The Know Your Customer (KYC) form is a crucial document required by banks and financial institutions to verify the identity of their customers. ICICI Bank, one of India's leading private sector banks, also requires its customers to submit a KYC form to comply with regulatory requirements. In this article, we will provide a step-by-step guide on how to download the ICICI KYC form and complete it accurately.

Why is KYC Important?

Before we dive into the process of downloading and filling out the ICICI KYC form, let's understand the importance of KYC. The KYC process helps banks and financial institutions to:

- Verify the identity of their customers

- Prevent money laundering and terrorist financing

- Comply with regulatory requirements

- Reduce the risk of fraud and financial crimes

How to Download ICICI KYC Form

To download the ICICI KYC form, follow these steps:

- Visit the ICICI Bank website at

- Click on the "Forms" tab at the top of the page

- Select "KYC Form" from the drop-down menu

- Choose the type of account you want to open (e.g. savings, current, etc.)

- Click on the "Download" button to download the KYC form

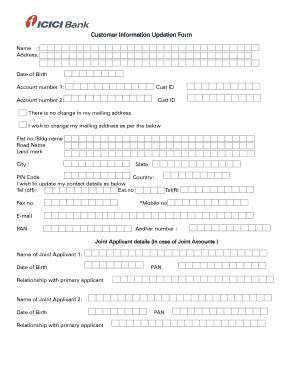

Filling Out the ICICI KYC Form

Once you have downloaded the ICICI KYC form, follow these steps to fill it out accurately:

Filling Out the ICICI KYC Form

- Read the instructions carefully before filling out the form

- Fill out the form in block letters and with a black ink pen

- Provide all the required documents, including:

- Proof of identity (e.g. PAN card, passport, etc.)

- Proof of address (e.g. utility bill, Aadhaar card, etc.)

- Proof of income (e.g. salary slip, income tax return, etc.)

- Fill out the form completely and accurately, leaving no fields blank

- Sign the form in the presence of an ICICI Bank official

Required Documents for ICICI KYC Form

To complete the ICICI KYC form, you will need to provide the following documents:

Proof of Identity

- PAN card

- Passport

- Driving license

- Voter ID card

- Aadhaar card

Proof of Address

- Utility bill (e.g. electricity, water, gas, etc.)

- Rent agreement

- Bank statement

- Credit card statement

- Passport

Proof of Income

- Salary slip

- Income tax return

- Form 16

- Bank statement

- Credit card statement

Tips for Filling Out the ICICI KYC Form

To avoid any errors or delays in the KYC process, follow these tips:

- Fill out the form carefully and accurately

- Provide all the required documents

- Ensure that the documents are valid and not expired

- Sign the form in the presence of an ICICI Bank official

- Keep a copy of the filled-out form and documents for your records

What to Do After Filling Out the ICICI KYC Form

Once you have filled out the ICICI KYC form and provided all the required documents, follow these steps:

What to Do After Filling Out the ICICI KYC Form

- Submit the form and documents to the ICICI Bank branch where you want to open an account

- Ensure that the form is signed in the presence of an ICICI Bank official

- Keep a copy of the filled-out form and documents for your records

- Wait for the KYC process to be completed, which may take a few days

- Once the KYC process is complete, you can start using your ICICI Bank account

Conclusion

In conclusion, filling out the ICICI KYC form is a crucial step in opening an account with ICICI Bank. By following the steps outlined in this article, you can download and fill out the form accurately, providing all the required documents. Remember to sign the form in the presence of an ICICI Bank official and keep a copy of the filled-out form and documents for your records.

Call to Action

If you have any questions or need help with filling out the ICICI KYC form, please comment below or share this article with your friends and family who may need assistance. Don't forget to share your experiences with ICICI Bank's KYC process in the comments section below.

FAQ Section

What is the purpose of the KYC form?

+The KYC form is required by banks and financial institutions to verify the identity of their customers and comply with regulatory requirements.

What documents do I need to provide with the ICICI KYC form?

+You will need to provide proof of identity, proof of address, and proof of income documents.

How long does the KYC process take?

+The KYC process may take a few days to complete, depending on the bank's verification process.