As a traveler, you're likely no stranger to the concept of hotel taxes. These additional fees can add up quickly, making your hotel stay more expensive than anticipated. However, did you know that there are ways to get hotel tax exemption in Texas? In this article, we'll explore four ways to help you save money on your next hotel stay in the Lone Star State.

Understanding Hotel Taxes in Texas

Before we dive into the ways to get hotel tax exemption, it's essential to understand how hotel taxes work in Texas. In Texas, hotel taxes are composed of two parts: the state hotel occupancy tax and the local hotel occupancy tax. The state hotel occupancy tax is 6%, while the local hotel occupancy tax varies by city and county, ranging from 1% to 2%.

1. Qualify for a State Hotel Occupancy Tax Exemption

The state of Texas offers a hotel occupancy tax exemption for certain individuals and organizations. To qualify, you must meet one of the following criteria:

- Be a employee of the U.S. government or a foreign government

- Be a student or teacher on official business

- Be a member of a non-profit organization or a charitable organization

- Be a Texas resident who is 65 years or older

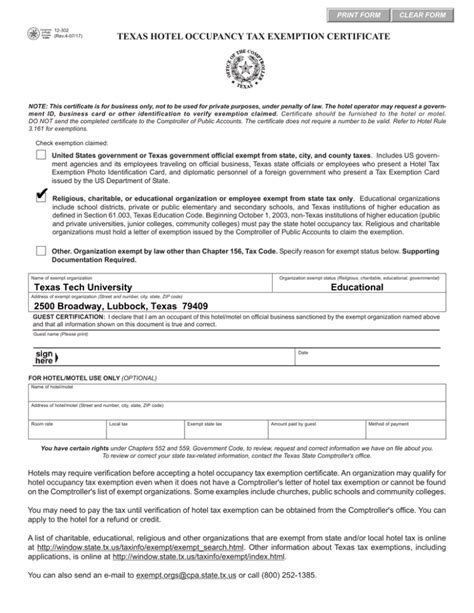

If you meet any of these criteria, you can fill out Form 12-302, Hotel Occupancy Tax Exemption Certificate, and provide it to the hotel to receive the exemption.

How to Apply for a State Hotel Occupancy Tax Exemption

To apply for a state hotel occupancy tax exemption, follow these steps:

- Download and complete Form 12-302, Hotel Occupancy Tax Exemption Certificate.

- Attach the required documentation, such as a copy of your government ID or a letter from your employer.

- Submit the form and documentation to the hotel at least 30 days prior to your stay.

- The hotel will verify your information and apply the exemption to your bill.

2. Get a Local Hotel Occupancy Tax Exemption

In addition to the state hotel occupancy tax exemption, some cities and counties in Texas offer their own local hotel occupancy tax exemptions. These exemptions can range from 1% to 2% and can be applied on top of the state exemption.

To qualify for a local hotel occupancy tax exemption, you'll need to meet the specific criteria set by the city or county. This may include being a resident of the city or county, being a student or teacher, or being a member of a non-profit organization.

How to Apply for a Local Hotel Occupancy Tax Exemption

To apply for a local hotel occupancy tax exemption, follow these steps:

- Contact the city or county where you'll be staying to inquire about their local hotel occupancy tax exemption.

- Ask about the specific criteria and requirements for the exemption.

- Fill out the required application form and attach any necessary documentation.

- Submit the application to the city or county at least 30 days prior to your stay.

3. Use a Hotel Tax Exemption Certificate

If you're not eligible for a state or local hotel occupancy tax exemption, you may still be able to get a hotel tax exemption using a hotel tax exemption certificate. These certificates are issued by the state of Texas and can be used by individuals and organizations that meet certain criteria.

To qualify for a hotel tax exemption certificate, you'll need to meet one of the following criteria:

- Be a Texas resident who is 65 years or older

- Be a disabled veteran

- Be a member of a non-profit organization or a charitable organization

If you meet any of these criteria, you can apply for a hotel tax exemption certificate through the Texas Comptroller's website.

How to Apply for a Hotel Tax Exemption Certificate

To apply for a hotel tax exemption certificate, follow these steps:

- Go to the Texas Comptroller's website and fill out the hotel tax exemption certificate application form.

- Attach the required documentation, such as a copy of your government ID or a letter from your employer.

- Submit the application and documentation to the Texas Comptroller's office.

- Once your application is approved, you'll receive a hotel tax exemption certificate that you can use to get a hotel tax exemption.

4. Negotiate with the Hotel

If you're not eligible for a state or local hotel occupancy tax exemption, or a hotel tax exemption certificate, you may still be able to negotiate with the hotel to get a reduced rate or a tax exemption. This is especially true if you're booking a large block of rooms or staying for an extended period.

When negotiating with the hotel, be sure to ask about any available discounts or promotions that may be able to reduce your tax liability. You can also ask about any additional fees or charges that may be added to your bill.

Tips for Negotiating with the Hotel

When negotiating with the hotel, here are a few tips to keep in mind:

- Be respectful and courteous: Remember that the hotel staff are people too, and being respectful and courteous can go a long way in getting a positive response.

- Do your research: Know the hotel's rates and policies before you start negotiating, and be prepared to make a strong case for why you deserve a discount or tax exemption.

- Be flexible: Be willing to compromise and negotiate on the terms of your stay, such as the length of your stay or the type of room you're booking.

By following these tips and using one of the four methods outlined above, you can save money on your next hotel stay in Texas and reduce your tax liability.

We hope this article has been helpful in explaining the ways to get hotel tax exemption in Texas. If you have any questions or need further assistance, please don't hesitate to comment below or reach out to us directly.

What is the hotel occupancy tax in Texas?

+The hotel occupancy tax in Texas is composed of two parts: the state hotel occupancy tax and the local hotel occupancy tax. The state hotel occupancy tax is 6%, while the local hotel occupancy tax varies by city and county, ranging from 1% to 2%.

How do I qualify for a state hotel occupancy tax exemption?

+To qualify for a state hotel occupancy tax exemption, you must meet one of the following criteria: be a employee of the U.S. government or a foreign government, be a student or teacher on official business, be a member of a non-profit organization or a charitable organization, or be a Texas resident who is 65 years or older.

Can I get a hotel tax exemption certificate?

+Yes, you can get a hotel tax exemption certificate if you meet certain criteria, such as being a Texas resident who is 65 years or older, being a disabled veteran, or being a member of a non-profit organization or a charitable organization.