As a business owner in Hawaii, it's essential to understand the tax filing requirements for your company. One of the crucial forms you'll need to file is the Hawaii Form N-200V, also known as the Corporation Income Tax Return. In this article, we'll delve into the details of Form N-200V, its filing requirements, and provide guidance on how to accurately complete and submit the form.

Why is Form N-200V important?

Form N-200V is used to report a corporation's income tax liability to the state of Hawaii. The form is a critical component of the state's tax system, as it helps the government collect revenue and ensures that businesses comply with tax laws. Failure to file Form N-200V or submitting inaccurate information can result in penalties, fines, and even loss of business licenses.

Who needs to file Form N-200V?

Corporations, including S corporations, C corporations, and limited liability companies (LLCs) that elect to be taxed as corporations, are required to file Form N-200V. This includes businesses that operate in Hawaii, as well as those that have a presence in the state but are not physically located there.

Filing Requirements for Form N-200V

To file Form N-200V, corporations must meet the following requirements:

- Business Registration: The business must be registered with the Hawaii Department of Commerce and Consumer Affairs (DCCA) and have a valid tax ID number.

- Tax Year: The tax year for Form N-200V corresponds to the corporation's fiscal year, which can be a calendar year or a fiscal year that ends on the last day of a month other than December.

- Gross Income: The corporation must have gross income from sources within Hawaii, including sales, services, and rentals.

- Tax Liability: The corporation must have a tax liability, which is calculated based on its taxable income and the applicable tax rates.

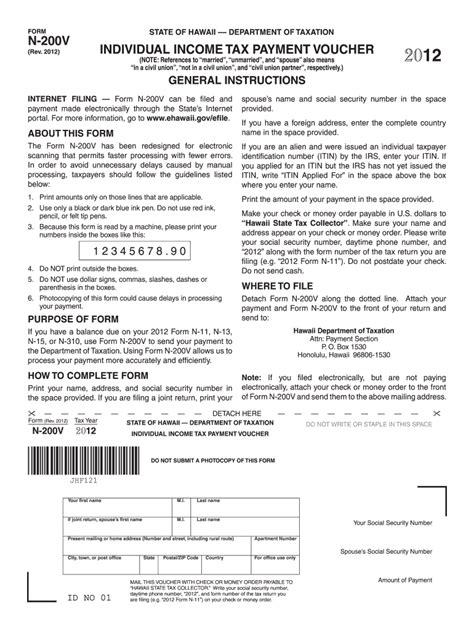

How to Complete Form N-200V

Form N-200V consists of several sections, including:

- Identification Section: This section requires the corporation's name, address, tax ID number, and other identifying information.

- Income Section: This section requires the corporation to report its gross income, deductions, and exemptions.

- Tax Liability Section: This section requires the corporation to calculate its tax liability based on its taxable income and the applicable tax rates.

- Payment Section: This section requires the corporation to report any payments made towards its tax liability.

Steps to File Form N-200V

To file Form N-200V, follow these steps:

- Obtain the Form: Download Form N-200V from the Hawaii Department of Taxation's website or obtain a copy from a tax professional.

- Gather Required Documents: Collect all required documents, including financial statements, receipts, and other supporting documentation.

- Complete the Form: Accurately complete Form N-200V, ensuring that all required information is provided.

- Submit the Form: Submit Form N-200V to the Hawaii Department of Taxation, either electronically or by mail, along with any required supporting documentation.

Deadlines and Penalties

The deadline for filing Form N-200V is the 20th day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the deadline for filing Form N-200V is April 20. Failure to file Form N-200V or submitting inaccurate information can result in penalties, fines, and even loss of business licenses.

Additional Resources

For more information on Form N-200V and other Hawaii tax forms, visit the Hawaii Department of Taxation's website or consult with a tax professional.

Conclusion

Filing Form N-200V is a critical component of a corporation's tax compliance in Hawaii. By understanding the filing requirements and accurately completing the form, businesses can ensure they meet their tax obligations and avoid penalties. If you're unsure about any aspect of the filing process, consult with a tax professional or seek guidance from the Hawaii Department of Taxation.

Frequently Asked Questions

Who is required to file Form N-200V?

+Corporations, including S corporations, C corporations, and limited liability companies (LLCs) that elect to be taxed as corporations, are required to file Form N-200V.

What is the deadline for filing Form N-200V?

+The deadline for filing Form N-200V is the 20th day of the fourth month following the end of the tax year.

What are the consequences of not filing Form N-200V?

+Failure to file Form N-200V or submitting inaccurate information can result in penalties, fines, and even loss of business licenses.