As a student, it's essential to understand the importance of the 1098-T form, which is used to report tuition payments to the Internal Revenue Service (IRS). The City University of New York (CUNY) provides this form to its students through CUNYfirst, an online portal that offers various services to students, faculty, and staff. In this article, we will explore three ways to obtain your 1098-T form on CUNYfirst.

Understanding the 1098-T Form

The 1098-T form is a tuition statement that colleges and universities are required to provide to their students by January 31st of each year. This form reports the amount of tuition paid by the student during the previous tax year. The IRS requires this form to be filed by educational institutions to help students claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

Why Do You Need the 1098-T Form?

The 1098-T form is crucial for students who want to claim tax credits for their education expenses. By reporting the tuition payments on this form, students can claim the AOTC or LLC, which can help reduce their tax liability. Additionally, this form provides students with a record of their tuition payments, which can be useful for financial aid purposes.

Method 1: Accessing the 1098-T Form through CUNYfirst Self-Service

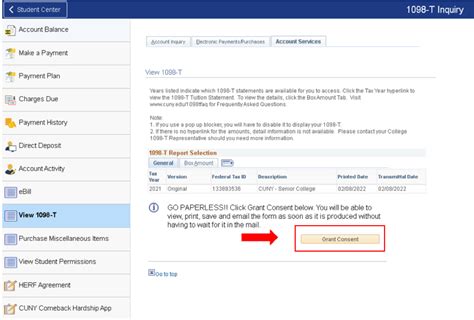

One way to obtain your 1098-T form is by accessing CUNYfirst Self-Service. To do this:

- Log in to your CUNYfirst account

- Click on the "Student Center" tab

- Select "Finances" from the drop-down menu

- Click on "View 1098-T"

- Select the tax year for which you want to view the 1098-T form

- Click on "View Form" to download and print the 1098-T form

Method 2: Requesting the 1098-T Form through CUNYfirst

If you're having trouble accessing the 1098-T form through CUNYfirst Self-Service, you can request the form through CUNYfirst. To do this:

- Log in to your CUNYfirst account

- Click on the "Student Center" tab

- Select "Finances" from the drop-down menu

- Click on "Request 1098-T"

- Select the tax year for which you want to request the 1098-T form

- Enter your email address and click on "Submit"

- CUNYfirst will send you an email with a link to download and print the 1098-T form

Method 3: Contacting the Bursar's Office

If you're unable to access the 1098-T form through CUNYfirst, you can contact the Bursar's Office at your college for assistance. They can provide you with a paper copy of the 1098-T form or help you access it through CUNYfirst.

- Visit the Bursar's Office website for your college

- Click on the "Contact Us" tab

- Enter your name, email address, and phone number

- Select "1098-T Form" as the reason for your inquiry

- Click on "Submit"

- The Bursar's Office will contact you to provide assistance with obtaining the 1098-T form

Conclusion and Next Steps

Obtaining your 1098-T form is an essential step in claiming tax credits for your education expenses. By following the three methods outlined in this article, you can access your 1098-T form through CUNYfirst and start the process of claiming your tax credits. If you have any further questions or concerns, don't hesitate to reach out to the Bursar's Office at your college for assistance.

We encourage you to share your experiences and tips for obtaining the 1098-T form in the comments section below. Additionally, if you have any questions or need further clarification on any of the steps outlined in this article, please don't hesitate to ask.

What is the deadline for obtaining the 1098-T form?

+The deadline for obtaining the 1098-T form is January 31st of each year.

Can I obtain the 1098-T form for previous tax years?

+Yes, you can obtain the 1098-T form for previous tax years by contacting the Bursar's Office at your college.

What if I'm having trouble accessing the 1098-T form through CUNYfirst?

+If you're having trouble accessing the 1098-T form through CUNYfirst, you can contact the Bursar's Office at your college for assistance.