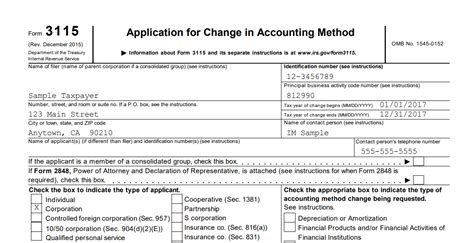

Inaccurate or incomplete depreciation can significantly impact a company's financial statements and tax obligations. The IRS provides a mechanism for correcting depreciation errors through Form 3115, Application for Change in Accounting Method. This form allows businesses to request a change in their accounting method, including correcting missed depreciation. In this article, we will guide you through the 5 steps to fill out Form 3115 for missed depreciation.

Understanding the Importance of Accurate Depreciation

Depreciation is a critical component of a company's financial statements, as it represents the decrease in value of assets over their useful life. Inaccurate depreciation can lead to incorrect financial reporting, tax liabilities, and potentially even audits. Therefore, it is essential to ensure that depreciation is accurately calculated and recorded.

The Role of Form 3115 in Correcting Missed Depreciation

Form 3115 is used to request a change in accounting method, including corrections to depreciation. The form allows businesses to:

- Correct errors in depreciation calculations

- Change depreciation methods (e.g., from straight-line to accelerated depreciation)

- Revise the useful life of assets

By filing Form 3115, businesses can correct missed depreciation and ensure accurate financial reporting.

Step 1: Determine the Need for Form 3115

Before filling out Form 3115, you must determine whether a change in accounting method is necessary. Review your company's financial statements and depreciation records to identify any errors or inaccuracies. Consider the following:

- Have there been changes in accounting principles or methods?

- Are there errors in depreciation calculations or records?

- Have there been changes in asset useful lives or salvage values?

If you identify any of these issues, you may need to file Form 3115 to correct the errors.

Step 2: Gather Required Information

To complete Form 3115, you will need to gather specific information, including:

- Company name and taxpayer identification number

- Description of the accounting method change (e.g., correction of missed depreciation)

- Identification of the assets affected by the change

- Calculation of the adjustment to depreciation expense

- Supporting documentation (e.g., financial statements, depreciation records)

Ensure that you have all necessary information before proceeding with the form.

**Step 3: Complete Form 3115 Sections 1-3**

Form 3115 is divided into sections. Complete Sections 1-3 as follows:

- Section 1: Provide company information, including name and taxpayer identification number.

- Section 2: Describe the accounting method change, including the reason for the change and the assets affected.

- Section 3: Calculate the adjustment to depreciation expense and provide supporting documentation.

Step 4: Complete Form 3115 Sections 4-6

Continue completing Form 3115 by filling out Sections 4-6:

- Section 4: Provide a detailed description of the accounting method change, including any supporting documentation.

- Section 5: Calculate the cumulative effect of the accounting method change on depreciation expense.

- Section 6: Sign and date the form, and provide the name and title of the person signing.

**Tips for Completing Sections 4-6**

- Ensure that you provide a clear and concise description of the accounting method change.

- Use supporting documentation to justify the calculation of the cumulative effect.

- Sign and date the form, and ensure that the person signing has the necessary authority.

Step 5: Submit Form 3115

Once you have completed Form 3115, submit it to the IRS according to the instructions provided. You can submit the form electronically or by mail.

**Tips for Submitting Form 3115**

- Ensure that you submit the form on time, as late submissions may be rejected.

- Use the correct mailing address or electronic submission method.

- Keep a copy of the submitted form for your records.

By following these 5 steps, you can accurately complete Form 3115 and correct missed depreciation. Remember to carefully review your company's financial statements and depreciation records to ensure accurate financial reporting.

Invitation to Engage

We hope that this article has provided valuable insights into completing Form 3115 for missed depreciation. If you have any questions or need further assistance, please comment below or share this article with your colleagues. Don't forget to subscribe to our blog for more informative articles on tax and accounting topics.

What is Form 3115 used for?

+Form 3115 is used to request a change in accounting method, including corrections to depreciation.

What information is required to complete Form 3115?

+Company name and taxpayer identification number, description of the accounting method change, identification of the assets affected, calculation of the adjustment to depreciation expense, and supporting documentation.

How do I submit Form 3115?

+Form 3115 can be submitted electronically or by mail, according to the instructions provided.