Filing taxes can be a daunting task for many business owners, especially when it comes to sales tax. In the state of Virginia, businesses are required to file a sales tax certificate, also known as Form ST-9. In this article, we will break down the ins and outs of Form ST-9, including what it is, who needs to file it, and how to file it correctly.

What is Form ST-9?

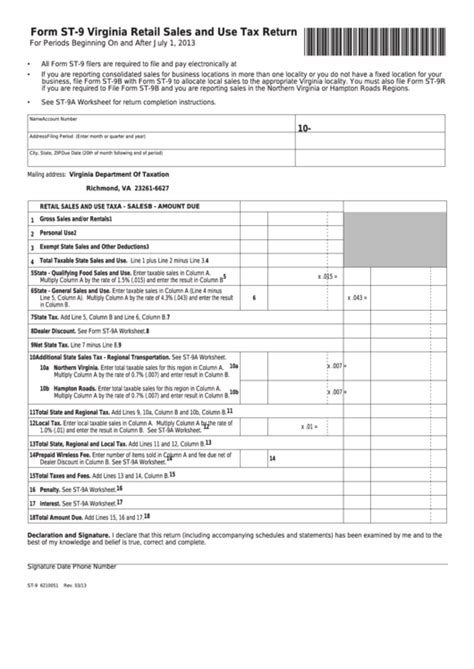

Form ST-9 is a sales tax certificate that businesses in Virginia are required to file with the Virginia Department of Taxation. The form is used to report sales tax owed to the state, as well as to claim any sales tax exemptions or deductions. Businesses that are required to file Form ST-9 include retailers, wholesalers, and other businesses that sell taxable goods or services.

Who Needs to File Form ST-9?

Not all businesses in Virginia are required to file Form ST-9. However, if your business meets any of the following criteria, you will need to file the form:

- Your business sells taxable goods or services in Virginia

- Your business has a physical presence in Virginia, such as a store or warehouse

- Your business has a nexus in Virginia, such as a sales representative or independent contractor

Types of Businesses That Need to File Form ST-9

There are several types of businesses that are required to file Form ST-9, including:

- Retailers: Businesses that sell goods or services directly to consumers, such as department stores, restaurants, and convenience stores.

- Wholesalers: Businesses that sell goods or services to other businesses, such as distributors and manufacturers.

- Service providers: Businesses that provide services, such as consulting firms, law firms, and medical practices.

How to File Form ST-9

Filing Form ST-9 is a relatively straightforward process. Here are the steps you need to follow:

- Register for a Virginia Tax Account: Before you can file Form ST-9, you need to register for a Virginia tax account. You can do this online through the Virginia Department of Taxation's website.

- Gather Required Documents: You will need to gather several documents, including your business's federal tax ID number, sales tax exemption certificates, and records of sales tax collected.

- Complete Form ST-9: You can complete Form ST-9 online or by mail. The form will ask for information about your business, including your tax account number, business name, and address.

- Calculate Sales Tax Owed: You will need to calculate the sales tax owed to the state, based on your business's sales tax rate and the amount of sales tax collected.

- Claim Exemptions or Deductions: If your business is eligible for sales tax exemptions or deductions, you can claim them on Form ST-9.

- Submit the Form: Once you have completed Form ST-9, you can submit it online or by mail.

Common Mistakes to Avoid When Filing Form ST-9

When filing Form ST-9, there are several common mistakes to avoid, including:

- Late Filing: Filing Form ST-9 late can result in penalties and interest.

- Inaccurate Information: Providing inaccurate information on Form ST-9 can result in delays or rejection of your return.

- Missing Documents: Failing to provide required documents, such as sales tax exemption certificates, can result in delays or rejection of your return.

Tips for Filing Form ST-9

Here are several tips for filing Form ST-9:

- File Electronically: Filing Form ST-9 electronically can help reduce errors and speed up processing.

- Use a Tax Professional: If you are unsure about how to file Form ST-9, consider using a tax professional.

- Keep Accurate Records: Keeping accurate records of sales tax collected and exemptions can help make filing Form ST-9 easier.

Penalties for Not Filing Form ST-9

If you fail to file Form ST-9, you may be subject to penalties and interest. The penalties for not filing Form ST-9 include:

- Late Filing Penalty: A penalty of 6% of the tax owed per month, up to a maximum of 30%.

- Interest: Interest on the tax owed, starting from the original due date.

We hope this article has provided you with a comprehensive understanding of Form ST-9 and how to file it correctly. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is the deadline for filing Form ST-9?

+The deadline for filing Form ST-9 is the 20th day of the month following the end of the tax period.

Can I file Form ST-9 electronically?

+Yes, you can file Form ST-9 electronically through the Virginia Department of Taxation's website.

What are the penalties for not filing Form ST-9?

+The penalties for not filing Form ST-9 include a late filing penalty of 6% of the tax owed per month, up to a maximum of 30%, and interest on the tax owed, starting from the original due date.