Alabama Last Will And Testament Form - Free Download

Creating a last will and testament is a crucial step in planning for the future and ensuring that your wishes are respected after you pass away. In Alabama, having a valid will in place can help prevent disputes among family members and ensure that your assets are distributed according to your desires. In this article, we will discuss the importance of having a last will and testament in Alabama, the requirements for creating a valid will, and provide a free downloadable template to get you started.

Why Do I Need a Last Will and Testament in Alabama?

Having a last will and testament is essential for several reasons:

- Avoids Intestacy: Without a will, the state of Alabama will determine how your assets are distributed, which may not align with your wishes.

- Ensures Asset Distribution: A will allows you to specify how you want your assets, including property, investments, and personal belongings, to be distributed among your loved ones.

- Appoints an Executor: You can name an executor, also known as a personal representative, to manage your estate and carry out your instructions.

- Provides for Minor Children: If you have minor children, a will allows you to name a guardian to care for them in the event of your passing.

- Reduces Conflict: Having a clear and valid will can help prevent disputes among family members and reduce the risk of costly litigation.

Requirements for Creating a Valid Will in Alabama

To create a valid last will and testament in Alabama, you must meet the following requirements:

- Age: You must be at least 18 years old to create a will.

- Capacity: You must be of sound mind and have the capacity to make decisions.

- Signature: You must sign your will in the presence of two witnesses.

- Witnesses: Your witnesses must be at least 19 years old, and they must sign the will in your presence.

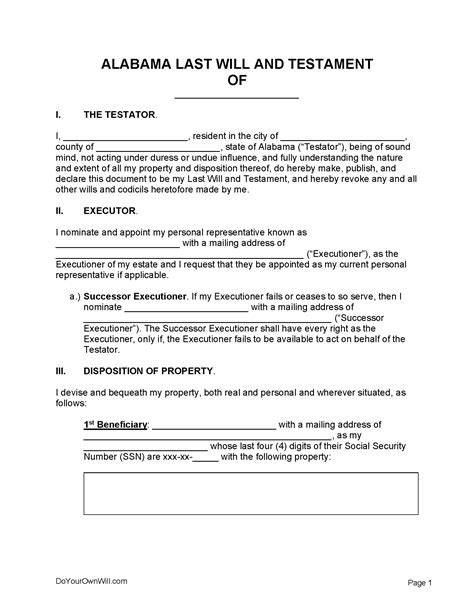

Alabama Last Will and Testament Form - Free Download

To help you get started, we provide a free downloadable last will and testament form for Alabama residents. This template is designed to meet the state's requirements and provides a basic outline for creating a valid will.

You can download the form here: [Insert link to downloadable form]

Please note that while this template can serve as a starting point, it is essential to consult with an attorney to ensure that your will meets your specific needs and complies with Alabama state laws.

What to Include in Your Last Will and Testament

When creating your last will and testament, there are several key elements to include:

- Identification: Your name, address, and date of birth.

- Appointment of Executor: The name and address of the person you appoint to manage your estate.

- Asset Distribution: A clear description of how you want your assets to be distributed.

- Beneficiaries: The names and addresses of the individuals or organizations you want to inherit your assets.

- Special Requests: Any specific requests, such as funeral arrangements or charitable donations.

- Signature: Your signature, witnessed by two individuals.

Additional Provisions to Consider

In addition to the basic elements, you may want to consider including the following provisions in your will:

- Trusts: Creating a trust to manage assets for minor children or individuals with special needs.

- Charitable Donations: Leaving a portion of your estate to a favorite charity or cause.

- Funeral Arrangements: Specifying your wishes for funeral arrangements, including burial or cremation.

- Debt Forgiveness: Forgiving debts owed to you by others.

Updating Your Last Will and Testament

It is essential to review and update your last will and testament regularly to ensure that it reflects any changes in your life or wishes. You should consider updating your will:

- After Marriage or Divorce: To reflect changes in your marital status.

- After the Birth of Children: To name a guardian and provide for their care.

- After Significant Changes in Assets: To reflect changes in your financial situation.

- After Moving to a New State: To ensure that your will complies with the laws of your new state.

What Happens If I Don't Have a Last Will and Testament?

If you pass away without a valid last will and testament, the state of Alabama will determine how your assets are distributed according to the state's intestacy laws. This can lead to:

- Unintended Consequences: Your assets may be distributed in a way that does not align with your wishes.

- Family Conflict: Disputes among family members may arise, leading to costly litigation.

- Additional Costs: The administration of your estate may be more expensive and time-consuming.

What is the difference between a will and a trust?

+A will is a document that outlines how you want your assets to be distributed after you pass away, while a trust is a separate entity that holds assets on behalf of beneficiaries. A trust can provide more control and flexibility in managing assets, but it can also be more complex and expensive to establish.

Can I create a last will and testament online?

+Yes, you can create a last will and testament online using a template or online will preparation service. However, it is essential to consult with an attorney to ensure that your will meets your specific needs and complies with Alabama state laws.

How often should I update my last will and testament?

+You should review and update your last will and testament every 2-3 years or whenever there are significant changes in your life or wishes. This ensures that your will reflects your current circumstances and wishes.

In conclusion, creating a last will and testament is a vital step in planning for the future and ensuring that your wishes are respected after you pass away. By understanding the requirements and including the necessary elements, you can create a valid will that reflects your desires. Remember to review and update your will regularly to ensure that it remains relevant and effective.