will focus on Line 10 of the 1040EZ form, exploring what it is, what information is required, and how to fill it out accurately.

Understanding the 1040EZ Form

The 1040EZ is a simplified tax form designed for individuals with basic tax situations, such as those who only have one source of income, do not claim any dependents, and do not itemize deductions. This form is ideal for taxpayers who have straightforward tax situations and want to file their taxes quickly and easily.

Line 10: The Question

Line 10 of the 1040EZ form asks, "Do you want $3 to go to the Presidential Election Campaign Fund?" This question may seem straightforward, but it's essential to understand the implications of your answer.

What is the Presidential Election Campaign Fund?

The Presidential Election Campaign Fund is a program that provides public funding to qualified presidential candidates during the general election. The fund is financed through a combination of taxes and voluntary contributions, such as the $3 check-off on tax returns.

Why should you consider contributing to the fund?

Contributing to the Presidential Election Campaign Fund can help level the playing field in presidential elections by providing candidates with an alternative to private funding sources. This can reduce the influence of special interest groups and promote a more transparent and accountable electoral process.

How do you answer Line 10?

If you want to contribute $3 to the Presidential Election Campaign Fund, simply check the box next to Line 10 on the 1040EZ form. If you do not want to contribute, leave the box unchecked.

Benefits of Contributing to the Presidential Election Campaign Fund

While contributing $3 to the Presidential Election Campaign Fund may seem like a small amount, it can have a significant impact when combined with the contributions of other taxpayers. Here are some benefits of contributing to the fund:

- Promotes a more transparent and accountable electoral process

- Reduces the influence of special interest groups

- Provides an alternative to private funding sources

- Helps level the playing field in presidential elections

Common Questions and Answers

Q: Is contributing to the Presidential Election Campaign Fund mandatory? A: No, contributing to the fund is voluntary.

Q: Will contributing to the fund affect my tax refund? A: No, contributing to the fund will not affect your tax refund.

Q: Can I contribute more than $3 to the fund? A: No, the maximum contribution amount is $3.

Conclusion

Line 10 of the 1040EZ form provides taxpayers with the opportunity to contribute to the Presidential Election Campaign Fund. While the contribution amount may seem small, it can have a significant impact when combined with the contributions of other taxpayers. By understanding the purpose and benefits of the fund, taxpayers can make informed decisions about whether to contribute.

Take Action

If you're ready to contribute to the Presidential Election Campaign Fund, simply check the box next to Line 10 on your 1040EZ form. If you have any questions or concerns, consult with a tax professional or the IRS website for more information.

Share Your Thoughts

We'd love to hear from you! Share your thoughts on the Presidential Election Campaign Fund and Line 10 of the 1040EZ form in the comments below.

FAQ Section

What is the purpose of the Presidential Election Campaign Fund?

+The Presidential Election Campaign Fund provides public funding to qualified presidential candidates during the general election.

Is contributing to the Presidential Election Campaign Fund mandatory?

+No, contributing to the fund is voluntary.

Will contributing to the fund affect my tax refund?

+No, contributing to the fund will not affect your tax refund.