As a fiduciary, managing the financial affairs of an estate or trust can be a daunting task. One of the key responsibilities is ensuring compliance with tax laws, which includes filing the California Fiduciary Income Tax Return, Form 588. In this article, we will delve into the world of fiduciary taxation, exploring the importance of Form 588, its components, and the process of filing.

Understanding Fiduciary Taxation

Fiduciary taxation refers to the tax obligations of a fiduciary, who is responsible for managing the financial affairs of an estate or trust. In California, fiduciaries are required to file a tax return on behalf of the estate or trust, reporting the income earned and taxes owed. The California Fiduciary Income Tax Return, Form 588, is used to report the income, deductions, and credits of the estate or trust.

The Importance of Form 588

Form 588 is a critical document that ensures compliance with California tax laws. It provides the Franchise Tax Board (FTB) with the necessary information to determine the tax liability of the estate or trust. Failure to file Form 588 can result in penalties, interest, and even loss of tax benefits.

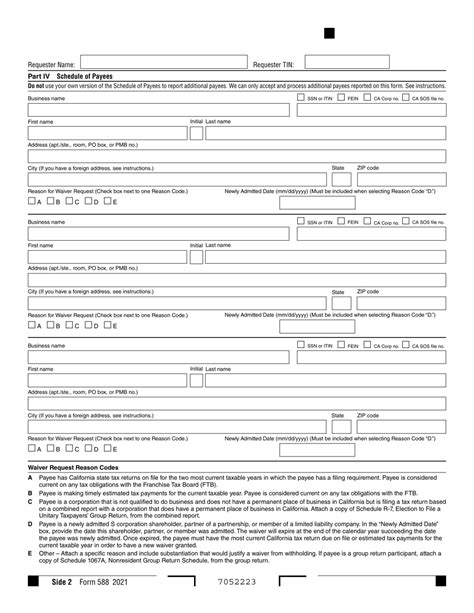

Components of Form 588

Form 588 is divided into several sections, each requiring specific information. The main components of the form include:

- Identification: This section requires the fiduciary to provide identification information, including the estate or trust name, address, and taxpayer identification number.

- Income: This section requires the fiduciary to report the income earned by the estate or trust, including dividends, interest, and capital gains.

- Deductions: This section allows the fiduciary to claim deductions, such as administrative expenses, charitable contributions, and investment expenses.

- Credits: This section allows the fiduciary to claim credits, such as the earned income tax credit or the credit for taxes withheld.

Who Must File Form 588?

The following entities are required to file Form 588:

- Estates: An estate is required to file Form 588 if it has gross income of $600 or more, regardless of the tax year.

- Trusts: A trust is required to file Form 588 if it has gross income of $600 or more, regardless of the tax year.

- Fiduciaries: A fiduciary is required to file Form 588 on behalf of the estate or trust if they are responsible for managing the financial affairs.

How to File Form 588

To file Form 588, the fiduciary must follow these steps:

- Gather required documents: The fiduciary must gather all required documents, including financial statements, receipts, and tax documents.

- Complete Form 588: The fiduciary must complete Form 588, reporting the income, deductions, and credits of the estate or trust.

- Attach supporting documents: The fiduciary must attach supporting documents, such as financial statements and receipts, to Form 588.

- File Form 588: The fiduciary must file Form 588 with the FTB by the tax filing deadline, which is typically April 15th.

Penalties for Late Filing

Failure to file Form 588 by the tax filing deadline can result in penalties and interest. The penalties for late filing include:

- Late filing penalty: A penalty of 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

- Late payment penalty: A penalty of 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

- Interest: Interest on the unpaid tax, which accrues from the original due date.

Conclusion

Filing the California Fiduciary Income Tax Return, Form 588, is a critical responsibility for fiduciaries managing the financial affairs of an estate or trust. By understanding the importance of Form 588, its components, and the filing process, fiduciaries can ensure compliance with California tax laws and avoid penalties and interest.

We invite you to share your experiences with filing Form 588 or ask questions in the comments section below. If you found this article informative, please share it with others who may benefit from this information.

Frequently Asked Questions

What is the deadline for filing Form 588?

+The deadline for filing Form 588 is typically April 15th.

Who is required to file Form 588?

+Estates, trusts, and fiduciaries managing the financial affairs of an estate or trust are required to file Form 588.

What are the penalties for late filing?

+The penalties for late filing include a late filing penalty, late payment penalty, and interest on the unpaid tax.