Navigating the complexities of state tax filing can be overwhelming, especially for businesses and individuals in Georgia. The Georgia G4 form is a crucial document for employers and taxpayers in the state, as it pertains to the withholding and payment of state income taxes. In this article, we will provide a comprehensive guide on how to file the Georgia G4 form, including step-by-step instructions, requirements, and important deadlines.

Understanding the Georgia G4 Form

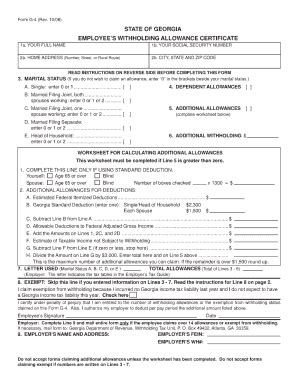

The Georgia G4 form, also known as the "State of Georgia Employer's Withholding Tax Return," is a quarterly tax return that employers must file with the Georgia Department of Revenue. The form is used to report and pay state income taxes withheld from employees' wages, as well as to report any additional taxes due or overpayments. Employers must file the G4 form even if no taxes are due or if they have no employees.

Who Must File the Georgia G4 Form?

All employers in Georgia who withhold state income taxes from employee wages must file the G4 form. This includes:

- Employers with one or more employees

- Employers who pay wages subject to Georgia income tax withholding

- Employers who are required to withhold federal income taxes

Exemptions from filing the G4 form include:

- Employers with no employees

- Employers who do not pay wages subject to Georgia income tax withholding

- Certain government agencies and tax-exempt organizations

What is the Filing Frequency?

The Georgia G4 form must be filed on a quarterly basis. The due dates for each quarter are:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st of the following year for the fourth quarter (October 1 - December 31)

Step-by-Step Instructions for Filing the Georgia G4 Form

Step 1: Gather Required Information

Before filing the G4 form, employers must gather the following information:

- Employee names, social security numbers, and wages paid

- Amounts of state income taxes withheld from employee wages

- Any additional taxes due or overpayments

- Employer identification number (EIN)

Step 2: Complete the G4 Form

The G4 form can be completed online through the Georgia Tax Center or by paper. Employers must provide the required information and calculate the total amount of taxes due or overpayment.

Step 3: Pay Any Taxes Due

Employers must pay any taxes due by the filing deadline to avoid penalties and interest. Payments can be made online, by phone, or by mail.

Step 4: Submit the G4 Form

The completed G4 form must be submitted to the Georgia Department of Revenue by the filing deadline. Employers can submit the form online or by mail.

Penalties and Interest for Late Filing or Payment

Employers who fail to file the G4 form or pay taxes due by the deadline may be subject to penalties and interest. The penalties and interest rates are as follows:

- Late filing penalty: 5% of the unpaid tax per month or fraction of a month, up to a maximum of 25%

- Late payment penalty: 5% of the unpaid tax per month or fraction of a month, up to a maximum of 25%

- Interest rate: 7% per annum

Conclusion and Next Steps

Filing the Georgia G4 form is a critical step in meeting state tax obligations. Employers must ensure they gather the required information, complete the form accurately, and pay any taxes due by the filing deadline. By following these step-by-step instructions, employers can avoid penalties and interest and maintain compliance with Georgia state tax laws.

If you have any questions or concerns about filing the Georgia G4 form, please comment below or share this article with your network.

What is the Georgia G4 form used for?

+The Georgia G4 form is used to report and pay state income taxes withheld from employee wages, as well as to report any additional taxes due or overpayments.

Who is required to file the Georgia G4 form?

+All employers in Georgia who withhold state income taxes from employee wages must file the G4 form.

What is the filing frequency for the Georgia G4 form?

+The Georgia G4 form must be filed on a quarterly basis. The due dates for each quarter are April 30th, July 31st, October 31st, and January 31st of the following year.