The world of mortgage lending can be complex and overwhelming, especially for those new to the industry. With numerous forms and regulations to navigate, it's essential to have a thorough understanding of the process to ensure compliance and avoid costly mistakes. One critical form in the mortgage lending process is Freddie Mac Form 710, also known as the Uniform Residential Loan Application. In this article, we will delve into the details of Freddie Mac Form 710, exploring its importance, components, and the benefits it provides to lenders and borrowers alike.

What is Freddie Mac Form 710?

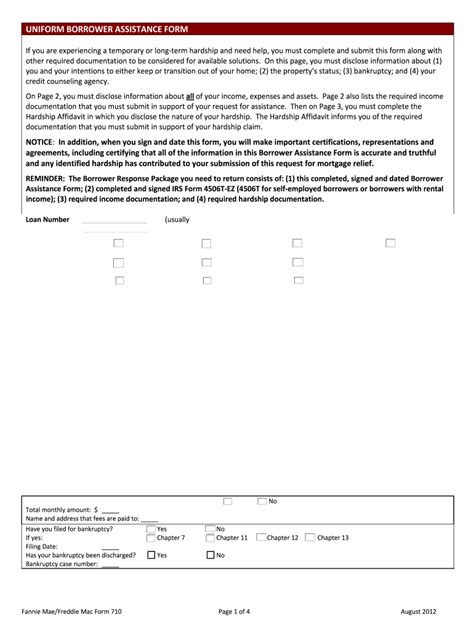

Freddie Mac Form 710 is a standardized residential loan application used by lenders to collect borrower information and credit data. The form is designed to provide a uniform format for lenders to assess borrower creditworthiness and make informed lending decisions. Freddie Mac, a government-sponsored enterprise (GSE), introduced the form to streamline the mortgage lending process and reduce the risk of defaults.

Benefits of Freddie Mac Form 710

The use of Freddie Mac Form 710 offers several benefits to both lenders and borrowers:

- Streamlined Process: The standardized format of the form simplifies the loan application process, reducing the time and effort required to review and process applications.

- Improved Accuracy: By using a uniform format, lenders can ensure that all necessary information is collected and accurate, reducing the risk of errors and miscommunication.

- Enhanced Credit Assessment: The form provides a comprehensive view of the borrower's credit profile, enabling lenders to make more informed lending decisions.

- Increased Transparency: The standardized format promotes transparency and consistency in the lending process, ensuring that borrowers are aware of the information required and the criteria used to evaluate their creditworthiness.

Components of Freddie Mac Form 710

Freddie Mac Form 710 is divided into several sections, each designed to collect specific information about the borrower and the loan:

- Section 1: Borrower Information: This section collects personal and contact information about the borrower, including name, address, phone number, and social security number.

- Section 2: Property Information: This section collects information about the property being financed, including the address, type of property, and purchase price.

- Section 3: Income and Employment: This section collects information about the borrower's income and employment history, including income sources, employment status, and job title.

- Section 4: Assets and Liabilities: This section collects information about the borrower's assets, including bank accounts, investments, and retirement accounts, as well as liabilities, including debts and obligations.

- Section 5: Credit History: This section collects information about the borrower's credit history, including credit scores, credit accounts, and any past credit issues.

- Section 6: Loan Terms: This section collects information about the loan terms, including the loan amount, interest rate, and repayment terms.

How to Complete Freddie Mac Form 710

To complete Freddie Mac Form 710, borrowers should follow these steps:

- Review the Form: Carefully review the form to ensure you understand the information required.

- Gather Required Documents: Gather all necessary documents, including identification, income verification, and asset statements.

- Complete the Form: Complete the form accurately and thoroughly, ensuring that all required information is provided.

- Sign and Date the Form: Sign and date the form, acknowledging that the information provided is accurate and true.

Best Practices for Lenders

To ensure compliance and accuracy when using Freddie Mac Form 710, lenders should follow these best practices:

- Verify Borrower Information: Verify the accuracy of borrower information, including identification and income verification.

- Review Credit Reports: Review credit reports to ensure that the borrower's credit history is accurate and up-to-date.

- Assess Creditworthiness: Assess the borrower's creditworthiness, using the information provided on the form and credit reports.

- Maintain Records: Maintain accurate and complete records of the loan application process, including the completed form and supporting documentation.

Common Mistakes to Avoid

When using Freddie Mac Form 710, lenders and borrowers should avoid the following common mistakes:

- Inaccurate or Incomplete Information: Providing inaccurate or incomplete information can lead to delays or even loan rejection.

- Failure to Verify Information: Failing to verify borrower information can lead to errors and miscommunication.

- Insufficient Credit Assessment: Insufficient credit assessment can lead to lending decisions that are not in the best interest of the borrower or lender.

Conclusion

Freddie Mac Form 710 is a critical component of the mortgage lending process, providing a standardized format for lenders to collect borrower information and credit data. By understanding the components and benefits of the form, lenders and borrowers can ensure a streamlined and accurate loan application process. By following best practices and avoiding common mistakes, lenders can ensure compliance and reduce the risk of defaults.

We hope this comprehensive overview of Freddie Mac Form 710 has provided valuable insights and information. If you have any questions or comments, please don't hesitate to reach out. Share this article with others who may find it helpful, and don't forget to follow us for more informative content on mortgage lending and finance.

What is Freddie Mac Form 710 used for?

+Freddie Mac Form 710 is used to collect borrower information and credit data for mortgage lending purposes.

What are the benefits of using Freddie Mac Form 710?

+The benefits of using Freddie Mac Form 710 include a streamlined process, improved accuracy, enhanced credit assessment, and increased transparency.

What information is required on Freddie Mac Form 710?

+The form requires personal and contact information, property information, income and employment information, asset and liability information, and credit history information.