Filling out tax forms can be a daunting task, especially for those who are new to the process. In Kentucky, one of the essential tax forms is the K-4 form, which is used to withhold state income tax from an employee's wages. As an employer or employee, it's crucial to understand how to fill out the K-4 form correctly to avoid any errors or penalties. In this article, we will break down the process of filling out the K-4 form into 5 easy steps.

Understanding the K-4 Form

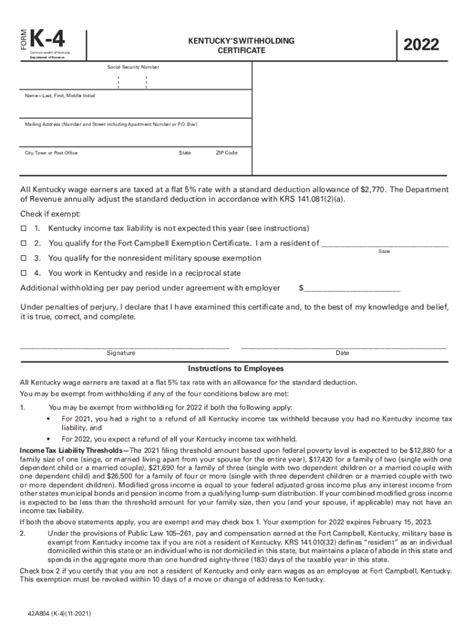

Before we dive into the steps, let's quickly understand what the K-4 form is and why it's necessary. The K-4 form is a Kentucky state tax form used to determine the amount of state income tax to withhold from an employee's wages. It's similar to the federal W-4 form, but it's specific to Kentucky state taxes. Employers are required to have all employees complete the K-4 form to ensure accurate tax withholding.

Step 1: Gather Necessary Information

To fill out the K-4 form, you'll need to gather some essential information. This includes:

- Your name and address

- Your social security number or individual taxpayer identification number (ITIN)

- Your filing status (single, married, head of household, etc.)

- The number of allowances you're claiming

- Your spouse's name and social security number (if applicable)

- The number of dependents you're claiming

Make sure you have all this information readily available before starting the form.

Completing the K-4 Form

Now that you have all the necessary information, let's move on to completing the K-4 form.

Step 2: Fill Out Section 1

Section 1 of the K-4 form requires you to provide your personal information, including your name, address, and social security number. Make sure to fill out this section accurately, as any errors can lead to delays or penalties.

Step 3: Determine Your Filing Status

In Section 2, you'll need to determine your filing status. This will help you calculate the correct amount of state income tax to withhold. Choose from the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 4: Claim Allowances

Section 3 allows you to claim allowances, which will reduce the amount of state income tax withheld from your wages. You can claim one allowance for yourself, one for your spouse (if you're married), and one for each dependent. Keep in mind that claiming too many allowances can result in underpayment of taxes, while claiming too few can result in overpayment.

Step 5: Sign and Date the Form

Finally, sign and date the K-4 form in Section 4. This confirms that the information provided is accurate and true. Make sure to keep a copy of the completed form for your records.

Tips and Reminders

Here are some additional tips and reminders to keep in mind when filling out the K-4 form:

- Make sure to complete the form accurately and thoroughly to avoid any errors or penalties.

- If you're unsure about any section of the form, consult with your employer or a tax professional.

- Keep a copy of the completed form for your records.

- If you need to make changes to your K-4 form, submit a new form to your employer as soon as possible.

Common Mistakes to Avoid

When filling out the K-4 form, there are a few common mistakes to avoid:

- Inaccurate or incomplete information

- Claiming too many or too few allowances

- Failing to sign and date the form

- Not keeping a copy of the completed form for your records

By avoiding these common mistakes, you can ensure that your K-4 form is completed accurately and efficiently.

Conclusion: Take Control of Your Kentucky State Taxes

Filling out the K-4 form may seem daunting, but by following these 5 easy steps, you can take control of your Kentucky state taxes. Remember to gather all necessary information, complete the form accurately, and avoid common mistakes. If you're unsure about any section of the form, don't hesitate to consult with your employer or a tax professional. By taking the time to complete the K-4 form correctly, you can ensure that your state income tax withholding is accurate and up-to-date.

What is the K-4 form used for?

+The K-4 form is used to determine the amount of state income tax to withhold from an employee's wages in Kentucky.

Who needs to complete the K-4 form?

+All employees in Kentucky need to complete the K-4 form to ensure accurate state income tax withholding.

What happens if I make a mistake on the K-4 form?

+If you make a mistake on the K-4 form, it can result in errors or penalties. Consult with your employer or a tax professional to correct any mistakes.