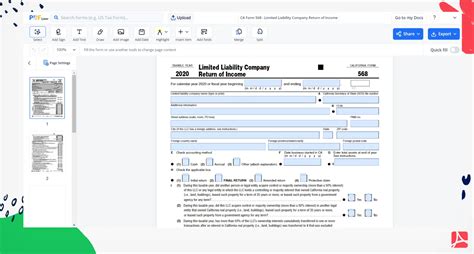

The Limited Liability Company (LLC) is a popular business structure among entrepreneurs due to its flexibility and liability protection. In California, the Franchise Tax Board (FTB) requires LLCs to file an annual report, known as Form 568, to maintain their good standing. In this article, we will guide you through the process of filing Form 568 online in five easy steps.

Why File Form 568?

Before we dive into the filing process, let's understand why Form 568 is essential for California LLCs. The primary purpose of this form is to report the LLC's income, deductions, and credits for the tax year. The FTB uses this information to calculate the LLC's tax liability and to ensure compliance with state tax laws.

Additionally, filing Form 568 is crucial for maintaining the LLC's good standing in California. Failure to file the form may result in penalties, fines, and even suspension or revocation of the LLC's business license.

Step 1: Gather Required Information

To file Form 568 online, you will need to gather the following information:

- Your LLC's name and address

- Your LLC's California Secretary of State file number

- Your LLC's federal employer identification number (FEIN)

- Your LLC's tax year-end date

- Your LLC's accounting method (cash or accrual)

- Your LLC's income, deductions, and credits for the tax year

You can find most of this information in your LLC's financial records, tax returns, and business license documents.

Accounting Method

When filing Form 568, you will need to choose an accounting method for your LLC. The two most common accounting methods are:

- Cash method: This method recognizes income and expenses when cash is received or paid.

- Accrual method: This method recognizes income and expenses when earned or incurred, regardless of when cash is received or paid.

Choose the accounting method that best suits your LLC's financial situation.

Step 2: Register for an Account

To file Form 568 online, you will need to register for an account on the FTB's website. Follow these steps to register:

- Go to the FTB's website at

- Click on the "Register" button in the top right corner of the page

- Fill out the registration form with your LLC's information

- Create a username and password for your account

Once you have registered, you can log in to your account and start the filing process.

Security Measures

When registering for an account, you will be required to provide security information, such as a security question and answer. This is to protect your account from unauthorized access.

Make sure to choose a strong password and keep your security information confidential.

Step 3: Fill Out Form 568

Once you have registered and logged in to your account, you can start filling out Form 568. The form is divided into several sections, including:

- LLC information

- Income and deductions

- Credits and payments

- Tax calculations

Fill out each section carefully and accurately, using the information you gathered in Step 1.

Calculation Errors

When filling out Form 568, make sure to double-check your calculations to avoid errors. Calculation errors can result in penalties and fines.

Use a calculator or accounting software to ensure accuracy.

Step 4: Submit Form 568

Once you have completed Form 568, you can submit it online. Follow these steps to submit:

- Review your form for accuracy and completeness

- Click the "Submit" button to transmit your form to the FTB

- Receive a confirmation number and a copy of your submitted form

Make sure to keep a record of your confirmation number and submitted form for your records.

Submission Deadline

The submission deadline for Form 568 is typically April 15th of each year. Make sure to submit your form on time to avoid penalties and fines.

Late submissions may result in additional fees and interest.

Step 5: Pay Any Tax Due

If your LLC owes tax, you will need to pay it by the submission deadline. You can pay online, by phone, or by mail.

Make sure to pay any tax due on time to avoid penalties and fines.

Payment Options

The FTB offers several payment options, including:

- Online payment

- Phone payment

- Mail payment

Choose the payment option that best suits your LLC's needs.

Filing Form 568 online is a straightforward process that can be completed in five easy steps. By following these steps, you can ensure that your California LLC remains in good standing and avoids penalties and fines.

If you have any questions or need assistance, you can contact the FTB or a qualified tax professional.

What is the deadline for filing Form 568?

+The deadline for filing Form 568 is typically April 15th of each year.

Can I file Form 568 by mail?

+What is the penalty for late filing of Form 568?

+The penalty for late filing of Form 568 is 5% of the tax due, plus interest and fees.