Tax season can be a daunting time for many individuals, especially when it comes to understanding the complexities of tax forms and regulations. One such form that often raises questions is the Form W-4V, also known as the Voluntary Withholding Request. In this article, we will delve into the world of Form W-4V, exploring its purpose, benefits, and how to fill it out correctly.

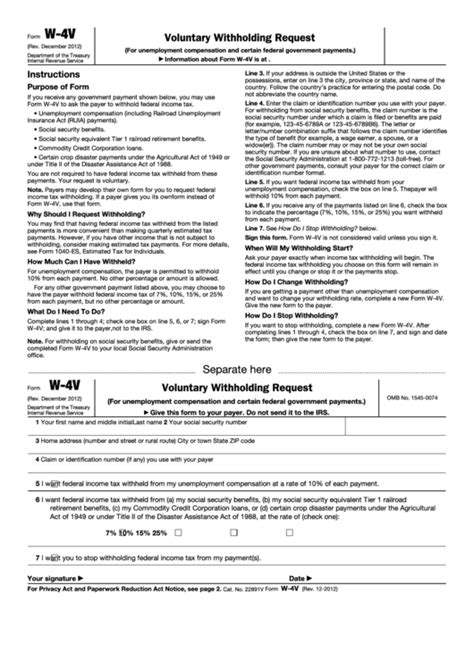

Form W-4V is a simple, one-page document that allows individuals to request voluntary withholding on certain government payments, such as Social Security benefits, Supplemental Security Income (SSI) benefits, and unemployment compensation. By filling out this form, individuals can choose to have a portion of their benefits withheld and applied to their tax liability, helping to reduce their tax bill at the end of the year.

Benefits of Form W-4V

So, why would someone want to voluntarily give up a portion of their hard-earned benefits? The answer lies in the benefits of Form W-4V. By choosing to have taxes withheld from their benefits, individuals can:

- Reduce their tax liability at the end of the year

- Avoid owing taxes when they file their tax return

- Avoid penalties and interest on unpaid taxes

- Simplify their tax obligations and reduce stress during tax season

Who Can Use Form W-4V?

Form W-4V is available to anyone receiving certain government payments, including:

- Social Security benefits

- Supplemental Security Income (SSI) benefits

- Unemployment compensation

- Railroad Retirement benefits

- Civil Service Retirement benefits

Individuals can use Form W-4V to request voluntary withholding on one or more of these payments.

How to Fill Out Form W-4V

Filling out Form W-4V is a straightforward process that requires some basic information. Here's a step-by-step guide to help you get started:

- Download and print Form W-4V: You can download Form W-4V from the IRS website or pick one up from your local Social Security office.

- Enter your name and Social Security number: Write your name and Social Security number in the spaces provided.

- Select the type of payment: Check the box next to the type of payment you want to have taxes withheld from (e.g., Social Security benefits, SSI benefits, etc.).

- Choose your withholding rate: Select the percentage of your payment that you want to have withheld for taxes. You can choose from 7%, 10%, 12%, or 22%.

- Sign and date the form: Sign and date the form to certify that the information is accurate.

Common Questions About Form W-4V

Here are some common questions about Form W-4V and their answers:

- Q: Can I change my withholding rate or cancel my request for voluntary withholding? A: Yes, you can change your withholding rate or cancel your request for voluntary withholding at any time by submitting a new Form W-4V.

- Q: How long does it take for the IRS to process my Form W-4V? A: The IRS typically processes Form W-4V within 4-6 weeks.

- Q: Can I use Form W-4V to request withholding on other types of income? A: No, Form W-4V is only used to request withholding on certain government payments, such as Social Security benefits and SSI benefits.

Conclusion: Taking Control of Your Taxes with Form W-4V

Form W-4V is a simple and effective way to take control of your taxes and reduce your tax liability. By choosing to have taxes withheld from your government payments, you can avoid owing taxes at the end of the year and simplify your tax obligations. Remember to fill out the form carefully and accurately, and don't hesitate to reach out to the IRS or a tax professional if you have any questions or concerns.

Now that you know more about Form W-4V, take the first step towards taking control of your taxes. Download and fill out the form today!

What is the purpose of Form W-4V?

+Form W-4V is used to request voluntary withholding on certain government payments, such as Social Security benefits and SSI benefits.

Who can use Form W-4V?

+Individuals receiving certain government payments, such as Social Security benefits, SSI benefits, and unemployment compensation, can use Form W-4V.

How do I change my withholding rate or cancel my request for voluntary withholding?

+You can change your withholding rate or cancel your request for voluntary withholding by submitting a new Form W-4V.