Non-Resident Indians (NRIs) who wish to invest in India or conduct financial transactions often face the challenge of completing the Know Your Customer (KYC) formalities. HDFC, one of India's leading banks, requires NRIs to fill out the KYC form to comply with regulatory requirements. In this article, we will discuss five ways to complete the HDFC KYC form for NRIs.

What is HDFC KYC Form?

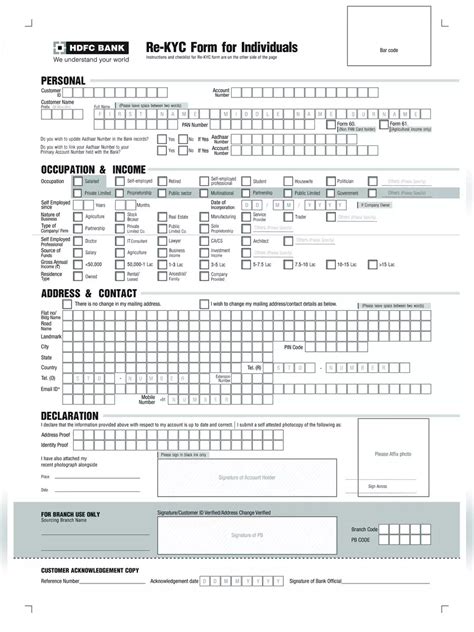

The HDFC KYC form is a mandatory document that NRIs need to fill out to provide personal and identification details to the bank. The form helps HDFC verify the identity of its customers and comply with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations.

Why is HDFC KYC Form Important for NRIs?

The HDFC KYC form is essential for NRIs as it enables them to:

- Open and operate bank accounts in India

- Invest in Indian stocks, mutual funds, and other financial instruments

- Conduct financial transactions, such as remittances and bill payments

- Comply with Indian regulatory requirements

5 Ways to Complete HDFC KYC Form for NRIs

Here are five ways NRIs can complete the HDFC KYC form:

1. Online KYC Form Submission

NRIs can fill out the HDFC KYC form online by visiting the HDFC website. They need to:

- Download the KYC form from the HDFC website

- Fill out the form with personal and identification details

- Scan the completed form and upload it to the HDFC website

- Attach supporting documents, such as a valid passport and proof of address

2. In-Person KYC Form Submission

NRIs can visit an HDFC branch in person to fill out the KYC form. They need to:

- Visit an HDFC branch and collect the KYC form

- Fill out the form with personal and identification details

- Attach supporting documents, such as a valid passport and proof of address

- Submit the completed form to the HDFC branch

3. Authorized Representative

NRIs can authorize a representative to fill out the KYC form on their behalf. The representative needs to:

- Collect the KYC form from an HDFC branch or download it from the HDFC website

- Fill out the form with the NRI's personal and identification details

- Attach supporting documents, such as a valid passport and proof of address

- Submit the completed form to the HDFC branch

4. Duly Attested KYC Form

NRIs can get the KYC form attested by an authorized official, such as a notary public or a bank official. The attested form needs to be:

- Filled out with personal and identification details

- Signed by the NRI

- Attested by an authorized official

- Submitted to the HDFC branch

5. Aadhaar-Based KYC

NRIs with an Aadhaar card can use it to complete the KYC form. They need to:

- Link their Aadhaar card to their HDFC account

- Fill out the KYC form with their Aadhaar number

- Attach supporting documents, such as a valid passport and proof of address

- Submit the completed form to the HDFC branch

Documents Required for HDFC KYC Form

NRIs need to submit the following documents to complete the HDFC KYC form:

- Valid passport

- Proof of address (utility bill, lease agreement, etc.)

- Proof of identity (driving license, PAN card, etc.)

- Proof of income (salary slip, income tax return, etc.)

- Aadhaar card (if applicable)

Benefits of Completing HDFC KYC Form

Completing the HDFC KYC form offers several benefits to NRIs, including:

- Compliance with Indian regulatory requirements

- Ability to open and operate bank accounts in India

- Ability to invest in Indian stocks, mutual funds, and other financial instruments

- Convenience in conducting financial transactions

- Enhanced security and protection against financial fraud

Conclusion

Completing the HDFC KYC form is a mandatory requirement for NRIs who wish to conduct financial transactions or invest in India. By following the five methods outlined in this article, NRIs can easily complete the KYC form and enjoy the benefits of banking with HDFC.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the purpose of the HDFC KYC form?

+The HDFC KYC form is a mandatory document that NRIs need to fill out to provide personal and identification details to the bank. The form helps HDFC verify the identity of its customers and comply with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations.

What documents are required to complete the HDFC KYC form?

+NRI's need to submit the following documents to complete the HDFC KYC form: valid passport, proof of address, proof of identity, proof of income, and Aadhaar card (if applicable).

Can I submit the HDFC KYC form online?

+Yes, NRIs can fill out the HDFC KYC form online by visiting the HDFC website. They need to download the form, fill it out, scan it, and upload it to the HDFC website along with supporting documents.