When applying for disability benefits from the Social Security Administration (SSA), you'll likely encounter Form SSA-821-BK, also known as the Work Activity Report - Employee. This form is crucial in helping the SSA understand your work history and earnings, which in turn, can impact your eligibility for disability benefits. In this article, we'll break down the importance of Form SSA-821-BK and provide you with 5 tips to help you fill it out accurately.

The SSA uses Form SSA-821-BK to gather information about your work activities, earnings, and job duties. This information helps them determine whether your work constitutes "substantial gainful activity" (SGA), which can affect your eligibility for disability benefits. If you're unsure about how to complete this form or have questions about the process, don't worry, we've got you covered.

Understanding Form SSA-821-BK

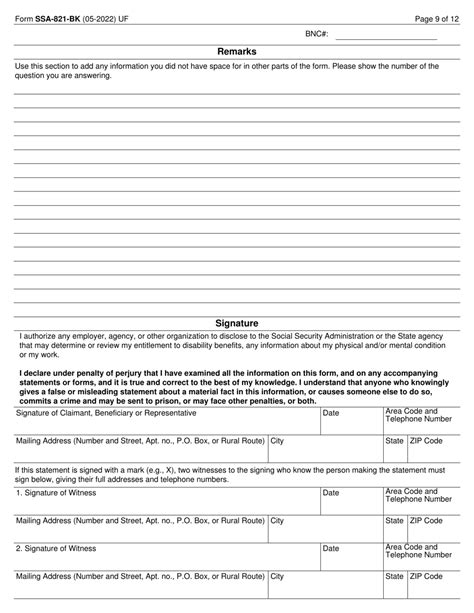

Before we dive into the tips, let's take a closer look at what Form SSA-821-BK entails. This form typically consists of several sections, including:

- Identifying information (your name, Social Security number, and date of birth)

- Work activity information (your job title, employer, and dates of employment)

- Earnings information (your gross earnings, hours worked, and pay rate)

- Job duties and responsibilities

The SSA will use this information to assess your work activities and determine whether you're eligible for disability benefits.

Tip 1: Gather Relevant Documents and Information

Before filling out Form SSA-821-BK, gather all relevant documents and information related to your work activities. This may include:

- Pay stubs

- W-2 forms

- Employer statements

- Job descriptions

- Time sheets

Having this information readily available will help you complete the form accurately and efficiently.

What to Do If You're Missing Documents

If you're missing any documents or information, don't worry. You can:

- Contact your employer to request a copy of your pay stubs or W-2 forms

- Check with your state's unemployment office for records of your employment

- Look for digital copies of your documents, such as online pay stubs or email records

Tip 2: Be Accurate and Honest When Reporting Your Earnings

When reporting your earnings on Form SSA-821-BK, it's essential to be accurate and honest. Make sure to:

- Report all earnings, including tips, bonuses, and overtime pay

- Include earnings from all jobs, not just your primary job

- Use gross earnings, not net earnings (after taxes)

Inaccurate or incomplete reporting can lead to delays or even denial of your disability benefits.

Consequences of Inaccurate Reporting

If you're found to have inaccurately reported your earnings, you may face:

- Delays in processing your disability benefits application

- Denial of your application

- Overpayment of benefits, which you'll need to repay

Tip 3: Provide Detailed Job Descriptions

When describing your job duties and responsibilities on Form SSA-821-BK, be as detailed as possible. Include:

- Specific tasks and activities you performed

- Equipment and tools you used

- Physical and mental demands of the job

This information will help the SSA understand your work activities and determine whether you're eligible for disability benefits.

Example of a Detailed Job Description

For example, if you worked as a customer service representative, your job description might include:

- Answering phone calls and responding to customer inquiries

- Using a computer to access customer information and resolve issues

- Maintaining a calm and professional demeanor in a fast-paced environment

Tip 4: Report All Work Activities, Including Unpaid Work

When filling out Form SSA-821-BK, make sure to report all work activities, including unpaid work. This may include:

- Volunteer work

- Unpaid internships

- Family business or farm work

The SSA considers all work activities, including unpaid work, when determining your eligibility for disability benefits.

Why Unpaid Work Matters

Unpaid work can still be considered "substantial gainful activity" (SGA) by the SSA, which can impact your eligibility for disability benefits. By reporting all work activities, you can ensure that your application is processed accurately.

Tip 5: Review and Double-Check Your Application

Before submitting Form SSA-821-BK, review and double-check your application for:

- Accuracy and completeness

- Signatures and dates

- Attachments and supporting documentation

A thorough review can help prevent errors and ensure that your application is processed smoothly.

What to Do If You Need Help

If you need help filling out Form SSA-821-BK or have questions about the process, you can:

- Contact the SSA directly

- Consult with a disability attorney or advocate

- Visit a local SSA office for assistance

By following these 5 tips, you can ensure that your Form SSA-821-BK is completed accurately and efficiently, which can help you receive the disability benefits you need.

What is Form SSA-821-BK used for?

+Form SSA-821-BK is used to gather information about your work activities, earnings, and job duties to help the SSA determine whether your work constitutes "substantial gainful activity" (SGA), which can affect your eligibility for disability benefits.

What happens if I inaccurately report my earnings on Form SSA-821-BK?

+If you inaccurately report your earnings, you may face delays in processing your disability benefits application, denial of your application, or overpayment of benefits, which you'll need to repay.

Do I need to report unpaid work on Form SSA-821-BK?

+Yes, you should report all work activities, including unpaid work, on Form SSA-821-BK. This includes volunteer work, unpaid internships, and family business or farm work.

We hope this article has provided you with valuable insights and tips on how to fill out Form SSA-821-BK accurately. Remember to gather relevant documents, be accurate and honest when reporting your earnings, provide detailed job descriptions, report all work activities, and review your application carefully. If you have any further questions or concerns, don't hesitate to reach out to the SSA or a disability attorney for assistance.