The COVID-19 pandemic has brought about unprecedented challenges for individuals and families worldwide. In response, governments have implemented various relief measures, including tax credits and deductions. In the United States, the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the Consolidated Appropriations Act, 2021, introduced the Recovery Rebate Credit and the Advance Payment of the Recovery Rebate Credit. To claim these credits, eligible individuals must file Form 8915-E with the Internal Revenue Service (IRS).

In this article, we will guide you through the 5 essential steps to fill out Form 8915-E for Coronavirus-related tax credits. Understanding these steps will help you navigate the form and ensure you receive the credits you are eligible for.

Step 1: Determine Your Eligibility

Before filling out Form 8915-E, you must determine if you are eligible for the Recovery Rebate Credit or the Advance Payment of the Recovery Rebate Credit. The eligibility criteria include:

- Your age: You must be 18 years or older (or under 18 years if you are a qualifying child or a student).

- Your residency: You must be a U.S. citizen or resident alien.

- Your income: You must have a valid Social Security number and meet the income requirements.

- Your filing status: You must file as single, married filing jointly, head of household, or qualifying widow(er).

Recovery Rebate Credit Eligibility

The Recovery Rebate Credit is available to eligible individuals who did not receive the full Economic Impact Payment (EIP) or did not receive any EIP. To be eligible, you must meet the income requirements, which are:

- $150,000 or less for married filing jointly

- $112,500 or less for head of household

- $75,000 or less for single filers

Step 2: Gather Required Documents

To fill out Form 8915-E, you will need the following documents:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- Your dependents' Social Security numbers or ITINs

- Your EIP payment amount (if you received any)

- Your 2020 tax return (if you filed one)

- Your 2020 Form 1099-INT and 1099-DIV (if you received any interest or dividend income)

Other Required Information

You will also need to provide other information, such as:

- Your filing status

- Your number of qualifying children

- Your student status (if applicable)

- Your disability status (if applicable)

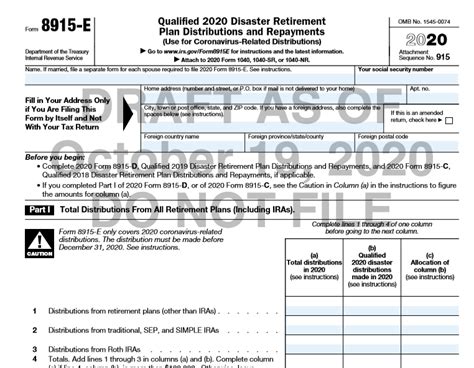

Step 3: Complete Form 8915-E

Form 8915-E consists of two parts: Part I and Part II. Part I requires you to provide your personal and filing information, while Part II requires you to calculate your Recovery Rebate Credit.

- Part I: Provide your name, address, Social Security number, and filing status.

- Part II: Calculate your Recovery Rebate Credit based on your income, filing status, and number of qualifying children.

Calculating the Recovery Rebate Credit

To calculate the Recovery Rebate Credit, follow these steps:

- Determine your Adjusted Gross Income (AGI) from your 2020 tax return.

- Calculate your credit amount based on your AGI and filing status.

- Subtract any EIP payments you received from your credit amount.

Step 4: Report the Recovery Rebate Credit on Your Tax Return

Once you have completed Form 8915-E, report the Recovery Rebate Credit on your 2020 tax return (Form 1040 or Form 1040-SR).

- Report the credit on Line 30 of Form 1040 or Line 29 of Form 1040-SR.

- Attach Form 8915-E to your tax return.

Step 5: Submit Your Tax Return and Form 8915-E

Finally, submit your tax return and Form 8915-E to the IRS. You can file electronically or by mail.

- E-file: Use tax preparation software or the IRS Free File program to e-file your tax return and Form 8915-E.

- Mail: Send your tax return and Form 8915-E to the IRS address listed in the instructions for Form 1040.

By following these 5 steps, you can ensure you fill out Form 8915-E correctly and claim the Recovery Rebate Credit you are eligible for.

Take the next step and claim the tax credits you deserve. If you have any questions or concerns, feel free to ask in the comments below.

Embed Call-to-Action

Share this article with friends and family who may be eligible for the Recovery Rebate Credit. Help them navigate the tax filing process and claim the credits they deserve.

What is the deadline for filing Form 8915-E?

+The deadline for filing Form 8915-E is April 15, 2023, for the 2020 tax year.

Can I claim the Recovery Rebate Credit if I didn't receive an EIP?

+Yes, you can claim the Recovery Rebate Credit even if you didn't receive an EIP. You must meet the eligibility criteria and file Form 8915-E with your tax return.

How do I report the Recovery Rebate Credit on my tax return?

+Report the Recovery Rebate Credit on Line 30 of Form 1040 or Line 29 of Form 1040-SR. Attach Form 8915-E to your tax return.