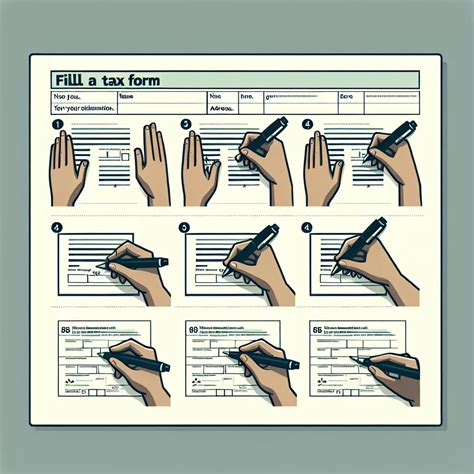

Completing tax forms can be a daunting task, especially when dealing with complex forms like the Canada Revenue Agency's (CRA) Form 535. This form is used to report income earned by individuals and businesses in Canada. In this article, we will guide you through the 6 steps to fill out Form 535 accurately and efficiently.

Why Filling Out Form 535 Correctly Matters

Filling out tax forms correctly is crucial to avoid errors, penalties, and delays in receiving your tax refund. The CRA uses the information provided on Form 535 to calculate your tax liability, so it's essential to ensure accuracy and completeness. Inaccurate or incomplete information can lead to audits, fines, and even interest on owed taxes.

Step 1: Gather Required Documents and Information

Before starting to fill out Form 535, gather all necessary documents and information, including:

- Your tax ID number (Social Insurance Number or Business Number)

- T4 slips (Statement of Remuneration Paid) from your employer

- T5 slips (Statement of Investment Income) for investment income

- T3 slips (Statement of Trust Income Allocations and Designations) for trust income

- RRSP contribution receipts

- Medical expense receipts

- Charitable donation receipts

- Business expense records (if self-employed)

Step 2: Determine Your Filing Status

Your filing status affects the tax rates and credits you're eligible for. Choose the correct filing status:

- Single

- Married or common-law

- Separated

- Divorced

- Widowed

Step 3: Report Income

Report all income earned in the tax year, including:

- Employment income (T4 slips)

- Investment income (T5 slips)

- Trust income (T3 slips)

- Self-employment income (business income and expenses)

- Other income (e.g., alimony, scholarships)

Step 4: Claim Deductions and Credits

Claim all eligible deductions and credits, including:

- RRSP contributions

- Medical expenses

- Charitable donations

- Business expenses (if self-employed)

- Home office expenses (if self-employed)

- Tuition credits

Step 5: Calculate Tax Liability

Calculate your tax liability by subtracting total deductions and credits from your total income. You may need to complete additional schedules and forms, such as:

- Schedule 1 (Combined Federal and Provincial Tax Return)

- Schedule 2 (Federal Tax Return)

- Form T1-General (Personal Tax Return)

Step 6: Review and Submit

Review Form 535 carefully to ensure accuracy and completeness. Make sure to sign and date the form. Submit your tax return to the CRA by the deadline (usually April 30th) to avoid penalties and interest.

Additional Tips and Reminders

- Use the CRA's certified tax software or consult a tax professional if you're unsure about any part of the process.

- Keep receipts and supporting documents for at least six years in case of an audit.

- Check for any provincial or territorial tax credits and deductions you may be eligible for.

By following these 6 steps, you'll be able to fill out Form 535 accurately and efficiently. Remember to review and submit your tax return on time to avoid any issues.

Get Help with Your Tax Return

If you're unsure about any part of the process, don't hesitate to reach out to a tax professional or contact the CRA for assistance.

What is Form 535 used for?

+Form 535 is used to report income earned by individuals and businesses in Canada.

What documents do I need to fill out Form 535?

+You'll need your tax ID number, T4 slips, T5 slips, T3 slips, RRSP contribution receipts, medical expense receipts, charitable donation receipts, and business expense records (if self-employed).

What is the deadline to submit Form 535?

+The deadline to submit Form 535 is usually April 30th.