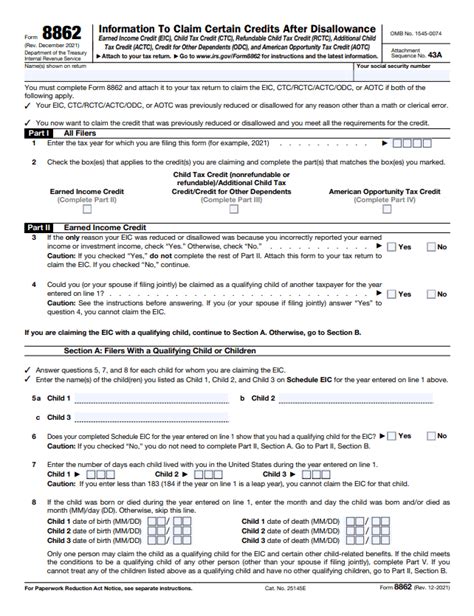

Form 8862, also known as the Information to Claim Earned Income Tax Credit (EITC) After Disallowance, is a crucial document for taxpayers who have been denied the Earned Income Tax Credit (EITC) in the past. The form allows individuals to reapply for the EITC and claim the credit for the current tax year. In this article, we will delve into the Form 8862 processing time, what to expect, and provide valuable insights to help taxpayers navigate the process.

Understanding the Importance of Form 8862

The Earned Income Tax Credit (EITC) is a refundable tax credit designed to help low-to-moderate-income working individuals and families. However, if the Internal Revenue Service (IRS) denies the EITC due to an error or ineligibility, taxpayers may need to file Form 8862 to reapply for the credit. This form is essential in resolving any issues related to EITC eligibility and ensures that taxpayers receive the credit they are entitled to.

How Long Does it Take to Process Form 8862?

The processing time for Form 8862 can vary depending on several factors, including the complexity of the case, the workload of the IRS, and the time of year. Generally, the IRS takes around 6-8 weeks to process Form 8862, but it can take up to 12 weeks or more in some cases.

Factors Affecting Form 8862 Processing Time

Several factors can influence the processing time of Form 8862. Some of these factors include:

- Time of year: The IRS receives a high volume of tax returns and forms during peak tax season (January to April). As a result, processing times may be longer during this period.

- Complexity of the case: If the taxpayer's case is complex or requires additional review, the processing time may be longer.

- Incomplete or inaccurate information: If the taxpayer provides incomplete or inaccurate information on Form 8862, it may delay the processing time.

What Happens After Filing Form 8862?

After filing Form 8862, the taxpayer will receive a letter from the IRS indicating the outcome of their application. If the IRS approves the taxpayer's request, they will receive a revised tax return reflecting the corrected EITC amount. If the IRS denies the request, the taxpayer will receive a letter explaining the reason for the denial and any additional steps they can take.

Tips to Expedite Form 8862 Processing Time

While the IRS processes Form 8862, there are several steps taxpayers can take to expedite the process:

- Ensure accurate and complete information: Double-check the form for accuracy and completeness before submitting it.

- Use the correct mailing address: Use the correct mailing address to avoid delays in processing.

- Follow up with the IRS: If the taxpayer has not received a response after 8-10 weeks, they can contact the IRS to check on the status of their application.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions related to Form 8862 processing time:

Q: Can I check the status of my Form 8862 online?

A: No, the IRS does not provide online status updates for Form 8862. Taxpayers can contact the IRS to check on the status of their application.Q: Can I expedite the processing time of Form 8862?

A: No, the IRS does not offer expedited processing for Form 8862. However, taxpayers can take steps to ensure accurate and complete information, which can help expedite the process.Q: What happens if my Form 8862 is denied?

A: If the IRS denies the taxpayer's request, they will receive a letter explaining the reason for the denial and any additional steps they can take.How long does it take to process Form 8862?

+The processing time for Form 8862 can vary depending on several factors, including the complexity of the case, the workload of the IRS, and the time of year. Generally, the IRS takes around 6-8 weeks to process Form 8862, but it can take up to 12 weeks or more in some cases.

What happens after filing Form 8862?

+After filing Form 8862, the taxpayer will receive a letter from the IRS indicating the outcome of their application. If the IRS approves the taxpayer's request, they will receive a revised tax return reflecting the corrected EITC amount. If the IRS denies the request, the taxpayer will receive a letter explaining the reason for the denial and any additional steps they can take.

Can I check the status of my Form 8862 online?

+No, the IRS does not provide online status updates for Form 8862. Taxpayers can contact the IRS to check on the status of their application.

Conclusion

Form 8862 is an essential document for taxpayers who have been denied the Earned Income Tax Credit (EITC) in the past. Understanding the processing time and factors that affect it can help taxpayers plan and prepare for the application process. By following the tips and guidelines outlined in this article, taxpayers can ensure a smooth and efficient processing experience.

If you have any questions or concerns about Form 8862 processing time, feel free to ask in the comments section below.