As a resident of Georgia, it's essential to understand the process of filing your taxes accurately and efficiently. With the various tax forms and regulations, it can be overwhelming to navigate the system. However, with this comprehensive guide, you'll be able to file your Georgia tax form with confidence.

In this article, we'll walk you through the step-by-step process of filing your Georgia tax form, including the necessary documents, tax credits, and deadlines. Whether you're a first-time filer or a seasoned taxpayer, this guide will provide you with the information you need to ensure a smooth and stress-free filing experience.

Understanding Georgia Tax Forms

Before we dive into the filing process, it's essential to understand the different types of tax forms used in Georgia. The most common forms include:

- Form 500: This is the primary tax form used for individual income tax returns.

- Form 500EZ: This form is used for simple returns, where the taxpayer has no dependents and only has one source of income.

- Form 500X: This form is used for amended returns, where the taxpayer needs to make changes to their original return.

Tax Filing Status

Your tax filing status determines the tax rates and deductions you're eligible for. In Georgia, the following filing statuses are recognized:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

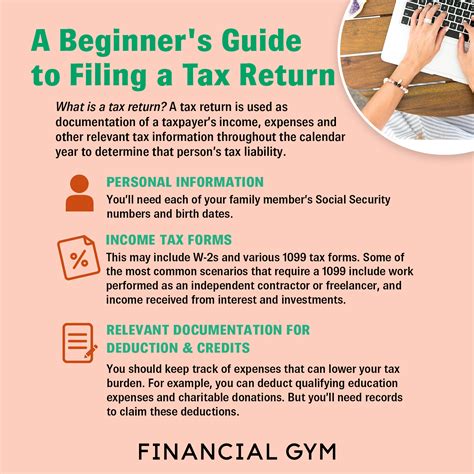

Gathering Necessary Documents

To file your Georgia tax form, you'll need to gather the necessary documents, including:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or other income

- Interest statements from banks and investments

- Dividend statements from stocks and mutual funds

- Charitable donation receipts

- Medical expense receipts

Tax Credits and Deductions

Georgia offers various tax credits and deductions to help reduce your tax liability. Some of the most common credits and deductions include:

- Standard deduction: This is a fixed amount that can be deducted from your taxable income.

- Itemized deductions: These include deductions for medical expenses, charitable donations, and mortgage interest.

- Earned income tax credit (EITC): This credit is designed for low-income working individuals and families.

- Child tax credit: This credit is designed for families with dependents under the age of 17.

Filing Your Georgia Tax Form

Now that you have all the necessary documents, it's time to file your Georgia tax form. You can file electronically or by mail.

- E-filing: You can e-file your tax return through the Georgia Tax Center or through a tax preparation software.

- Mailing: You can mail your tax return to the Georgia Department of Revenue.

Deadlines and Penalties

The deadline for filing your Georgia tax form is April 15th. If you fail to file on time, you may be subject to penalties and interest.

- Late filing penalty: 5% of the unpaid tax due for each month or part of a month, up to a maximum of 25%.

- Late payment penalty: 0.5% of the unpaid tax due for each month or part of a month, up to a maximum of 25%.

Audit and Appeals Process

If you're selected for an audit, you'll receive a notice from the Georgia Department of Revenue. The audit process typically involves a review of your tax return and supporting documents.

- Audit process: The auditor will review your tax return and supporting documents to ensure accuracy and compliance with tax laws.

- Appeals process: If you disagree with the audit findings, you can appeal the decision.

Taxpayer Bill of Rights

As a taxpayer, you have certain rights and responsibilities. The Taxpayer Bill of Rights includes:

- The right to be informed

- The right to quality service

- The right to pay no more than the correct amount of tax

- The right to challenge the IRS's position and be heard

- The right to appeal a decision in an independent forum

Conclusion

Filing your Georgia tax form can be a daunting task, but with this guide, you'll be able to navigate the process with confidence. Remember to gather all necessary documents, take advantage of tax credits and deductions, and file on time to avoid penalties and interest.

What is the deadline for filing my Georgia tax form?

+The deadline for filing your Georgia tax form is April 15th.

What is the standard deduction for Georgia taxpayers?

+The standard deduction for Georgia taxpayers varies depending on filing status. For the 2022 tax year, the standard deduction is $4,600 for single filers and $9,200 for joint filers.

Can I e-file my Georgia tax form?

+Yes, you can e-file your Georgia tax form through the Georgia Tax Center or through a tax preparation software.

We hope this guide has been helpful in navigating the process of filing your Georgia tax form. If you have any further questions or concerns, please don't hesitate to reach out.