The Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by the Internal Revenue Service (IRS) to gather information about taxpayers. If you're a freelancer, independent contractor, or business owner, you may be required to provide this form to your clients or customers. In this article, we'll delve into the world of Form W-9, exploring its importance, components, and instructions for completion.

What is Form W-9?

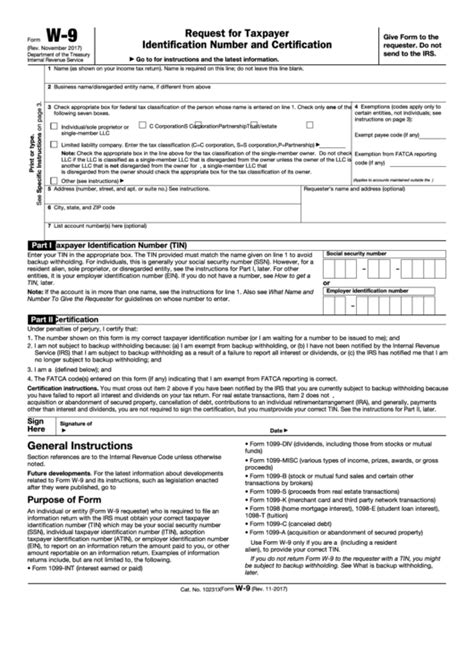

Form W-9 is a single-page document that certifies a taxpayer's identification number, such as their Social Security Number (SSN) or Employer Identification Number (EIN). The form is used by payers, such as businesses and financial institutions, to verify the identity of payees, including freelancers, independent contractors, and other recipients of income.

Why is Form W-9 Important?

Form W-9 serves several purposes:

- It helps the IRS to track income paid to individuals and businesses.

- It verifies the identity of taxpayers, reducing the risk of identity theft and fraud.

- It ensures compliance with tax laws and regulations.

Components of Form W-9

Form W-9 consists of the following components:

- Name and Business Name: The payee's name and business name (if applicable).

- Business Entity Type: The payee's business entity type (e.g., sole proprietorship, partnership, corporation).

- Address: The payee's mailing address.

- Taxpayer Identification Number (TIN): The payee's Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: A certification statement that the payee is a U.S. person (including a resident alien) and that the TIN provided is correct.

Instructions for Completing Form W-9

To complete Form W-9, follow these steps:

- Download the Form: Obtain a copy of Form W-9 from the IRS website or use a printable template.

- Fill in the Name and Business Name: Enter the payee's name and business name (if applicable).

- Select the Business Entity Type: Choose the correct business entity type from the options provided.

- Enter the Address: Provide the payee's mailing address.

- Enter the Taxpayer Identification Number (TIN): Enter the payee's Social Security Number (SSN) or Employer Identification Number (EIN).

- Certify the Information: Sign and date the form, certifying that the information provided is accurate.

Special Considerations

- Limited Liability Company (LLC): If the payee is an LLC, it must provide its EIN, not its SSN.

- Non-U.S. Persons: If the payee is a non-U.S. person, it must complete Form W-8 instead of Form W-9.

- Backup Withholding: If the payee fails to provide a correct TIN, the payer may be required to withhold a portion of the payment as backup withholding.

Penalties for Failure to Comply

Failure to comply with Form W-9 requirements can result in penalties, including:

- Backup Withholding: The payer may be required to withhold a portion of the payment as backup withholding.

- Fines and Penalties: The payee may be subject to fines and penalties for failure to provide a correct TIN.

Conclusion

Form W-9 is a critical document that plays a vital role in the tax reporting process. By understanding the importance of Form W-9, its components, and instructions for completion, taxpayers can ensure compliance with tax laws and regulations. If you have any questions or concerns about Form W-9, consult with a tax professional or contact the IRS directly.

What is the purpose of Form W-9?

+Form W-9 is used to certify a taxpayer's identification number, such as their Social Security Number (SSN) or Employer Identification Number (EIN), and to verify the identity of payees.

Who needs to complete Form W-9?

+Freelancers, independent contractors, and other recipients of income are typically required to complete Form W-9.

What happens if I fail to provide a correct TIN?

+If you fail to provide a correct TIN, the payer may be required to withhold a portion of the payment as backup withholding, and you may be subject to fines and penalties.