In today's business world, managing risk is crucial for entrepreneurs and organizations of all sizes. One way to mitigate potential risks is by obtaining the right insurance coverage. General Liability Acord 125 is a widely used form in the insurance industry that provides essential information about a business's general liability insurance coverage. As a business owner, understanding the intricacies of this form is vital to ensure you have the necessary protection for your company. In this article, we will delve into five essential facts about General Liability Acord 125 that every business owner should know.

What is General Liability Acord 125?

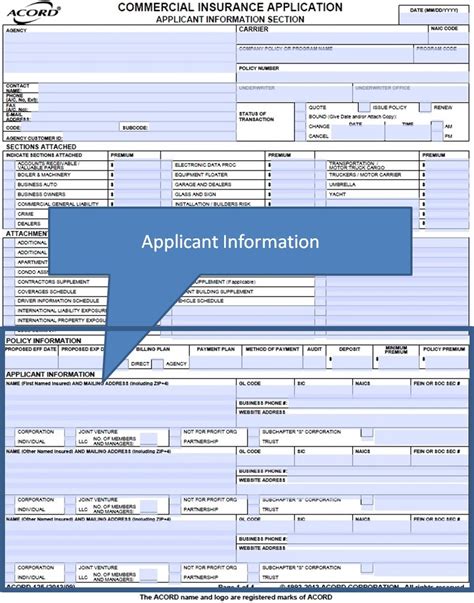

The General Liability Acord 125 form, also known as the Certificate of Liability Insurance, is a standardized form used by insurance companies to provide a snapshot of a business's general liability insurance coverage. This form is typically required by clients, contractors, or vendors to verify that a business has the necessary insurance coverage before entering into a contract or agreement.

Key Components of General Liability Acord 125

The General Liability Acord 125 form typically includes the following key components:

- Policy information: This section includes the policy number, policy period, and the type of policy (e.g., general liability, professional liability, etc.).

- Insured information: This section lists the name and address of the insured business or organization.

- Coverage information: This section outlines the types of coverage provided, including the policy limits, deductibles, and any special conditions or endorsements.

- Additional insureds: This section lists any additional parties that are covered under the policy, such as contractors or vendors.

- Cancellation provisions: This section outlines the terms and conditions under which the policy can be cancelled.

Why is General Liability Acord 125 Important?

The General Liability Acord 125 form is essential for several reasons:

- Verifies coverage: The form provides proof of general liability insurance coverage, which is often required by clients, contractors, or vendors before entering into a contract or agreement.

- Provides essential information: The form outlines the key components of the policy, including the policy limits, deductibles, and any special conditions or endorsements.

- Helps mitigate risk: By verifying coverage and providing essential information, the General Liability Acord 125 form helps businesses mitigate potential risks and avoid costly lawsuits.

Types of Businesses that Need General Liability Acord 125

The General Liability Acord 125 form is not limited to specific industries or businesses. Any business that wants to verify its general liability insurance coverage and provide essential information to clients, contractors, or vendors can use this form. Some examples of businesses that may need General Liability Acord 125 include:

- Construction companies

- Manufacturing businesses

- Retail stores

- Restaurants and bars

- Professional services firms (e.g., law firms, medical practices, etc.)

How to Obtain General Liability Acord 125

To obtain a General Liability Acord 125 form, business owners can follow these steps:

- Contact your insurance provider: Reach out to your insurance provider and request a General Liability Acord 125 form.

- Provide required information: Provide your insurance provider with the necessary information, including your policy number, business name, and address.

- Review and verify the form: Review the completed form to ensure it accurately reflects your general liability insurance coverage.

Conclusion and Next Steps

In conclusion, the General Liability Acord 125 form is an essential document that provides a snapshot of a business's general liability insurance coverage. By understanding the key components and importance of this form, business owners can ensure they have the necessary protection for their company. To learn more about General Liability Acord 125 or to obtain a form, contact your insurance provider or a licensed insurance professional.

We encourage you to share your thoughts and experiences with General Liability Acord 125 in the comments section below. If you have any questions or concerns, please don't hesitate to reach out. By working together, we can help businesses mitigate potential risks and succeed in today's competitive market.

What is the purpose of General Liability Acord 125?

+The purpose of General Liability Acord 125 is to provide a snapshot of a business's general liability insurance coverage, verifying coverage and providing essential information to clients, contractors, or vendors.

Who needs General Liability Acord 125?

+Any business that wants to verify its general liability insurance coverage and provide essential information to clients, contractors, or vendors can use General Liability Acord 125.

How do I obtain General Liability Acord 125?

+To obtain General Liability Acord 125, contact your insurance provider, provide the required information, and review and verify the completed form.