The world of insurance claims can be overwhelming, especially when dealing with complex forms like the GA Form 525-TV. Whether you're a seasoned insurance professional or an individual seeking to navigate the claims process, understanding this form is crucial. In this article, we'll delve into the intricacies of the GA Form 525-TV, exploring its purpose, key components, and practical tips for successful claims submission.

What is the GA Form 525-TV?

The GA Form 525-TV is a standardized form used in the state of Georgia for filing insurance claims related to vehicle accidents. This form is designed to provide a structured format for claimants to report incidents, document damages, and submit required information to insurance companies. Its primary purpose is to facilitate the claims process, ensuring that all necessary details are captured and evaluated efficiently.

Key Components of the GA Form 525-TV

The GA Form 525-TV is divided into several sections, each requiring specific information. Understanding these components is vital for accurate and complete form submission:

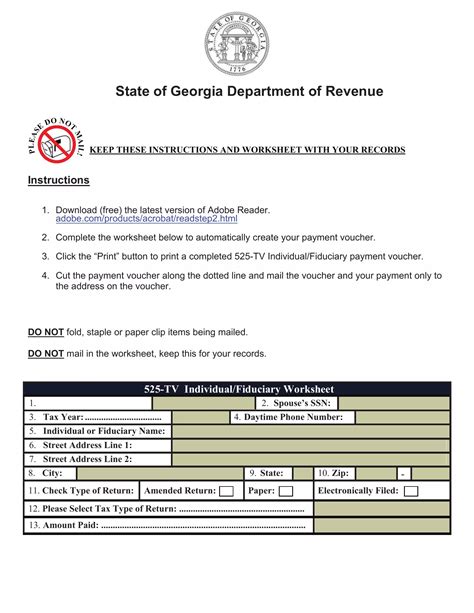

- Section 1: Claimant Information - This section requires personal details, including name, address, phone number, and policy information.

- Section 2: Vehicle Information - Claimants must provide vehicle make, model, year, and Vehicle Identification Number (VIN).

- Section 3: Accident Information - This section requires a detailed description of the accident, including date, time, location, and parties involved.

- Section 4: Damages and Injuries - Claimants must report any damages or injuries sustained during the accident.

- Section 5: Witness Information - If applicable, claimants should provide witness contact information.

- Section 6: Additional Information - This section allows claimants to provide any additional details or supporting documentation.

Benefits of Using the GA Form 525-TV

The GA Form 525-TV offers several benefits for both claimants and insurance companies:

- Streamlined Claims Process - The standardized format ensures that all necessary information is captured, reducing the risk of errors or omissions.

- Improved Communication - The form facilitates clear communication between claimants and insurance companies, ensuring that all parties are on the same page.

- Enhanced Accuracy - The structured format minimizes the risk of misinterpretation or misunderstandings.

- Increased Efficiency - The GA Form 525-TV saves time and resources by reducing the need for follow-up questions or additional documentation.

Practical Tips for Filing a GA Form 525-TV

To ensure a smooth claims process, follow these practical tips when filing a GA Form 525-TV:

- Read and Understand the Form - Take the time to carefully review the form and instructions before submitting.

- Provide Accurate Information - Ensure that all information is accurate and complete, including personal details, vehicle information, and accident descriptions.

- Supporting Documentation - Attach any supporting documentation, such as police reports, medical records, or photographs, to the form.

- Double-Check for Errors - Carefully review the form for errors or omissions before submitting.

Common Mistakes to Avoid When Filing a GA Form 525-TV

When filing a GA Form 525-TV, it's essential to avoid common mistakes that can delay or complicate the claims process:

- Inaccurate or Incomplete Information - Ensure that all information is accurate and complete to avoid delays or rejections.

- Missing or Insufficient Documentation - Attach all required supporting documentation to avoid additional requests.

- Untimely Submission - Submit the form within the required timeframe to avoid potential penalties or losses.

- Failure to Follow Instructions - Carefully follow the form instructions to ensure accurate and complete submission.

What to Expect After Submitting a GA Form 525-TV

After submitting a GA Form 525-TV, claimants can expect the following:

- Acknowledgement of Receipt - Insurance companies will acknowledge receipt of the form and provide a claim number.

- Claims Evaluation - Insurance adjusters will evaluate the claim, reviewing the submitted information and supporting documentation.

- Communication and Updates - Insurance companies will communicate with claimants throughout the process, providing updates on the status of the claim.

- Claims Resolution - The insurance company will make a decision regarding the claim, either approving or denying it.

Next Steps After a GA Form 525-TV is Submitted

After submitting a GA Form 525-TV, claimants should:

- Monitor Progress - Regularly check the status of the claim with the insurance company.

- Respond to Requests - Promptly respond to any requests for additional information or documentation.

- Review and Understand the Claims Decision - Carefully review the claims decision and ask questions if necessary.

Conclusion and Final Thoughts

The GA Form 525-TV is a critical component of the insurance claims process in Georgia. By understanding the form's purpose, key components, and practical tips for submission, claimants can navigate the process with confidence. Remember to avoid common mistakes, monitor progress, and respond to requests to ensure a smooth and efficient claims experience.

We hope this comprehensive guide has provided valuable insights into the GA Form 525-TV. If you have any questions or concerns, please don't hesitate to comment below. Share this article with others who may benefit from this information, and take the first step towards a successful insurance claims experience.

What is the purpose of the GA Form 525-TV?

+The GA Form 525-TV is a standardized form used in the state of Georgia for filing insurance claims related to vehicle accidents.

What information is required on the GA Form 525-TV?

+The form requires personal details, vehicle information, accident descriptions, damages and injuries, witness information, and additional supporting documentation.

How long does it take to process a GA Form 525-TV?

+The processing time may vary depending on the complexity of the claim and the insurance company's evaluation process.