Filling out the Fr Y-6 form can be a daunting task for many, especially for those who are new to the process. The Fr Y-6 form is a crucial document required by the Federal Reserve for banks and other financial institutions to report their annual financial data. In this article, we will break down the Fr Y-6 form into six manageable sections, providing you with a step-by-step guide on how to fill it out accurately and efficiently.

Understanding the Fr Y-6 Form

Before we dive into the six ways to fill out the Fr Y-6 form, it's essential to understand the purpose and content of the form. The Fr Y-6 form is an annual report that banks and other financial institutions must submit to the Federal Reserve. The form provides a comprehensive overview of the institution's financial condition, including its assets, liabilities, and capital.

Why Accurate Reporting Matters

Accurate reporting on the Fr Y-6 form is crucial for several reasons. Firstly, it helps the Federal Reserve to assess the financial stability of the institution and the overall banking system. Secondly, it provides valuable information for regulators, investors, and other stakeholders to make informed decisions. Finally, accurate reporting helps institutions to identify areas for improvement and optimize their financial performance.

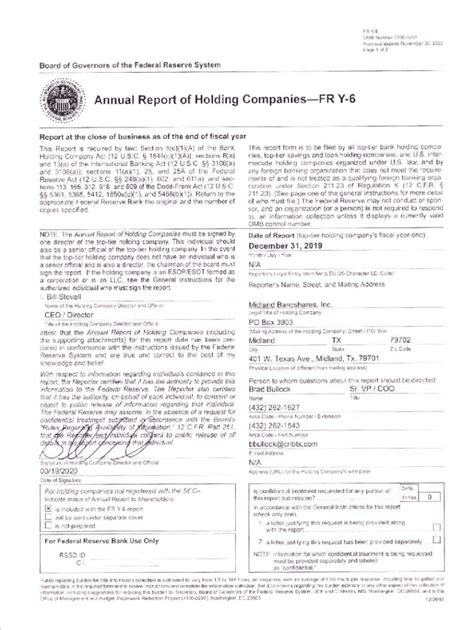

Section 1: General Information

The first section of the Fr Y-6 form requires general information about the institution, including its name, address, and Federal Reserve ID number.

- Institution Name: Enter the full name of the institution as registered with the Federal Reserve.

- Address: Provide the institution's mailing address, including the street address, city, state, and zip code.

- Federal Reserve ID Number: Enter the institution's unique Federal Reserve ID number.

Tips for Accurate Reporting

When filling out the general information section, ensure that the institution's name and address are accurate and up-to-date. Verify the Federal Reserve ID number to avoid any errors or delays in processing.

Section 2: Financial Data

The second section of the Fr Y-6 form requires financial data, including the institution's assets, liabilities, and capital.

- Assets: Report the institution's total assets, including cash and due from banks, securities, loans, and other assets.

- Liabilities: Report the institution's total liabilities, including deposits, short-term debt, and long-term debt.

- Capital: Report the institution's total capital, including common stock, retained earnings, and other capital accounts.

Best Practices for Financial Reporting

When reporting financial data, ensure that all figures are accurate and consistent with the institution's financial statements. Use the correct accounting standards and follow the Federal Reserve's instructions for reporting financial data.

Section 3: Loan Data

The third section of the Fr Y-6 form requires loan data, including the institution's loan portfolio and credit quality.

- Loan Portfolio: Report the institution's total loan portfolio, including commercial loans, consumer loans, and real estate loans.

- Credit Quality: Report the institution's credit quality, including the number of loans past due and the amount of loans charged off.

Importance of Accurate Loan Reporting

Accurate loan reporting is crucial for assessing the institution's credit risk and financial stability. Ensure that all loan data is accurate and up-to-date, and follow the Federal Reserve's instructions for reporting loan data.

Section 4: Deposit Data

The fourth section of the Fr Y-6 form requires deposit data, including the institution's deposit portfolio and deposit rates.

- Deposit Portfolio: Report the institution's total deposit portfolio, including demand deposits, time deposits, and other deposits.

- Deposit Rates: Report the institution's deposit rates, including the rates paid on demand deposits and time deposits.

Best Practices for Deposit Reporting

When reporting deposit data, ensure that all figures are accurate and consistent with the institution's financial statements. Use the correct accounting standards and follow the Federal Reserve's instructions for reporting deposit data.

Section 5: Capital Adequacy

The fifth section of the Fr Y-6 form requires capital adequacy data, including the institution's capital ratios and risk-weighted assets.

- Capital Ratios: Report the institution's capital ratios, including the tier 1 capital ratio and the total capital ratio.

- Risk-Weighted Assets: Report the institution's risk-weighted assets, including the risk weights assigned to different asset classes.

Importance of Capital Adequacy Reporting

Accurate capital adequacy reporting is crucial for assessing the institution's financial stability and capital adequacy. Ensure that all capital adequacy data is accurate and up-to-date, and follow the Federal Reserve's instructions for reporting capital adequacy data.

Section 6: Regulatory Capital

The sixth section of the Fr Y-6 form requires regulatory capital data, including the institution's regulatory capital requirements and capital buffers.

- Regulatory Capital Requirements: Report the institution's regulatory capital requirements, including the minimum capital requirements and capital buffers.

- Capital Buffers: Report the institution's capital buffers, including the countercyclical capital buffer and the conservation buffer.

Best Practices for Regulatory Capital Reporting

When reporting regulatory capital data, ensure that all figures are accurate and consistent with the institution's financial statements. Use the correct accounting standards and follow the Federal Reserve's instructions for reporting regulatory capital data.

In conclusion, filling out the Fr Y-6 form requires attention to detail and accuracy. By following these six steps and best practices, institutions can ensure that their reporting is accurate and compliant with Federal Reserve regulations. We encourage readers to share their experiences and tips for filling out the Fr Y-6 form in the comments section below.

What is the purpose of the Fr Y-6 form?

+The Fr Y-6 form is an annual report required by the Federal Reserve for banks and other financial institutions to report their financial data.

What information is required on the Fr Y-6 form?

+The Fr Y-6 form requires general information, financial data, loan data, deposit data, capital adequacy data, and regulatory capital data.

Why is accurate reporting on the Fr Y-6 form important?

+Accurate reporting on the Fr Y-6 form is crucial for assessing the institution's financial stability and capital adequacy, and for making informed decisions by regulators, investors, and other stakeholders.