Navigating the complexities of financial forms can be a daunting task, especially when it comes to completing the FS Form 5396, also known as the "Individual Retirement Account (IRA) Distribution Form." This form is crucial for individuals who need to report distributions from their Individual Retirement Accounts (IRAs) to the Internal Revenue Service (IRS). The importance of accurately completing this form cannot be overstated, as errors can lead to delays in processing, fines, or even audits. In this article, we will explore five ways to ensure you complete the FS Form 5396 successfully, minimizing the risk of complications and ensuring a smooth reporting process.

Understanding the Purpose and Components of the FS Form 5396

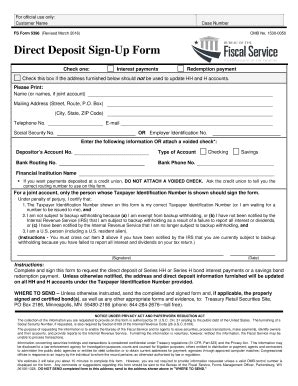

Before diving into the steps to complete the form successfully, it's essential to understand its purpose and components. The FS Form 5396 is used by the IRS to track and process distributions from IRAs, which are reported on the taxpayer's annual tax return. The form requires detailed information about the distribution, including the type of IRA, the amount distributed, and whether the distribution is taxable. Understanding the purpose and requirements of the form is crucial for accurate completion.

1. Gather All Necessary Information and Documents

To complete the FS Form 5396 accurately, you need to gather all relevant information and documents beforehand. This includes:

- Your IRA account information

- The type of IRA (e.g., traditional, Roth, etc.)

- The distribution amount

- The tax withholding amount (if applicable)

- Your tax identification number (Social Security number or Employer Identification Number)

Having these details readily available will save time and reduce the likelihood of errors.

**Accurate Completion of the Form**

2. Follow the Instructions Carefully

The FS Form 5396 comes with detailed instructions that outline how to fill out each section accurately. It's crucial to follow these instructions carefully, paying attention to any specific requirements or exceptions. The instructions will guide you on how to report different types of distributions, calculate tax withholdings, and indicate whether the distribution is taxable.

3. Use the Correct Boxes and Fields

The form is divided into boxes and fields designed for specific information. Ensure you use the correct boxes and fields for each piece of information. For example, the distribution amount should be reported in Box 1, and the tax withholding amount should be reported in Box 4. Incorrectly placing information can lead to processing delays or even rejection of the form.

**Reporting and Withholding**

4. Accurately Report Distributions and Withholding

Accurate reporting of distributions and withholding is critical. The form requires you to report the total distribution amount and the amount of federal income tax withheld. Ensure these amounts are accurate and match the information provided by your IRA custodian or administrator. Additionally, if you are reporting a first-time homebuyer distribution or a qualified education expense distribution, ensure you follow the specific reporting instructions for these exceptions.

5. Review and Double-Check Your Entries

Before submitting the FS Form 5396, thoroughly review and double-check your entries for accuracy. Ensure all required fields are completed, calculations are correct, and the form is signed and dated. Errors or incomplete information can lead to delays or even require you to refile the form.

**Submission and Follow-Up**

After completing the form accurately, submit it to the IRS by the required deadline. Keep a copy of the submitted form for your records. If you encounter any issues or have questions during the submission process, don't hesitate to contact the IRS or a tax professional for assistance.

Invitation to Engage

Completing the FS Form 5396 accurately is a crucial step in reporting IRA distributions to the IRS. By following the five steps outlined in this article, you can ensure a smooth and error-free reporting process. We invite you to share your experiences with completing the FS Form 5396 in the comments section below. Additionally, if you have any questions or need further clarification on any of the steps, please don't hesitate to ask.

What is the FS Form 5396 used for?

+The FS Form 5396 is used by the IRS to track and process distributions from Individual Retirement Accounts (IRAs).

What information do I need to complete the FS Form 5396?

+You will need your IRA account information, the type of IRA, the distribution amount, the tax withholding amount (if applicable), and your tax identification number.

Where can I find instructions for completing the FS Form 5396?

+The instructions for completing the FS Form 5396 can be found on the IRS website or in the form's instructions provided with the form.