Filing tax forms can be a daunting task, especially for individuals who are not familiar with the process. However, with the advancement of technology, the Internal Revenue Service (IRS) has made it easier for taxpayers to file their tax forms electronically. One such form is Form 8862, also known as the Information to Claim Earned Income Tax Credit After Disallowance. In this article, we will guide you through the process of filing Form 8862 electronically in three simple steps.

The Earned Income Tax Credit (EITC) is a refundable tax credit designed to help low-income working individuals and families. However, if the IRS disallows your EITC claim, you may need to file Form 8862 to claim the credit again. This form is used to provide additional information to support your EITC claim, and filing it electronically can help you get your refund faster.

What is Form 8862 and Who Needs to File It?

Form 8862 is used by taxpayers who have been disallowed from claiming the EITC in a previous tax year. This can happen if the IRS determines that you do not meet the eligibility requirements for the credit or if you have provided incomplete or inaccurate information. If you are eligible to claim the EITC again, you will need to file Form 8862 to provide additional information to support your claim.

Eligibility Requirements for Form 8862

To file Form 8862, you must meet certain eligibility requirements. These requirements include:

- You must have been disallowed from claiming the EITC in a previous tax year.

- You must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- You must have earned income from a job or self-employment.

- You must meet the income and family size requirements for the EITC.

Step 1: Gather Required Documents and Information

Before you start the filing process, you will need to gather certain documents and information. These include:

- Your Social Security number or ITIN

- Your earned income information, including your W-2 forms and 1099 forms

- Your family size and income information

- Your previous tax return, if applicable

Required Documents for Form 8862

You will need to attach certain documents to your Form 8862, including:

- Your W-2 forms and 1099 forms

- Your previous tax return, if applicable

- Any other supporting documentation, such as proof of income or family size

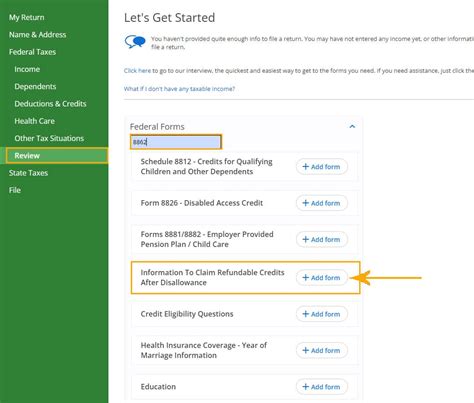

Step 2: Choose an Electronic Filing Option

Once you have gathered all the required documents and information, you can choose an electronic filing option. The IRS offers several options for filing Form 8862 electronically, including:

- IRS Free File: This is a free service offered by the IRS that allows you to file your tax forms electronically.

- Tax software: You can use tax software, such as TurboTax or H&R Block, to file your tax forms electronically.

- Tax professional: You can hire a tax professional to file your tax forms electronically on your behalf.

Benefits of Electronic Filing

Electronic filing offers several benefits, including:

- Faster refund: When you file electronically, you can get your refund faster.

- Accuracy: Electronic filing reduces the risk of errors and omissions.

- Convenience: Electronic filing is convenient and can be done from the comfort of your own home.

Step 3: Submit Your Form 8862

Once you have chosen an electronic filing option, you can submit your Form 8862. Make sure to review your form carefully before submitting it to ensure that all the information is accurate and complete.

What to Expect After Submitting Your Form 8862

After submitting your Form 8862, you can expect to receive a confirmation from the IRS. This confirmation will indicate that your form has been received and is being processed. If there are any issues with your form, the IRS will contact you to request additional information.

By following these three simple steps, you can easily file Form 8862 electronically. Remember to gather all the required documents and information, choose an electronic filing option, and submit your form carefully. If you have any questions or concerns, you can contact the IRS or a tax professional for assistance.

We hope this article has been helpful in guiding you through the process of filing Form 8862 electronically. If you have any questions or comments, please feel free to share them below.

What is Form 8862?

+Form 8862 is a tax form used to claim the Earned Income Tax Credit (EITC) after it has been disallowed by the IRS.

Who needs to file Form 8862?

+Taxpayers who have been disallowed from claiming the EITC in a previous tax year need to file Form 8862 to claim the credit again.

How do I file Form 8862 electronically?

+You can file Form 8862 electronically using the IRS Free File service, tax software, or by hiring a tax professional.