As a GT Independence contractor, you may be wondering how to obtain your W2 form. The W2 form, also known as the Wage and Tax Statement, is a crucial document that outlines your earnings and taxes withheld from your employer. In this article, we'll explore three ways to obtain your GT Independence W2 form.

Understanding the Importance of W2 Forms

Before we dive into the methods of obtaining your W2 form, let's quickly understand its significance. The W2 form is essential for filing your tax returns, as it provides critical information about your income and taxes paid. You'll need this form to complete your tax return accurately, and it's usually required by the IRS and state tax authorities.

Method 1: Online Portal

One of the most convenient ways to obtain your GT Independence W2 form is through their online portal. To access your W2 form online, follow these steps:

- Visit the GT Independence website and log in to your account.

- Navigate to the "My Account" or "Payroll" section.

- Look for the "W2 Forms" or "Tax Documents" option.

- Select the tax year for which you want to download your W2 form.

- Click on the "Download" or "Print" button to access your W2 form.

Method 2: Contact GT Independence Support

Contact GT Independence Support

If you're unable to access your W2 form through the online portal, you can contact GT Independence support for assistance. Here's how:

- Reach out to GT Independence customer support via phone or email.

- Provide your contractor ID or other identifying information to verify your account.

- Request that they email or mail your W2 form to you.

- Wait for the support team to process your request and send your W2 form.

Method 3: Mail or Fax Request

Mail or Fax Request

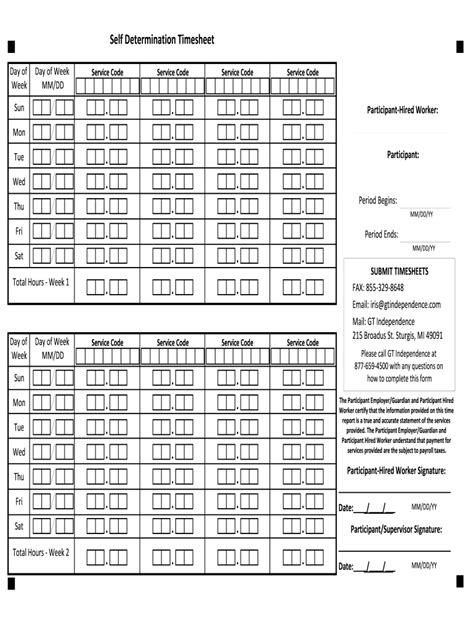

If you prefer to request your W2 form by mail or fax, you can do so by following these steps:

- Download and complete the W2 request form from the GT Independence website.

- Attach a copy of your government-issued ID, such as a driver's license or passport.

- Mail or fax the completed form and ID to the address or fax number provided on the form.

- Wait for GT Independence to process your request and mail your W2 form to you.

Additional Tips

- Ensure you have the correct login credentials and account information to access your W2 form online.

- If you're having trouble accessing your W2 form online, try clearing your browser cache or using a different browser.

- When contacting GT Independence support, have your contractor ID and other identifying information ready to expedite the process.

- If you're requesting your W2 form by mail or fax, make sure to follow the instructions carefully and include all required documentation.

By following these three methods, you should be able to obtain your GT Independence W2 form with ease. Remember to keep your W2 form safe and secure, as it contains sensitive information about your income and taxes.

We hope this article has been informative and helpful. If you have any further questions or concerns, feel free to comment below.

What is the deadline for receiving my W2 form?

+The deadline for receiving your W2 form is typically January 31st of each year.

Can I request a duplicate W2 form if I lost mine?

+How do I correct errors on my W2 form?

+If you notice errors on your W2 form, contact GT Independence support immediately to report the issue and request corrections.