Filing taxes is a daunting task for many, and when it comes to the International Fuel Tax Agreement (IFTA), the process can be even more overwhelming. However, with a clear understanding of the steps involved, filling out the IFTA form can be a breeze. In this article, we will guide you through the 7 essential steps to fill out the IFTA form easily.

Understanding the Importance of IFTA

Before we dive into the steps, it's essential to understand the purpose of IFTA. The International Fuel Tax Agreement is a tax collection agreement between the United States and Canadian provinces to simplify the reporting and payment of fuel taxes. IFTA requires drivers to report their fuel consumption and mileage for each jurisdiction they operate in.

Step 1: Gather Required Documents

To start filling out the IFTA form, you'll need to gather the necessary documents. These include:

- Your IFTA license or permit

- Vehicle registration

- Fuel receipts

- Mileage logs

- A calculator

Step 2: Determine Your Filing Frequency

IFTA requires you to file your tax returns quarterly. The filing deadlines are as follows:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Step 3: Calculate Your Total Miles and Fuel Consumption

To calculate your total miles and fuel consumption, you'll need to review your mileage logs and fuel receipts. You can use a spreadsheet or a fuel tax calculator to simplify the process.

- Calculate your total miles driven in each jurisdiction

- Calculate your total fuel consumption in each jurisdiction

- Calculate your total fuel tax liability

Step 4: Complete the IFTA Form

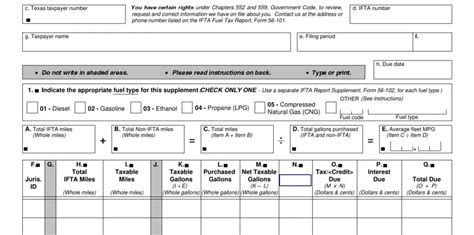

Now that you have your calculations, it's time to complete the IFTA form. The form typically includes the following sections:

- IFTA license or permit information

- Vehicle information

- Fuel consumption and mileage information for each jurisdiction

- Fuel tax liability and payment information

Step 5: Attach Supporting Documents

You'll need to attach supporting documents to your IFTA form, including:

- Fuel receipts

- Mileage logs

- Vehicle registration

Step 6: Review and Sign the Form

Before submitting your IFTA form, review it carefully to ensure accuracy. Sign the form, and make sure to include your IFTA license or permit number.

Step 7: Submit the Form and Payment

Finally, submit your IFTA form and payment to your base jurisdiction. You can submit the form electronically or by mail. Make sure to include the required payment, which can be made by check, money order, or electronic funds transfer.

Take Action Today!

Filling out the IFTA form doesn't have to be a daunting task. By following these 7 steps, you can ensure accuracy and compliance with IFTA regulations. If you're still unsure, consider consulting with a tax professional or using IFTA software to simplify the process. Share your experiences and tips in the comments below, and don't forget to share this article with your fellow truckers and fleet owners!

What is the purpose of IFTA?

+IFTA is a tax collection agreement between the United States and Canadian provinces to simplify the reporting and payment of fuel taxes.

How often do I need to file my IFTA tax returns?

+You need to file your IFTA tax returns quarterly, with deadlines on April 30th, July 31st, October 31st, and January 31st.

What documents do I need to attach to my IFTA form?

+You need to attach fuel receipts, mileage logs, and vehicle registration to your IFTA form.