The world of tax deductions can be a complex and daunting place, especially for businesses and individuals who are not well-versed in the intricacies of the US tax code. One such deduction that can provide significant benefits to eligible taxpayers is the Section 199 deduction, also known as the Domestic Production Activities Deduction (DPAD). In this article, we will delve into the world of the 8885 form and explore the ins and outs of the IRS Section 199 deduction.

The Section 199 deduction is a tax incentive designed to encourage domestic production activities within the United States. This deduction was first introduced in 2004 as part of the American Jobs Creation Act and has undergone several changes since its inception. The deduction allows eligible taxpayers to claim a percentage of their qualified production activities income (QPAI) as a deduction against their taxable income.

What is the 8885 Form?

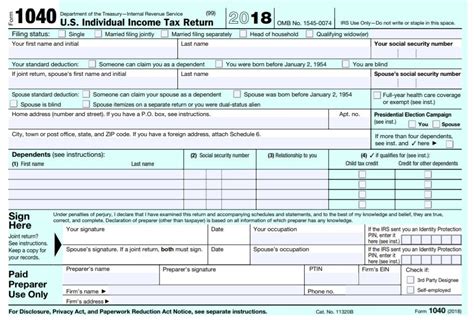

The 8885 form is a crucial document that taxpayers must complete and attach to their tax return to claim the Section 199 deduction. The form, officially known as the "Qualified Domestic Production Activities Deduction," is used to calculate the amount of the deduction that a taxpayer is eligible for. The form requires taxpayers to provide detailed information about their qualified production activities, including the type of activity, the amount of QPAI, and the percentage of deduction claimed.

Eligible Activities for the Section 199 Deduction

To qualify for the Section 199 deduction, taxpayers must engage in one or more of the following domestic production activities:

- Manufacturing: This includes the production of tangible personal property, such as goods, wares, and merchandise.

- Construction: This includes the construction of real property, such as buildings, roads, and bridges.

- Engineering and architectural services: This includes services related to the design and development of real property and tangible personal property.

- Software development: This includes the development of software for sale or lease.

- Film and video production: This includes the production of films, videos, and other audiovisual works.

- Electricity, natural gas, and water production: This includes the production of electricity, natural gas, and water for sale or lease.

Calculating the Section 199 Deduction

The Section 199 deduction is calculated as a percentage of the taxpayer's QPAI. The percentage of deduction allowed is 9% of QPAI, subject to certain limits and phase-outs. The deduction is limited to 50% of the taxpayer's wages paid during the tax year.

Benefits of the Section 199 Deduction

The Section 199 deduction can provide significant benefits to eligible taxpayers, including:

- Reduced taxable income: The deduction can reduce a taxpayer's taxable income, resulting in lower tax liability.

- Increased cash flow: By reducing taxable income, the deduction can increase a taxpayer's cash flow.

- Competitive advantage: The deduction can provide a competitive advantage to businesses that engage in domestic production activities.

Common Challenges and Pitfalls

While the Section 199 deduction can provide significant benefits, there are common challenges and pitfalls that taxpayers should be aware of, including:

- Complexity of the rules: The rules surrounding the Section 199 deduction can be complex and difficult to navigate.

- Limited guidance: The IRS has provided limited guidance on the application of the Section 199 deduction, leaving taxpayers to interpret the rules.

- Audit risk: The Section 199 deduction is a high-risk area for audits, and taxpayers should be prepared to defend their deduction in case of an audit.

Best Practices for Claiming the Section 199 Deduction

To ensure that taxpayers can successfully claim the Section 199 deduction, the following best practices should be followed:

- Consult with a tax professional: Taxpayers should consult with a tax professional to ensure that they are eligible for the deduction and to navigate the complex rules.

- Maintain accurate records: Taxpayers should maintain accurate records of their qualified production activities, including QPAI and wages paid.

- Document the deduction: Taxpayers should document the deduction on Form 8885 and attach it to their tax return.

Conclusion

In conclusion, the Section 199 deduction is a valuable tax incentive that can provide significant benefits to eligible taxpayers. However, the rules surrounding the deduction can be complex, and taxpayers should be aware of the common challenges and pitfalls. By following best practices and consulting with a tax professional, taxpayers can successfully claim the Section 199 deduction and reduce their taxable income.

We encourage you to share your thoughts and experiences with the Section 199 deduction in the comments below. Have you successfully claimed the deduction? What challenges did you face? Your input will help others navigate the complexities of the Section 199 deduction.

What is the Section 199 deduction?

+The Section 199 deduction is a tax incentive designed to encourage domestic production activities within the United States. It allows eligible taxpayers to claim a percentage of their qualified production activities income (QPAI) as a deduction against their taxable income.

What activities are eligible for the Section 199 deduction?

+Eligible activities for the Section 199 deduction include manufacturing, construction, engineering and architectural services, software development, film and video production, and electricity, natural gas, and water production.

How is the Section 199 deduction calculated?

+The Section 199 deduction is calculated as a percentage of the taxpayer's QPAI. The percentage of deduction allowed is 9% of QPAI, subject to certain limits and phase-outs.