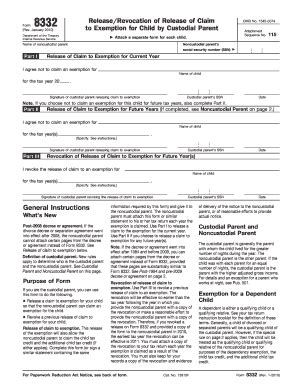

Filing taxes can be a daunting task, especially when it comes to claiming dependents. However, with the introduction of electronic filing, the process has become more streamlined and efficient. One such form that can be filed electronically is Form 8332, also known as the Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. In this article, we will guide you through the process of filing Form 8332 electronically in 5 easy steps.

Understanding Form 8332

Before we dive into the steps, let's quickly understand what Form 8332 is and why it's necessary. Form 8332 is used by custodial parents to release their claim to exemption for a child, allowing the non-custodial parent to claim the exemption instead. This form is typically used in cases where parents are divorced or separated and need to determine which parent can claim the child as a dependent on their tax return.

Step 1: Determine Eligibility

To file Form 8332 electronically, you must first determine if you are eligible to do so. You can file Form 8332 electronically if:

- You are the custodial parent of the child

- You have a qualifying child who meets the IRS's definition of a dependent

- You are releasing your claim to exemption for the child

- You have not already filed Form 8332 for the same tax year

Step 2: Gather Required Information

To file Form 8332 electronically, you will need to gather some required information. This includes:

- Your name, address, and Social Security number

- The child's name, Social Security number, and date of birth

- The non-custodial parent's name, address, and Social Security number

- The tax year for which you are releasing your claim to exemption

Filing Form 8332 Electronically

Now that you have determined your eligibility and gathered the required information, you can begin the process of filing Form 8332 electronically.

Step 3: Access the IRS Website

To file Form 8332 electronically, you will need to access the IRS website at irs.gov. From there, you can click on the "Filing" tab and select "Form 8332" from the drop-down menu.

Step 4: Complete the Form

Once you have accessed the Form 8332 webpage, you can begin completing the form. You will need to enter the required information, including your name, address, and Social Security number, as well as the child's name, Social Security number, and date of birth. You will also need to enter the non-custodial parent's name, address, and Social Security number.

Step 5: Submit the Form

After you have completed the form, you can submit it electronically. You will receive a confirmation email from the IRS once your form has been accepted.

Benefits of Electronic Filing

Filing Form 8332 electronically offers several benefits, including:

- Faster processing time

- Reduced errors

- Increased accuracy

- Convenience

Tips and Reminders

Here are a few tips and reminders to keep in mind when filing Form 8332 electronically:

- Make sure to keep a copy of your completed form for your records

- Ensure that you have the required information before starting the filing process

- Double-check your entries for accuracy before submitting the form

Conclusion

Filing Form 8332 electronically is a straightforward process that can be completed in just a few steps. By following the steps outlined above and gathering the required information, you can easily release your claim to exemption for a child and allow the non-custodial parent to claim the exemption instead. Remember to keep a copy of your completed form for your records and double-check your entries for accuracy before submitting the form.

What is Form 8332?

+Form 8332 is a tax form used by custodial parents to release their claim to exemption for a child, allowing the non-custodial parent to claim the exemption instead.

Who is eligible to file Form 8332 electronically?

+You can file Form 8332 electronically if you are the custodial parent of the child, have a qualifying child who meets the IRS's definition of a dependent, and are releasing your claim to exemption for the child.

What information do I need to gather before filing Form 8332 electronically?

+You will need to gather your name, address, and Social Security number, as well as the child's name, Social Security number, and date of birth, and the non-custodial parent's name, address, and Social Security number.