The Georgia Form 600s is a critical document for businesses operating in the state of Georgia, and understanding its instructions is vital for accurate and timely filing. In this comprehensive guide, we will walk you through the step-by-step process of filing the Georgia Form 600s, providing you with essential information to ensure compliance with the Georgia Department of Revenue's requirements.

Why is the Georgia Form 600s Important?

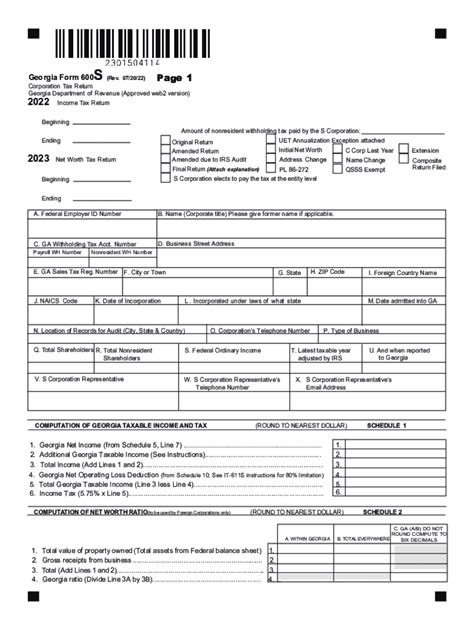

The Georgia Form 600s is a series of tax forms used by the Georgia Department of Revenue to collect information about a business's income, deductions, and credits. The form is used to calculate the business's tax liability, and it is essential for businesses to file the form accurately and on time to avoid penalties and interest. Whether you are a small business owner or a large corporation, understanding the Georgia Form 600s instructions is crucial for maintaining compliance with state tax laws.

Who Needs to File the Georgia Form 600s?

The Georgia Form 600s is required for all businesses operating in Georgia, including:

- Corporations

- Partnerships

- Limited Liability Companies (LLCs)

- S corporations

- Estates and trusts

Businesses with a Georgia tax liability must file the Form 600s, even if they have no taxable income. Additionally, businesses that are exempt from Georgia income tax may still be required to file the Form 600s if they have other tax liabilities, such as withholding tax or sales tax.

Step-by-Step Filing Guide

Filing the Georgia Form 600s involves several steps, which we will outline below:

Step 1: Gather Required Information

Before starting the filing process, gather all required information and documents, including:

- Business identification information (e.g., business name, address, and federal Employer Identification Number (EIN))

- Financial statements (e.g., balance sheet, income statement)

- Tax-related documents (e.g., W-2s, 1099s, prior year tax returns)

- Depreciation schedules

- Records of capital gains and losses

Step 2: Choose the Correct Form

The Georgia Form 600s consists of several forms, including:

- Form 600: Corporation Tax Return

- Form 600S: S Corporation Tax Return

- Form 600P: Partnership Tax Return

- Form 600LL: Limited Liability Company Tax Return

Choose the correct form based on your business type and follow the instructions for that specific form.

Step 3: Complete the Form

Complete the form by providing all required information, including:

- Business identification information

- Financial data (e.g., gross income, deductions, credits)

- Tax liability calculations

Ensure that you complete all required schedules and attachments, such as:

- Schedule 1: Income and Deductions

- Schedule 2: Credits

- Schedule 3: Depreciation and Amortization

Step 4: Sign and Date the Form

Sign and date the form, ensuring that the signature is of an authorized representative of the business.

Step 5: Submit the Form

Submit the completed form to the Georgia Department of Revenue, either electronically or by mail. The filing deadline is typically April 15th for calendar-year filers, but this date may vary depending on the business's fiscal year-end.

Additional Tips and Reminders

- Ensure accuracy and completeness when filing the Georgia Form 600s to avoid penalties and interest.

- Keep records of all supporting documentation, including financial statements and tax-related documents.

- Consider consulting a tax professional or accountant to ensure compliance with Georgia tax laws.

- Take advantage of electronic filing options to streamline the filing process and reduce errors.

Common Mistakes to Avoid

- Incomplete or inaccurate information

- Failure to sign and date the form

- Missing or incomplete schedules and attachments

- Late filing or payment of tax liability

Conclusion

Filing the Georgia Form 600s requires attention to detail and a thorough understanding of the instructions. By following this step-by-step guide, businesses can ensure compliance with Georgia tax laws and avoid costly penalties and interest. Remember to gather all required information, choose the correct form, complete the form accurately, sign and date the form, and submit it on time.

Share Your Thoughts

We hope this comprehensive guide has been helpful in understanding the Georgia Form 600s instructions. Share your thoughts and experiences with filing the Georgia Form 600s in the comments below. Have any questions or need further clarification? Ask us in the comments, and we'll do our best to assist you.

What is the deadline for filing the Georgia Form 600s?

+The filing deadline for the Georgia Form 600s is typically April 15th for calendar-year filers, but this date may vary depending on the business's fiscal year-end.

Can I file the Georgia Form 600s electronically?

+What are the consequences of late filing or payment of tax liability?

+Late filing or payment of tax liability can result in penalties and interest, which can be costly and time-consuming to resolve.